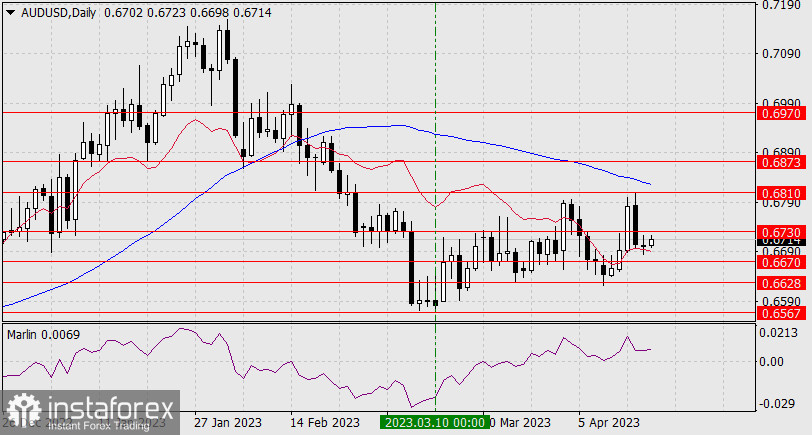

Having traded in a range of about 40 points, at the end of Monday, the Australian dollar closed almost at the level of Friday's close. The balance line acted as support for the price on the 24-hour view. Consolidating below this line will mean a shift towards short positions in the medium-term.

The signal line of the Marlin oscillator is directed strictly to the right, consolidating for a bit before it falls sharply as the most likely option for the oscillator's further development. The AUD/USD pair is aiming for 0.6670, 0.6628, 0.6567 (March 10th low).

We received good macro data from China this morning, and it seems to be slowing down the aussie's decline. China's GDP for Q1 showed a 4.5% YoY growth against an expected 4.0% YoY, industrial production rose from 2.4% YoY to 3.9% YoY, retail sales for March increased from 3.5% YoY to 10.6% YoY, and the unemployment rate fell from 5.6% to 5.3% immediately.

On the four-hour chart, the price has settled below the MACD indicator line, but it is still above the balance line. The Marlin oscillator is falling in the area of negative values - we have a downtrend but it is not final. I expect the aussie to gradually fall.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română