Bitcoin and Ethereum were painfully battered yesterday. After BTC's good correction around $27,200, a looming "credit crunch" in the American banking sector once again forced investors to revise drastically portfolios and shift focus towards cryptocurrencies. In this context, Bitcoin climbed to the $30,000 level, extending the recent period of turbulence at around the closely watched landmark level.

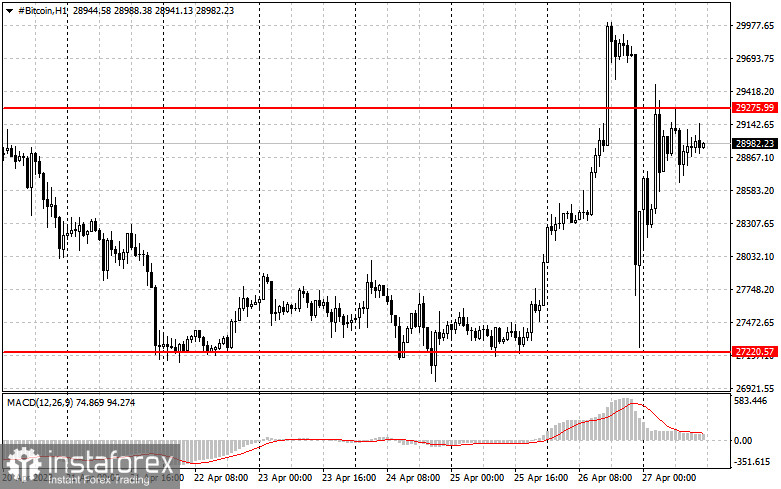

However, then in an instant, the world's first cryptocurrency plunged by 7% returning to the $27,200 area. Some attribute this to fake news about wallets linked with Mt. Gox and the US government which came to life and started to make transactions. Others simply connect it to massive liquidation of positions by speculative players who got caught in a "bull trap". The market was hit by a huge sell-off when market makers got rid of large volumes through well-known crypto platforms. Eventually, traders hurried up to open long positions during a slump. As for the fake news, we will not know the whole truth, but we don't need it.

As I have already said, many investors consider the growth of Bitcoin as one of the options for hedging the US ailing banking sector. Previously, a significant outflow of deposits from First Republic Bank led to a 25% stock crash on Tuesday and another 45% on Wednesday. The hedging argument is based on the concept that Bitcoin serves as an alternative to the fiat-based banking sector.

Despite all speculations, Bitcoin has already surged by 75% this year from the last year's collapse, which occurred due to the US government's crackdown on the crypto industry and the FTX exchange crash. Expectations that the Federal Reserve will eventually start cutting interest rates set the stage for the rally of digital assets.

As for today's technical picture of Bitcoin, we can only talk about further growth after the token ensures control over the $29,270 level, which has recently been acting as a crucial level. This will open the door to a bull market. So, the odds are that the crypto will be able to update $31,000. The ultimate target will be $32,300, the area of large profit-taking. Afterwards, Bitcoin might pull back. If the instrument comes under selling pressure again, emphasis will be placed on protecting $27,200. Its breakout will be a blow to the bullish trend, opening a direct path to $25,500. Later on, if this level is also broken, the flagship cryptocurrency could fall as low as $23,900.

Ether's buyers are now focused on maintaining control over the nearest support at $1,800 and breaking through the nearest resistance at $1,925, which has so far failed to hold. After that, we can expect a move to $2,028, which will allow the token to extend the bullish trend. This will enable a new Ether's surge to the $2,127 area. Moving beyond this border will open the door higher to $2,250. Alternatively, if pressure returns to ETH, the $1,803 level will come into play. Below that, the $1,697 area will be in sight. Its breakout will push the instrument down to a low of $1,640.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română