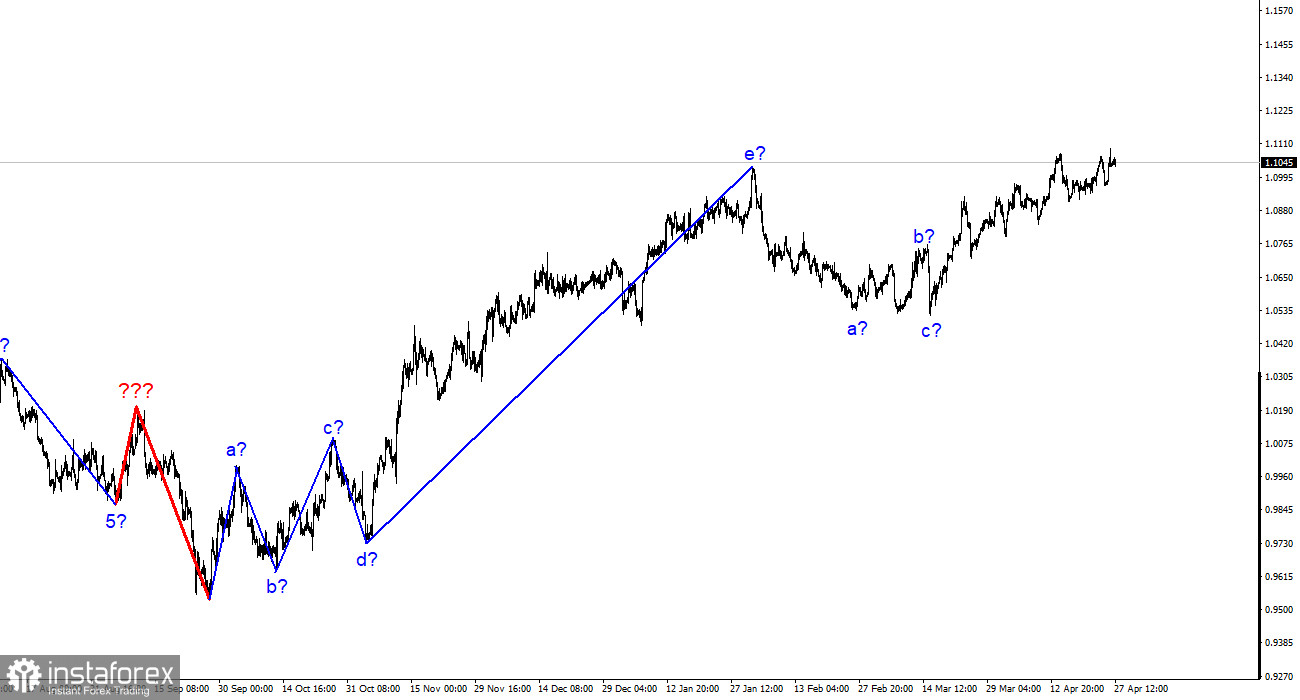

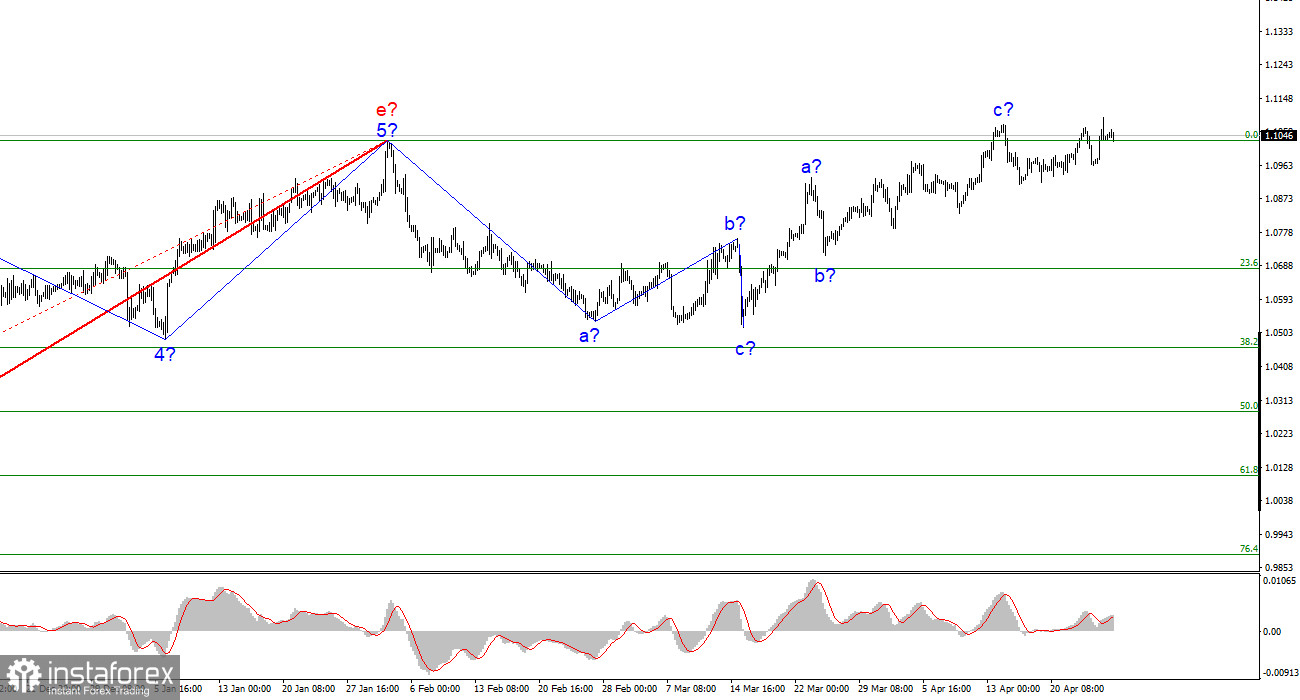

The wave analysis of the 4-hour chart for the euro/dollar pair continues to get tangled due to the latest ascending waves, but it has stayed the same in recent days and weeks. These waves are an independent upward section of the trend (as the last descending one can be considered three-wave and completed), and it may also be approaching completion if it takes on a three-wave form. Thus, the wave picture for the euro currency can become very complex, and it isn't easy to work with it now. At the current position, the formation of an upward set of waves may end since the peak of the third wave has gone beyond the peak of the first. The same thing was seen in the last descending formation (minimum update of the low and completion of the section). At the same time, there are other options for wave analysis. For example, a full-fledged five-wave (but also corrective) structure It is advisable to proceed from the scenario with a decrease in the pair because the ascending three-wave set looks complete and finished. Therefore, in the near future, the formation of a new descending three-wave set may begin, but a new successful attempt to break through the 1.1030 mark indicates the market's readiness for new purchases. For now, let's not rush with sales.

The ECB maintains optimism and "hawkish" rhetoric.

The euro/dollar pair rose by 70 basis points on Wednesday, and today is just the beginning of interesting events. An hour ago, a report on US GDP for the fourth quarter was released, so I expect the movements' amplitude to be high until the end of the day. Accordingly, I do not draw any conclusions in advance about the change in the currency pair's rate. We will talk about the GDP report later. I want to again draw the readers' attention to the key factors of price formation in the foreign exchange market. If you ignore all economic reports and events of the last two weeks (there were few of them, and their importance was not the highest), the European currency is still located near its peak values. The pair cannot complete the formation of an upward set of waves. It can take any form in terms of duration, but I proceed because it will be three waves. If this is the case, the decline should have started long ago.

At the same time, almost all key ECB figures spoke over the past one and a half weeks, and the same rhetoric was heard from everyone: interest rates will continue to rise and inflation will continue to decline. The second conclusion is that tightening monetary policy has a long-term effect. The first conclusion is not even a conclusion but a specific plan of the European regulator. The market is still determining whether interest rates in the European Union will continue to rise for long. Based on this, it can be explained why the euro currency remains at peak levels but demand for it is staying the same. The market is still preparing for a reversal and the formation of a new downward trend section.

General conclusions.

Based on the analysis, the formation of the upward trend section is nearing completion. Therefore, sales can now be advised, and the pair has much room for decline. Targets in the range of 1.0500–1.0600 can be considered quite realistic. With these targets, I advise selling the pair on reversals of the MACD indicator "down," but now it is necessary to wait for a successful attempt to break through the 1.1030 mark from above.

On the older wave scale, the wave analysis of the ascending trend section has taken on an extended form but is probably complete. We saw five waves, which are most likely an a-b-c-d-e structure. The formation of the downward trend section may still need to be completed, and it can take any form in terms of structure and duration.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română