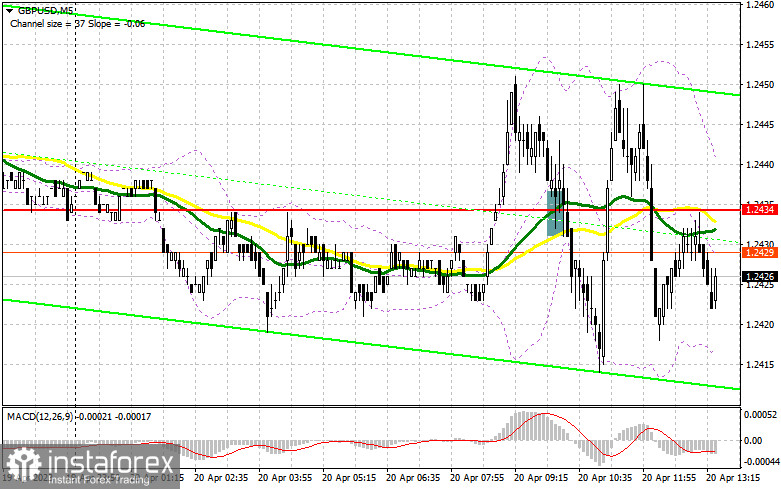

In my morning forecast, I called attention to the 1.2434 level and recommended entering the market from it. Let's look at the 5-minute chart and figure out what happened there. A breakout and reverse test of this level from top to bottom led to a signal to buy the pound, but unfortunately, it did not materialize, resulting in a loss of fixation. Considering that the 1.2434 level was significantly "smeared" in the first half of the day, I abandoned it altogether, as it is difficult to understand in which direction the pair may move.

To open long positions on GBP/USD:

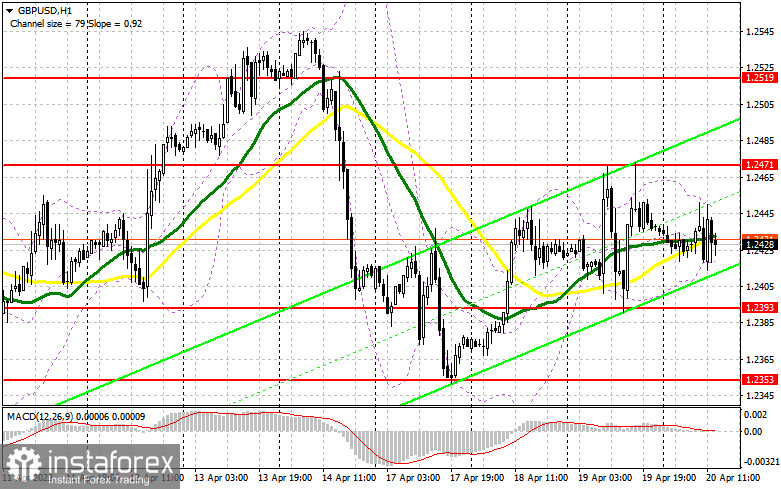

If reports on the number of initial jobless claims in the US, the Philadelphia Fed manufacturing index, and the volume of home sales in the secondary market manage to surprise on the upside, demand for the dollar will return, leading to a larger GBP/USD downward movement. Theoretically, statements from FOMC members Christopher Waller and Michelle Bowman could also help the dollar increase its advantage over the pound. Still, there is no need to rely on them too much. If the pair declines in the second half of the day, the bulls should focus on defending the lower boundary of the sideways channel at 1.2393. Forming a false breakout there will allow for an entry point into long positions with the prospect of a surge to the resistance area of 1.2471, formed based on yesterday's results. Controlling these levels will be important, as it can change the market direction to an upward trend. A breakout and consolidation above this range will form an additional signal to buy the pound with a movement to 1.2519. The furthest target will be the 1.2561 area, where I will fix the profit. In a declining scenario of around 1.2393 and a lack of activity from bulls, it's best not to rush with purchases. In this case, I will open long positions only on a false breakout in the area of the next support at 1.2353. I plan to buy GBP/USD immediately on the bounce only from the minimum of 1.2310, with a correction target of 30-35 points within the day.

To open short positions on GBP/USD:

Sellers have repelled the bulls' attempt to build a new upward trend, but the pair's further direction is quite foggy. For this reason, it's better to take your time with decisions. I will act only on a false breakout in the area of 1.2471, which will give a chance for a larger pound movement with the prospect of updating the new support at 1.2393, formed yesterday. A breakout and reverse test from the bottom to the top of this range after the speeches of the Federal Reserve System representatives will increase pressure on GBP/USD, forming a sell signal with a decline to 1.2353. The furthest target remains the minimum of 1.2310, where I will fix the profit. In a scenario of GBP/USD growth and lack of activity at 1.2471 in the second half of the day, which is also quite likely, postponing sales until the test of the next resistance at 1.2519. Only a false breakout there will provide an entry point into short positions. If there is no downward movement, I will sell GBP/USD on a bounce immediately from the maximum of 1.2561, but only with the expectation of a pair correction downwards by 30-35 points within the day.

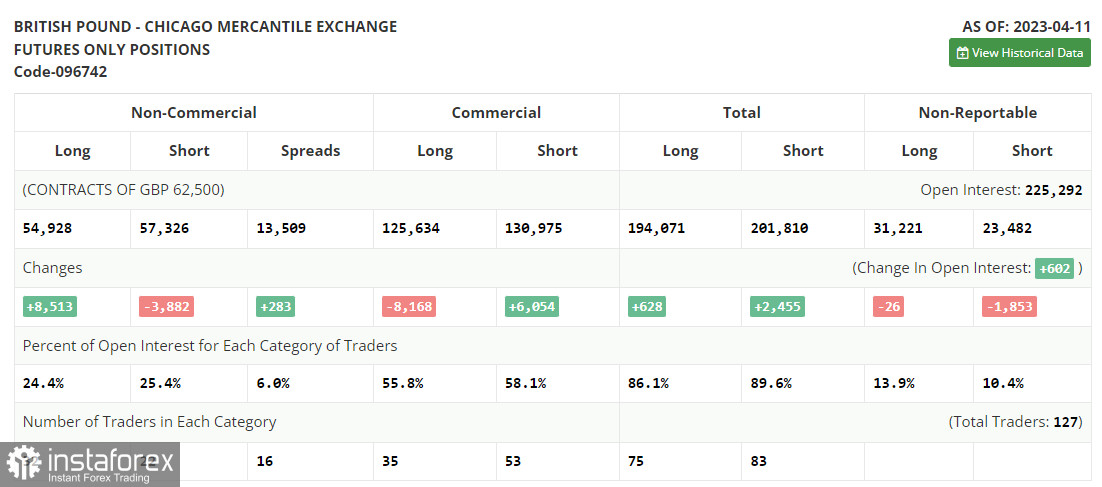

The COT report (Commitment of Traders) dated April 11 showed an increase in long positions and a reduction in short positions. The overall UK GDP growth rate data was pleasing to the market, so the demand for the pound remained even despite the downward correction of the pair, which had been overdue for quite some time. Considering that the Federal Reserve's aggressive policy is ending, and the Bank of England has no choice but to continue raising interest rates and fighting double-digit inflation, demand for the pound can be expected to remain. The correction will be a good reason to enter long positions. The latest COT report states that short non-commercial positions decreased by 3,882 to 57,326, while long non-commercial positions jumped by 8,513 to 54,928. This led to a sharp reduction in the negative value of the non-commercial net position to -2,398 against -14,793 a week earlier. The reduction is taking place for the third week in a row, which also confirms the bullish nature of the market. The weekly closing price dropped to 1.2440 against 1.2519.

Indicator signals:

Moving Averages

Trading is taking place in the area of 30 and 50-day moving averages, indicating market uncertainty.

Note: The author on the H1 chart considers the period and prices of moving averages and differ from the general definition of classical daily moving averages on the D1 chart.

Bollinger Bands

In case of a decline, the lower border of the indicator will act as support around 1.2420.

Description of indicators:

• Moving average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română