GBP/USD

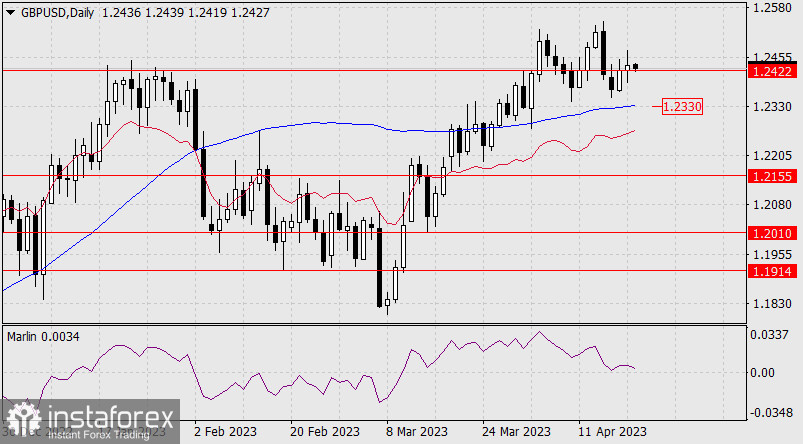

Yesterday's UK CPI figures for March were slightly better than expected and kept the pound in positive territory as the dollar index strengthened by 0.20%. The pound's success did not come without a fight – the range was 83 points. However, despite the advance above the resistance level at 1.2422, the Marlin oscillator continues to point downward on the daily chart.

If the price consolidates below 1.2422, then the pair can reach the next target at 1.2330 – the MACD line on the daily chart. This is the main scenario. If the price climbs above yesterday's high of 1.2473, it may open another scenario, which involves growth to 1.2598 – the June 2022 high. On the four-hour chart, it is clear that the price could not consolidate above the resistance of the MACD indicator line, even under favorable circumstances.

Today, there might not be any favorable circumstances, since the market expects optimistic data from the US on initial jobless claims, the Philadelphia Fed manufacturing survey, and existing home sales for March. As a result, I expect the price to settle below 1.2422, the Marlin oscillator to transition to negative territory, and an increase in bearish pressure on the GBP/USD pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română