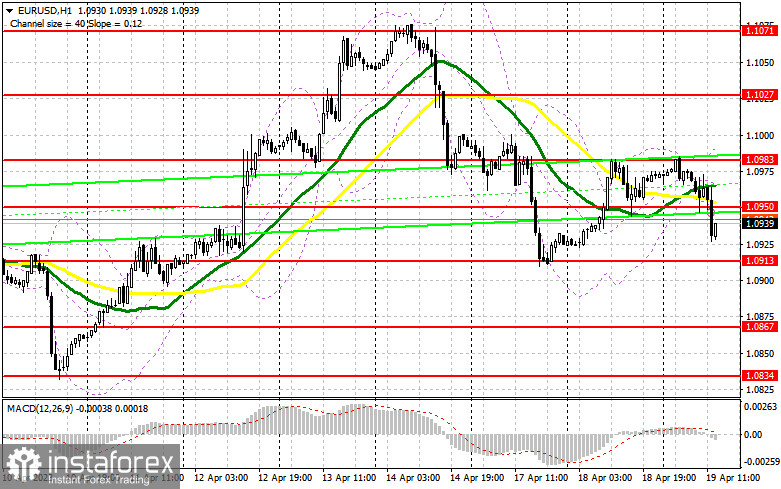

In my morning forecast, I called attention to the level of 1.0946 and recommended making decisions on entering the market from that level. Let's look at the 5-minute chart and figure out what happened there. The pair's decline occurred but lacked a few points to form a false breakout at this level. For this reason, I didn't get any entry points into the market.

To open long positions for EURUSD:

The inflation data in the eurozone has decreased, coinciding with economists' forecasts, weakening the euro buyers' positions in the first half of the day and allowing bears to take the initiative. Given that there are no statistics during the American session, except for the publication of the Federal Reserve's regional economic review, The Beige Book," which is not of great interest, the bulls will have every chance to compensate for the losses. To do this, it would be nice to show oneself near the nearest support at 1.0913, the movement towards which may take place at the very beginning of the North American session. The formation of a false breakout there will signal to buy with growth to the nearest resistance at 1.0950, formed as a result of the first half of the day and slightly above which the moving averages are located, already playing on the side of sellers. A breakthrough and a top-down test of 1.0950 will strengthen buyers' confidence, keeping the pair in a sideways channel and forming an additional entry point for building up long positions with the renewal of the next resistance at 1.0983. The furthest target remains the area of 1.1027, where I will fix the profit. In the case of a decline in EUR/USD and the absence of buyers at 1.0913 in the second half of the day, which is also quite likely, the pressure on the euro will increase, and we will see a new downward movement towards 1.0867. Only the formation of a false breakout will give a signal to buy euros. I will open long positions immediately on the rebound from the minimum of 1.0834 with the aim of an upward correction of 30-35 points within the day.

To open short positions for EURUSD:

Sellers managed to return to the market, and if the situation does not change in the second half of the day, it is likely to expect an update of the lower boundary of the short-term sideways channel at 1.0913. But before that, it would be nice to protect the nearest resistance at 1.0950, which would ensure the presence of a major player in the market. The formation of a false breakout at this level can lead to a sell signal and a decline in the pair to the area of 1.0913 - the weekly minimum. Its breakthrough and reverse testing from bottom to top will increase the pressure, leading to a more significant drop in EUR/USD to 1.0867. Consolidation below this range is a direct road to 1.0834, where I recommend fixing the profit. In case of an upward movement of EUR/USD during the American session and the absence of bears at 1.0950, which cannot be ruled out due to a lack of statistics, I advise postponing short positions to the upper boundary of the sideways channel at 1.0983. You can also sell only after unsuccessful consolidation. I will open short positions immediately on the rebound from the maximum of 1.1027 with the aim of a downward correction of 30-35 points.

Indicator signals:

Moving averages

Trading occurs below the 30- and 50-day moving averages, indicating the bears' attempt to seize the initiative.

Note: The author on the H1 chart considers the period and prices of moving averages and differs from the general definition of classical daily moving averages on the D1 chart.

Bollinger Bands

In the case of growth, the upper boundary of the indicator at 1.0990 will act as resistance.

Description of indicators

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

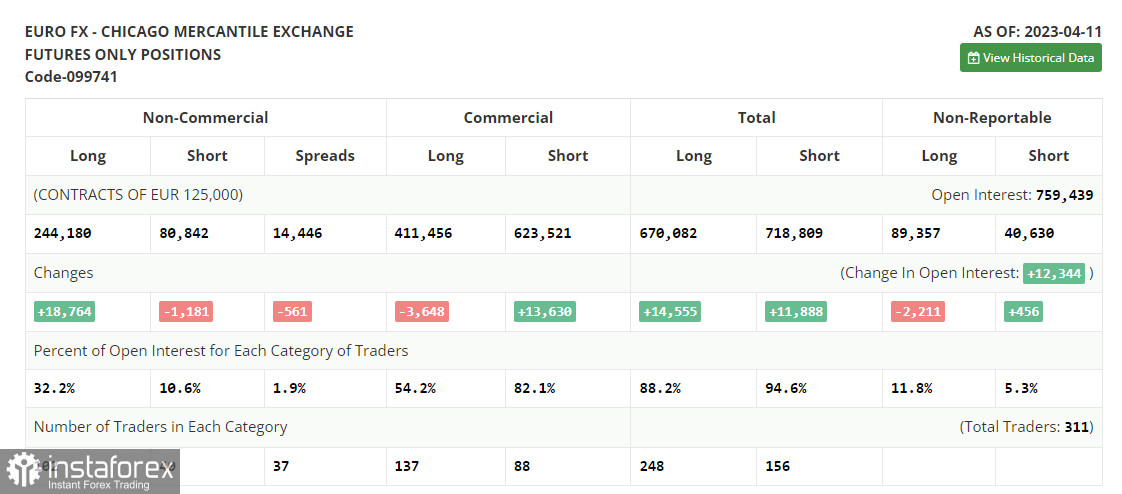

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

• Non-commercial long positions represent the total long open position of non-commercial traders.

• Non-commercial short positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română