Expectations for another rate hike by the Fed surged on Monday after Richmond Fed President Thomas Barkin said that before discussing the possibility of lowering interest rates, there is a need to confirm that inflation will stabilize at the desired value, not only reducing it to the target 2.0%.

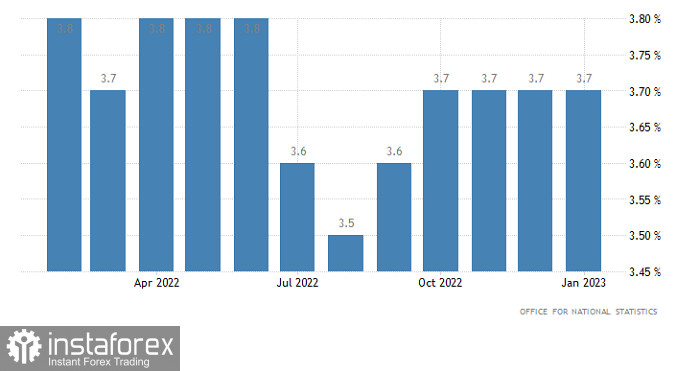

The statement also fueled demand for dollar, which may strengthen further today due to macroeconomic statistics. After all, the unemployment rate in the UK reportedly rose from 3.7% to 3.8%, and pound, through the dollar index, will drag euro along with it.

Unemployment Rate (UK):

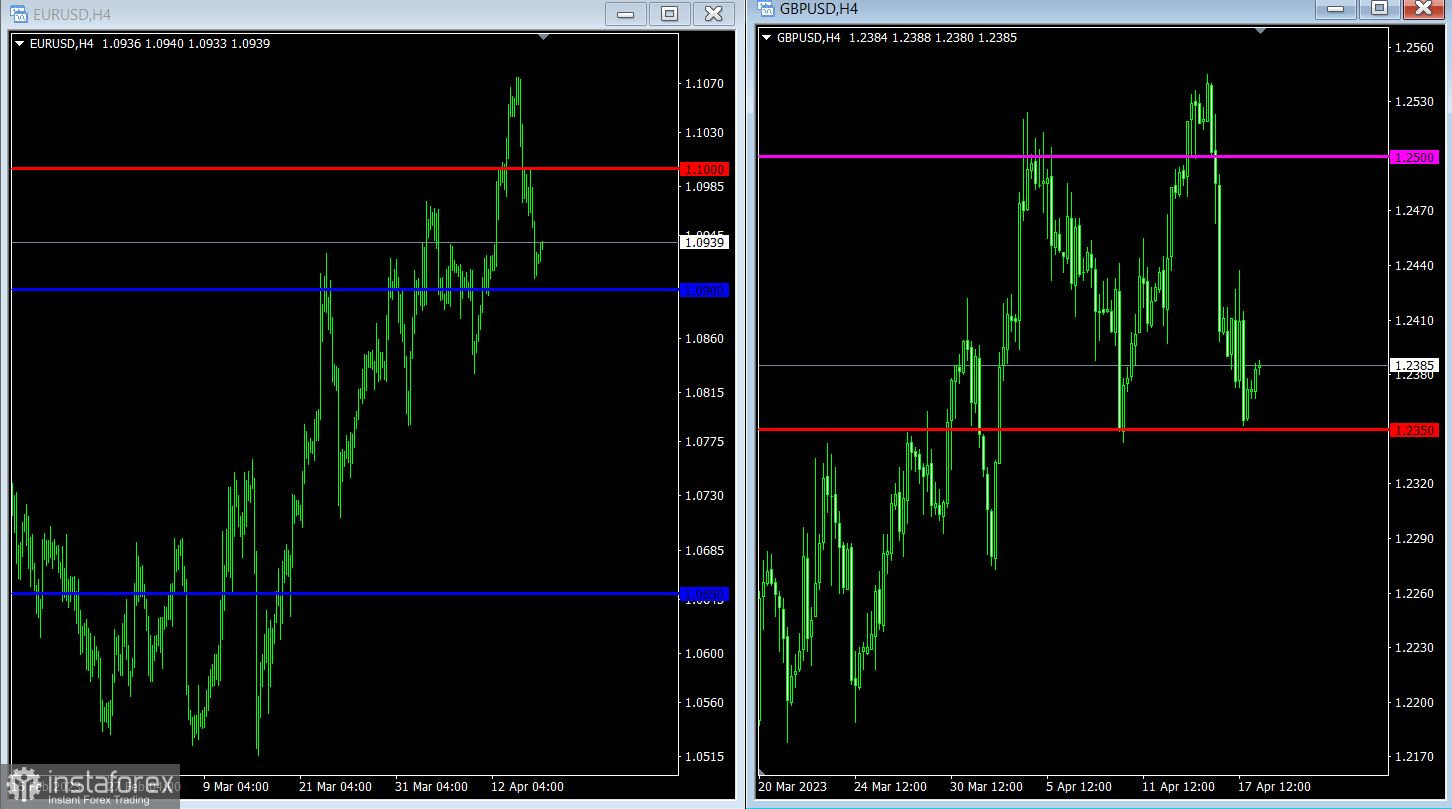

EUR/USD is currently in a correction, trading near the level of 1.0900. It is now oversold, so there is a chance that a reversal will occur, which will partially offset the decline in the pair.

GBP/USD hitting the local low eased the selling pressure, so there is a chance that breaking through 1.2350 will lead to the gradual increase of long positions. But if the quote stays below 1.2350, the current trend will continue.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română