Details of the economic calendar on April 27

The first estimate of the United States GDP for the first quarter showed growth of only 1.1%, while analysts expected 2%. The steady slowdown of the economy and the potential slide into recession are undoubtedly not the best factors for the U.S. dollar, although the U.S. currency did not react at the time of data publication.

At the same time as the GDP data, figures for jobless claims in the U.S. were published, where the overall index was forecasted to rise, but actual data recorded a decline. The details of the statistical data show that the volume of continuing claims for benefits fell from 1.861 million to 1.858 million, while the volume of initial claims for benefits fell from 246,000 to 230,000.

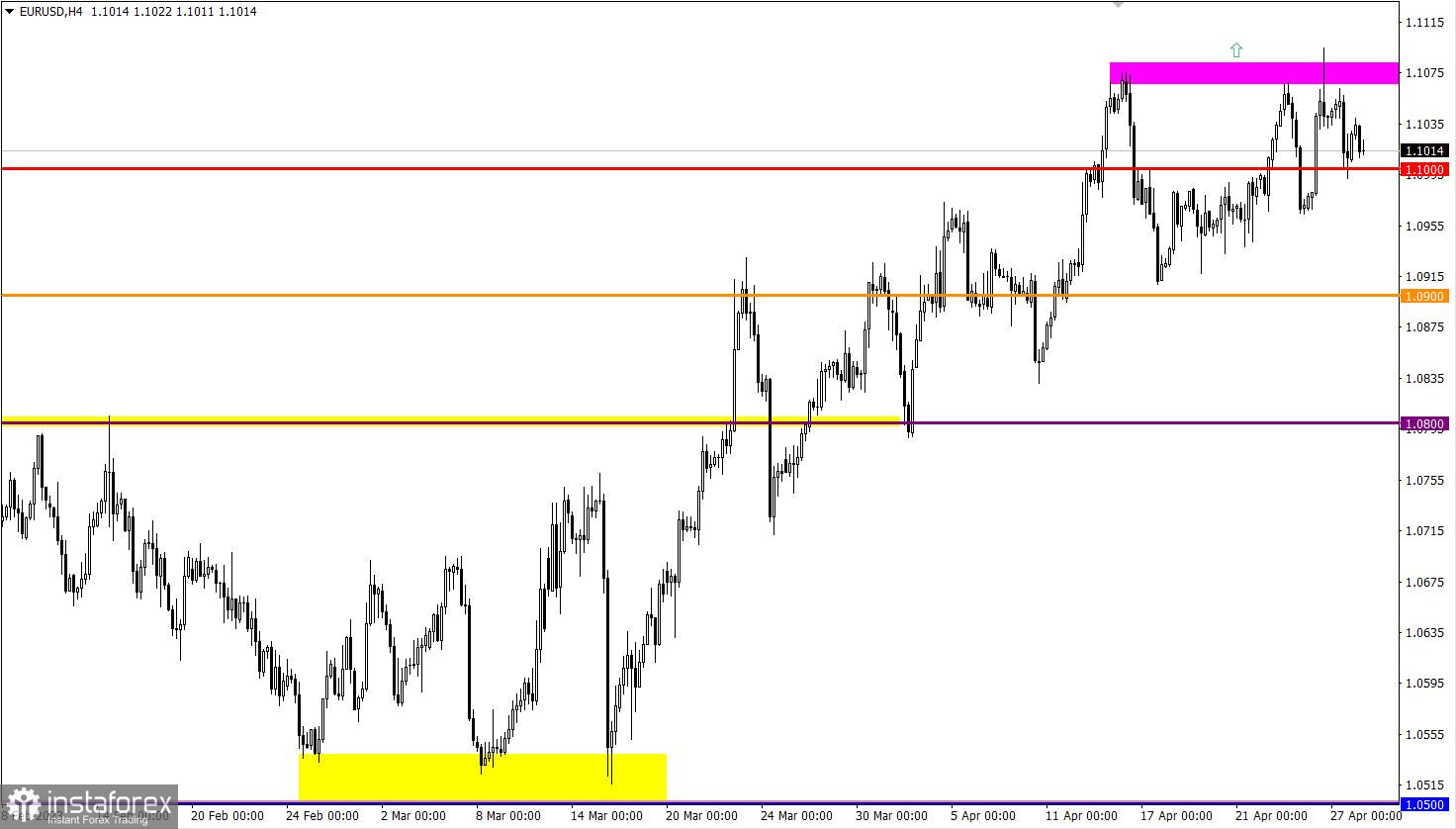

Analysis of trading charts from April 27

EURUSD again rebounded from the high of the medium-term trend, and now sellers have a support at the level of 1.1000, which is already known in the market.

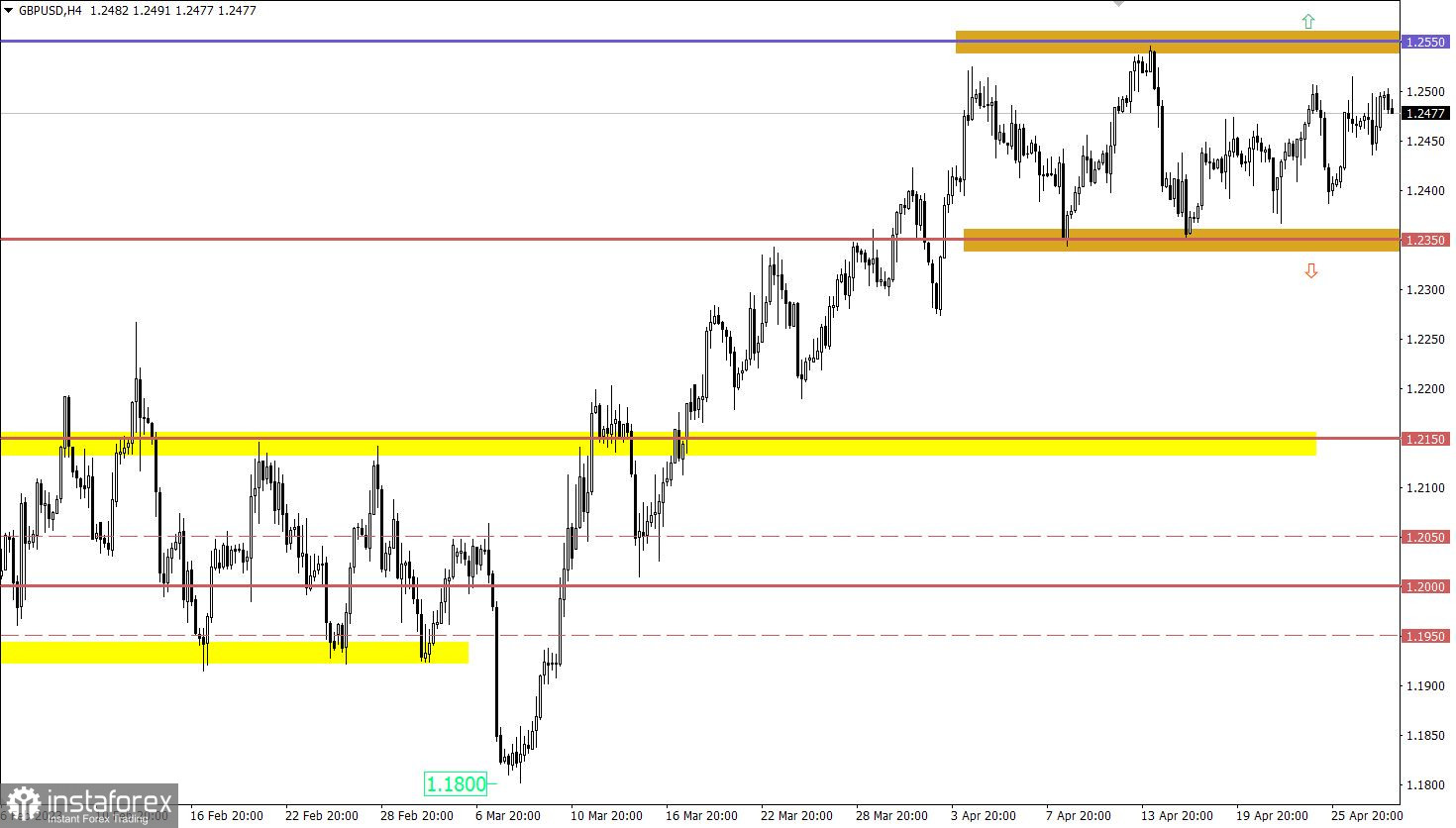

GBP/USD this week continued to fluctuate within the side channel 1.2350/1.2550 without radical changes. Such situation allows traders to work on the rebound tactic.

Economic calendar for April 28

Today, the publication of E.U. GDP data is expected, which may reflect a slowdown in the pace of economic growth. This is not yet a recession, but such a sharp slowdown in growth rates may indicate its approach.

Time targeting:

EU Q1 GDP – 09:00 UTC

EUR/USD trading plan for April 28

In this scenario, the pullback can be considered a transitional stage for the regrouping of trading positions. If the price returns above the 1.1100 level, it may lead to new growth and the prolongation of the medium-term upward trend. However, if the price returns below the 1.1000 level during the day, it may lead to a new stagnation stage and a reduction in long positions volume.

GBP/USD trading plan for April 28

While the quote is within the sideways channel, the rebound tactic remains optimal for traders. However, attention should be paid to the breakout tactic, which can lead to significant price changes and indicate the further direction of movement.

If the price holds above the 1.2550 level for 4 hours, a prolongation of the medium-term upward trend is possible. In turn, if the price holds below the 1.2350 level, it may lead to the construction of a corrective movement.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română