The currency pair EUR/USD on Monday, quite unexpectedly for many, showed an upward movement. Recall that no macroeconomic publications, even secondary ones, were planned for Monday. However, during the day, various data from ECB representatives appeared unexpectedly. In particular, Francois Villeroy de Galhau and Pierre Wunsch spoke. We will talk about this a little further down, but for now, let's note that both officials did not provide anything special to the traders, but in the context of a "thin" market, even what they said was enough to push the pair up several tens of points. Therefore, on the one hand, the pair quickly completed last week's flat; on the other hand, it did not show anything special on Monday. It's just growing again. Who can be surprised if the correction has been only 100–120 points for the past month and a half?

Thus, at the moment, there is every reason to expect a resumption of the upward trend. The euro currency is again approaching its local highs, so it is not excluded that it will update them this week. Very little macroeconomic data or fundamental events are planned for this week, but we will not be surprised if we see the euro 200 points higher than its current value on Friday. Therefore, for now, the overbought signal of the CCI indicator does not have the necessary effect. Remember that this indicator rarely visits areas above the 250 mark and below the -250 mark. Each such signal is strong, and each non-fulfillment of the signal is eloquent evidence of inertial and illogical movement. If there were a strong fundamental background in favor of the euro, then there would be no questions. But there isn't, and the euro continues to grow.

It is very difficult to say how long such a movement will continue, which is very difficult to predict if the fundamental analysis is not an empty phrase for you. The only thing left is to stick to the previous tactics: to treat all sell signals with great caution and expect the euro currency to collapse at any moment.

The ECB allows for a more extended rate hike.

Let's note right away that the information regarding the European Union Bank's three rate increases is solely the result of a social survey that Bloomberg conducted among economists. Most respondents disagreed with such a scenario, but this does not mean the ECB will adhere to it. We also believe the rate will grow by a maximum of 0.75%. However, Pierre Wunsch stated yesterday that the rate would grow until wage growth decreased. It should be noted that strong wage growth rates give people more money, and they start spending more, provoking price growth, i.e., inflation. Thus, the ECB believes fighting inflation should reduce wage growth rates. Wunsch also noted that core inflation had not decreased even once, and the ECB will not ignore it. "We are going to tighten monetary policy until both indicators show the necessary movement for us," Wunsch concluded.

One can treat Mr. Wunsch's statements differently, but we see nothing extraordinary. The ECB began to raise the rate last; it is logical if it finishes raising it last. Consequently, the ECB rate will continue to grow. Moreover, the ECB has yet to reduce its growth rate to a minimum, and when this moment comes, one can expect another 2-3 tightening of 0.25%. Thus, the ECB rate still has room to grow. Theoretically, this can support the euro currency for some time, but the market has long worked out this factor. And in any case, it does not cancel the need to adjust occasionally. And it should keep the data that frankly should provoke the strengthening of the US currency. The market interprets all incoming information one-sidedly, favoring the euro currency. There needs to be more logic in the movements now, and the movements themselves leave much to be desired, although, on a 4-hour TF, they may seem ideal. However, we do not think so and call for caution. The best option now is to trade on the youngest TFs to be able to react quickly to any changes.

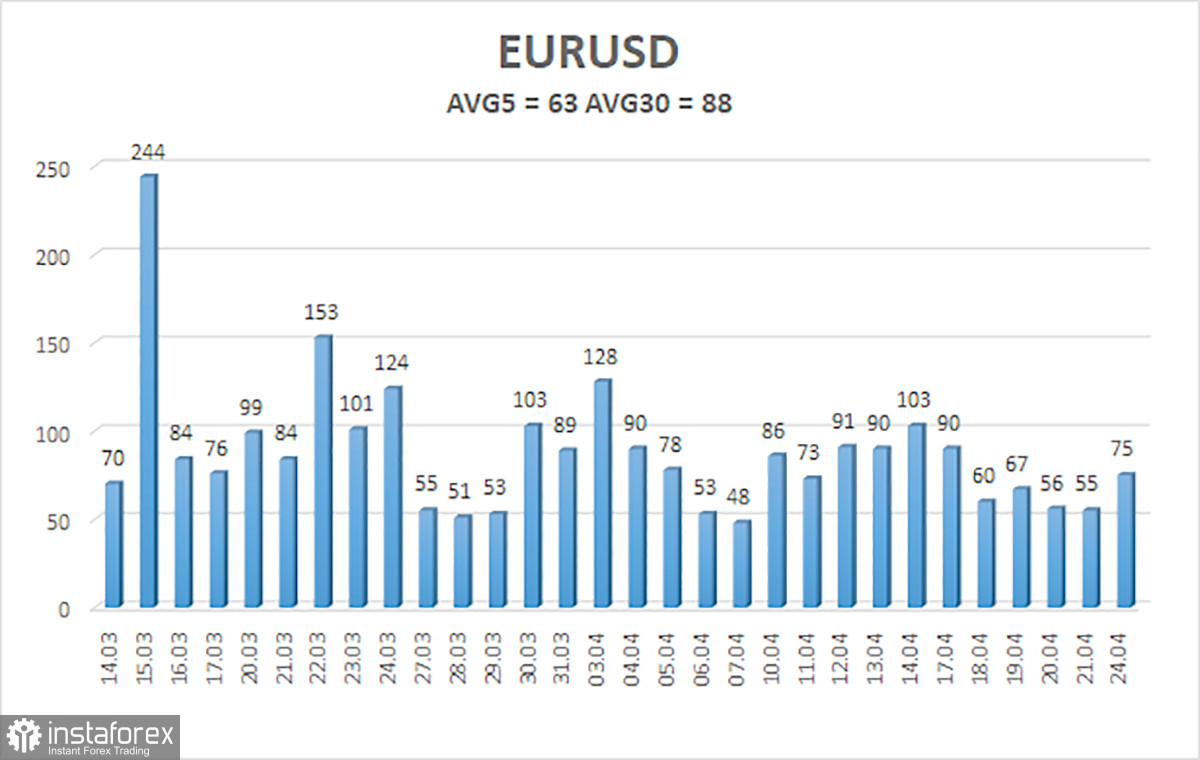

The average volatility of the euro/dollar currency pair for the last five trading days as of April 25 is 63 points and is characterized as "medium-low." Thus, we expect the pair to move between levels 1.0976 and 1.1104 on Tuesday. A reversal of the Heiken Ashi indicator back down will indicate a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair is trying to resume the upward movement. You can stay in long positions with targets at 1.1104 and 1.1108 until the Heiken Ashi indicator turns down. Short positions can be opened after the price consolidates below the moving average with a target of 1.0864.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term tendency and the direction in which trading should be conducted now.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română