Analysis of macroeconomic reports:

On Friday, there will be several macro data that are capable of causing a market reaction. It will all start in Germany, where unemployment, GDP, and inflation data will be published. However, the unemployment rate is estimated at the previous level of 5.6%, GDP at the level of 0.1-0.2%, and inflation at the level of 7.3%. Changes in inflation should be minimal, and Germany is just one country out of two dozen in the European Union, so there shouldn't be a significant reaction from the euro. In general, we can say the following: if there is a strong deviation in any report from the actual value to the forecasted value, a market reaction is possible, but we can now assume that there will not be one.

In the European Union, GDP for the first quarter will also be published, which should show growth at the level of 0.1-0.2% q/q. Again, it is very difficult to imagine the results to surpass the forecasts, as the growth rates of the economy are falling across the EU. The same goes for German data: if there is a strong deviation, then we can expect a reaction, but we believe that the likelihood of this is very low. Although the latest US GDP report was really disappointing with its weak value.

In the United States on Friday, data on personal income and expenses of the American population, as well as the personal consumption expenditure index, will be published. Secondary reports, on which we do not expect a market reaction. The University of Michigan Consumer Sentiment Index will also be released. Please remember that the pair's movements have been extremely illogical, so you can expect anything to happen on Friday.

Fundamental events:

There is absolutely nothing to highlight in terms of fundamental events on Friday. Perhaps during the day, some unplanned events will occur. For example, this week Janet Yellen and Philip Lane delivered speeches, which were not initially on the event calendar. In general, Friday may turn out to be boring if all reports coincide with forecasts and we don't receive unexpected news. Or it can be very fun if macro data surprise traders.

General conclusions:

On Friday, there will be quite a few macroeconomic reports, but they all look extremely neutral at the moment. It is very difficult to expect unexpected values from them, so there is no need to expect a market reaction either. However, one or two reports may still surprise with their values, so the reaction may follow. But even in this case, it is unlikely that it will be strong and affect the current state of affairs in the market.

Basic rules of the trading system:

1) The strength of the signal is determined by the time it took the signal to form (a rebound or a breakout of the level). The quicker it is formed, the stronger the signal is.

2) If two or more positions were opened near a certain level based on a false signal (which did not trigger a Take Profit or test the nearest target level), then all subsequent signals at this level should be ignored.

3) When trading flat, a pair can form multiple false signals or not form them at all. In any case, it is better to stop trading at the first sign of a flat movement.

4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours when all positions must be closed manually.

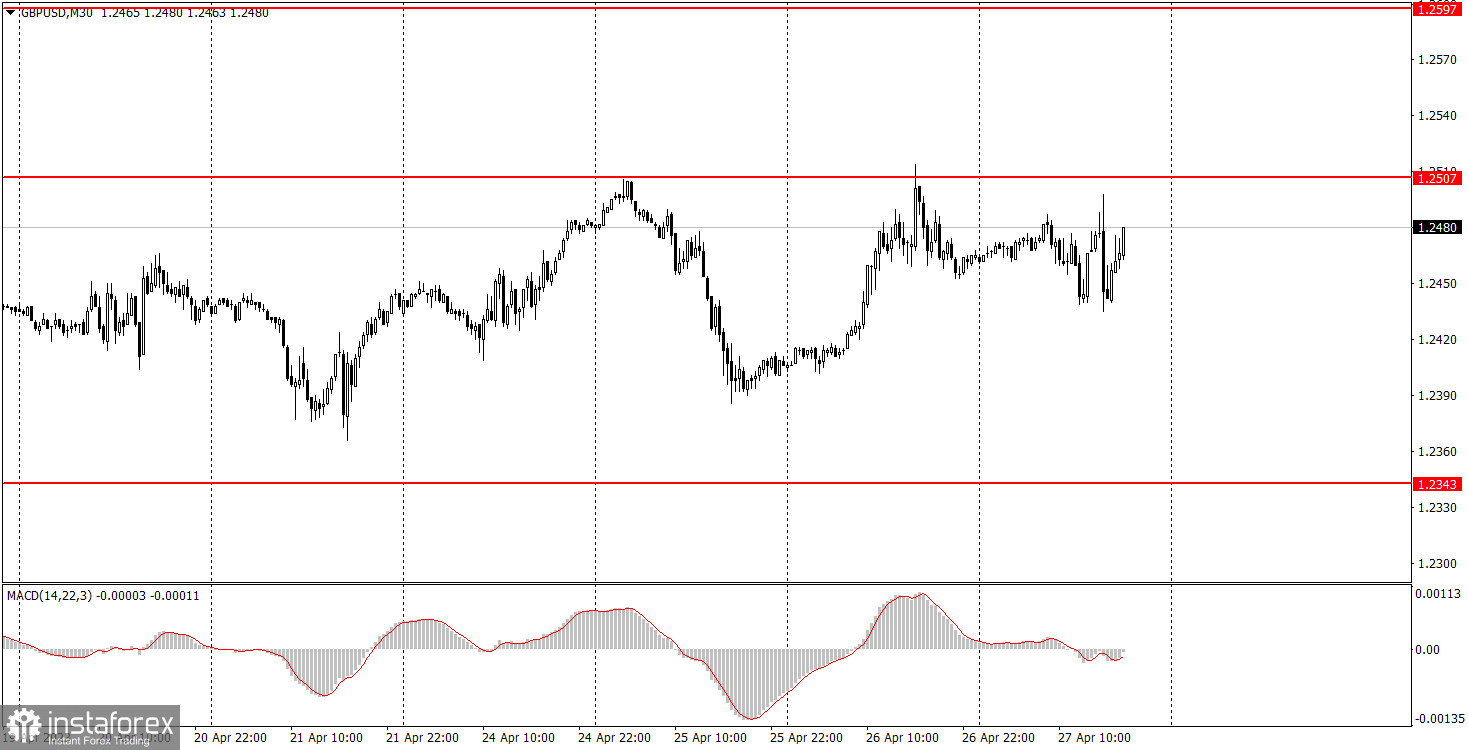

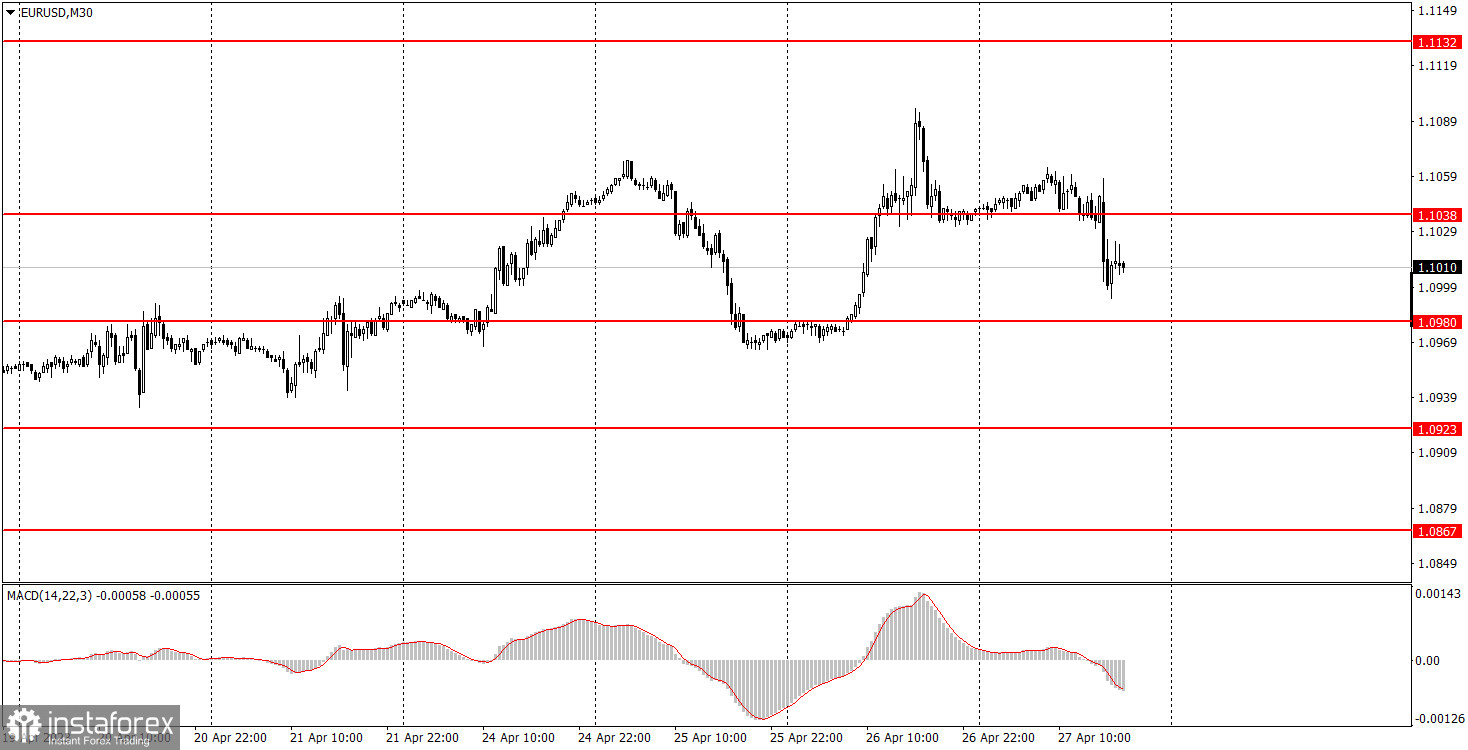

5) You can trade using signals from the MACD indicator on the 30-minute time frame only amid strong volatility and a clear trend that should be confirmed by a trendline or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels.

On the chart:

Support and Resistance levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines).

Important announcements and economic reports that can be found on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română