The US GDP data for the first quarter published on Thursday showed a significantly greater decline than expected. This could be considered a strong signal for the Fed to end the cycle of interest rate hikes.

According to the data, in the first quarter of this year, GDP rose by only 1.1% against a forecast of a 2.0% rise. In the previous period, the indicator advanced by 2.6%. In our opinion, this is a strong signal to the Federal Reserve to either stop raising rates or take a break at the June meeting. As for the May meeting, the market with almost an 85% probability believes that the key interest rate may be raised by 0.25% next week.

Is the slowdown in economic growth strong enough for the Fed to stop raising rates?

At the moment, it is not strong enough. However, this may happen. Earlier, some central bank members admitted such a possibility. However, the collapse of Silicon Valley Bank has already led to a smaller than expected key rate hike. Analysts anticipated a rise of 0.50%, but the Fed raised the benchmark rate by 0.25%. Now, the problems in First Republic Bank have raised concerns about the stability of the US banking system. This, in turn, boosted expectations that the regulator will be forced to stop raising interest rates, despite the fact that inflation has not yet reached the target of 2%.

Taking into account such a scenario, yesterday, traders reacted to the fall in GDP with an increase in stock indices. This trend may only strengthen today if the expected data on the Core PCE price index as well as figures for Americans' income and expenses show a decline relative to the previous periods. In addition, traders will focus on the Chicago business activity index (PMI) and the consumer sentiment index from the University of Michigan.

If all these indicators drop or, at best, come out in line with forecasts, this may lead to a continuation of the gradual growth in demand for risky assets. This will correspond to the scenario mentioned above, according to which the deterioration of the US economy amid the ongoing slackening in the inflation growth may force the Fed to end the cycle of interest rate hikes.

What can be expected today and until the end of the Fed meeting?

We believe that investors will remain cautious, which may become the basis for a decline in activity in the stock and government bond markets. The dollar is likely to consolidate around 101.50 within a narrow range.

Outlook for today:

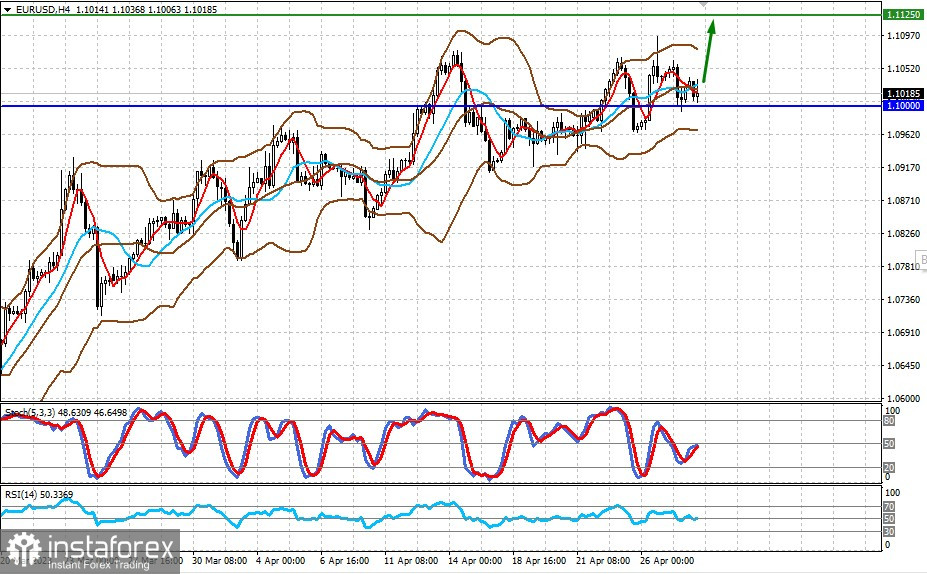

EUR/USD

The pair is trading above the 1.1000 level. If US economic data turns out to be below expectations, it may boost the pair to rise to 1.1125.

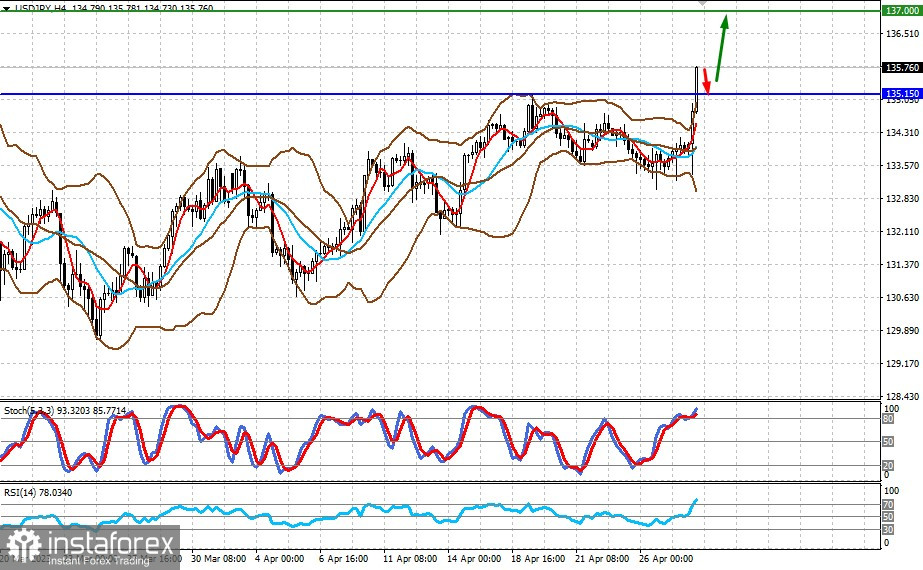

USD/JPY

The pair rose sharply following the Bank of Japan's decision to leave its ultra-loose monetary policy unchanged. In this light, the pair may continue to rise to 137.00 after a slight correction to the 135.15 level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română