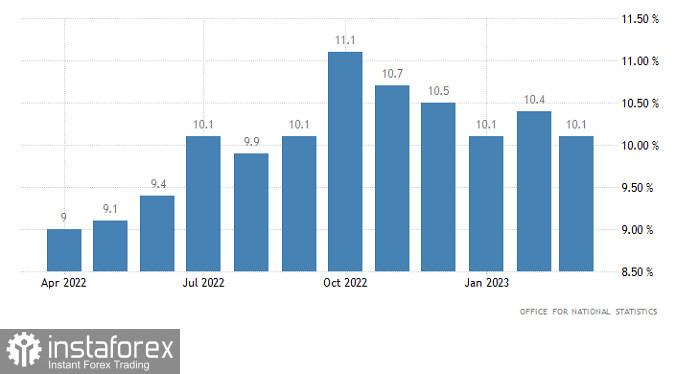

The Bank of England is likely to continue raising interest rates as inflation in the UK is reported to have slowed from 10.4% to 10.1%. Although this data is slightly below the forecast of 10.2%, inflation itself remains extremely high. Thus, the central bank had no choice but to further tighten the monetary policy parameters. However, there is nothing unexpected or new about all of this, so pound, although may have jumped back and forth, will remain in place.

Inflation (UK):

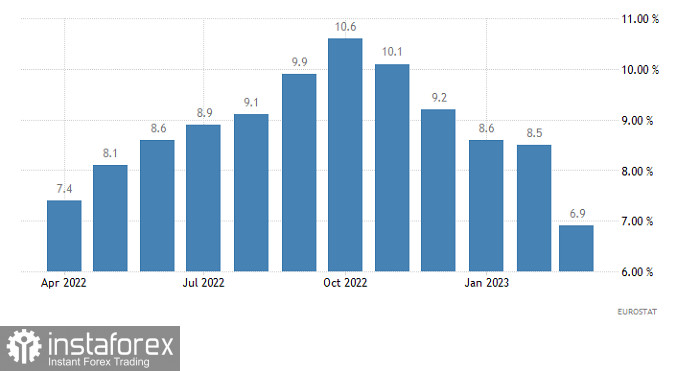

Similarly, inflation in the Euro area slowed, with consumer price growth falling from 8.5% to 6.9%. The market already expected such a scenario, so there was not much reaction. If the final data differed significantly from the preliminary data, there would have strong price movements.

Inflation (Europe):

Perhaps, the upcoming data on US jobless claims could shake the market, especially since the figure is expected to increase by around 10,000. Both initial and repeated claims are said to rise by 5,000 each. The changes may seem insignificant, but the deterioration of the situation in the labor market will weaken dollar.

Jobless claims (US):

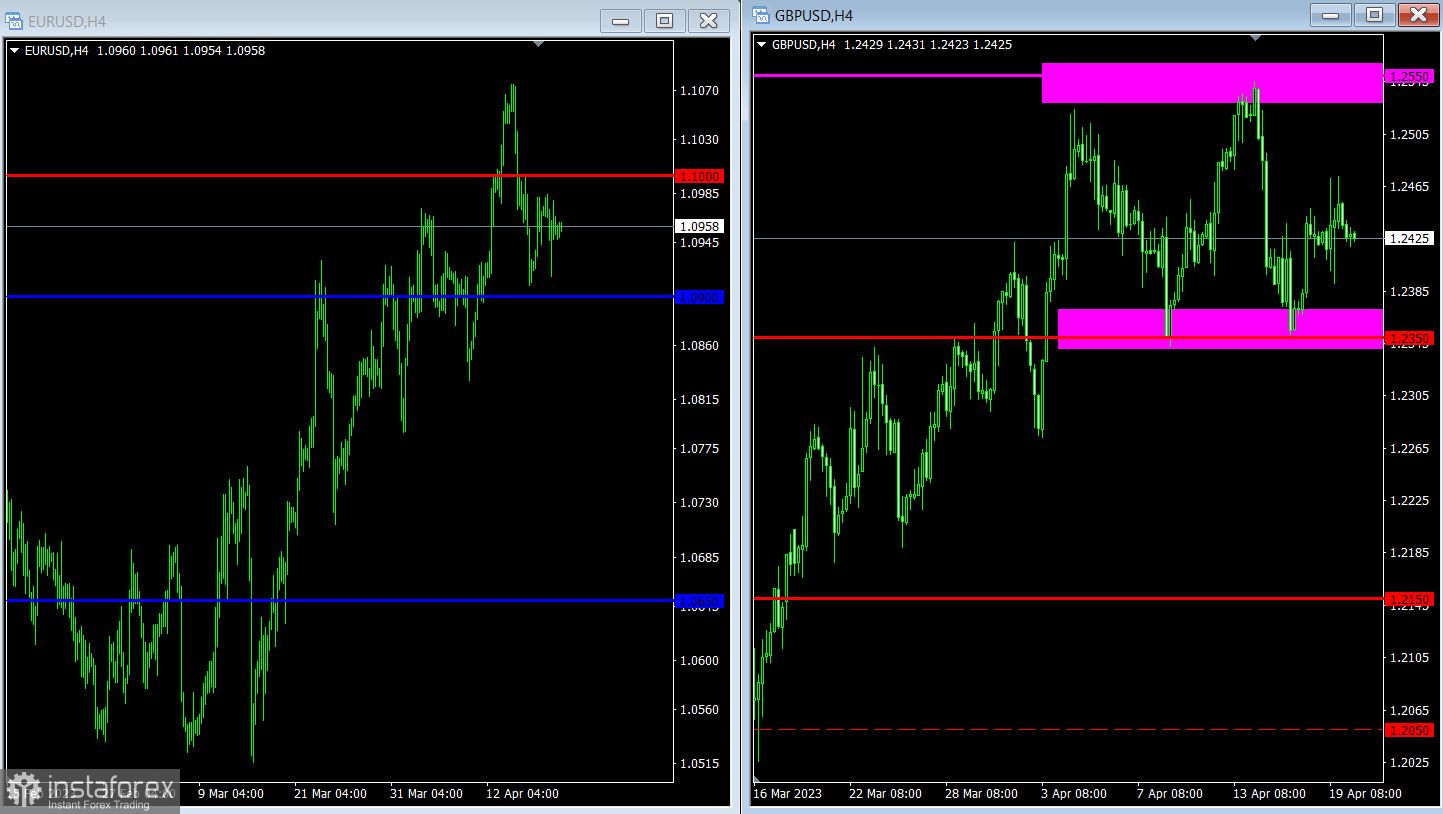

Although EUR/USD recovered from its recent decline, it is still below 1.1000, which means that buying pressure will not return any time soon, unless the pair succeeds in returning above 1.1000. Such a movement will lead to an update of the local high.

In the case of a further decline, the current correction will extend, which will fuel short positions.

In GBP/USD, trading remains in the range of 1.2350/1.2550 for the second week, with small rebounds from the lower boundary observed. The best action in this situation is opting for a breakdown. Trading within the flat is also possible.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română