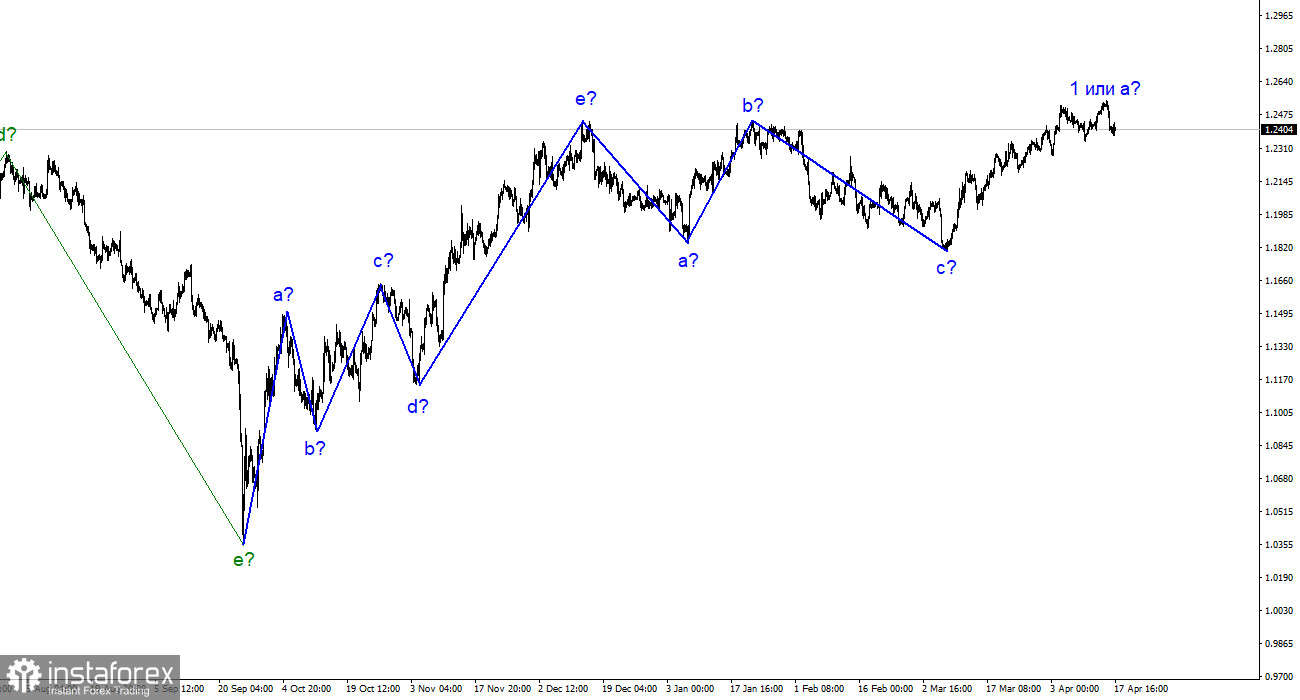

The wave pattern for the pound/dollar pair still looks complicated because it does not resemble a classical correction or impulse trend section. Since the current upward wave has exceeded the peak of the last wave b, the entire downward trend section, consisting of waves a-b-c, can be considered complete. Although it barely resembles the trend section for the same period in the euro currency performance, it must be admitted that both pairs have built downward three-wave sets of waves. If this assumption is correct, a new upward trend section has begun for the pound. Since I can only single out one wave starting from March 8th, there is every reason to assume that forming a new trend section will take a long time. Both pairs should build similar wave formations. If this is indeed the case, then wave 2 or b for the pound may be extended, while at the same time, a downward three-wave formation can be built for the euro. Thus, I expect a deep wave b, as with forming the previous three-wave set. Consequently, a decline in the pair can be expected to the 1.1850 level or slightly higher.

The pound is not finding support on Monday.

The pound/dollar pair rate fell by 110 basis points on Friday, but so far today, it has not lost a single point. The movement of the British currency on Monday corresponds to the news background, which is absent. At the same time, the euro currency continues to decline, possibly trying to catch up with the pound on Friday. One way or another, it became known today that Rishi Sunak will lower some taxes for the British population. Of course, these will not be income taxes, as they make up much of the state treasury's revenue. And the new government's policy is to refrain from inflating public debt. Thus, the taxes to be lowered are those that do not affect most of the British population or do not make up a significant part of the treasury's revenue. Therefore, such a step can be considered populist, as conservatives are already beginning to worry about the results of future parliamentary elections, where they may cede power to the Labor Party.

Many in the UK are dissatisfied with the government's actions in recent years, feeling a decline in living standards. People are only interested in their living standards rather than foreign policy or the state of the economy and industrial production. If the income level goes hand in hand with inflation or faster, then the current government is doing everything right. If not – it needs to be replaced. Rishi Sunak and his party may pay for the decisions of Boris Johnson and Liz Truss, as they were also part of the Conservative Party and sometimes made strange decisions. The news of possible tax cuts, if they had any small influence on the pound, was minimal. I believe that the decline will continue.

General conclusions.

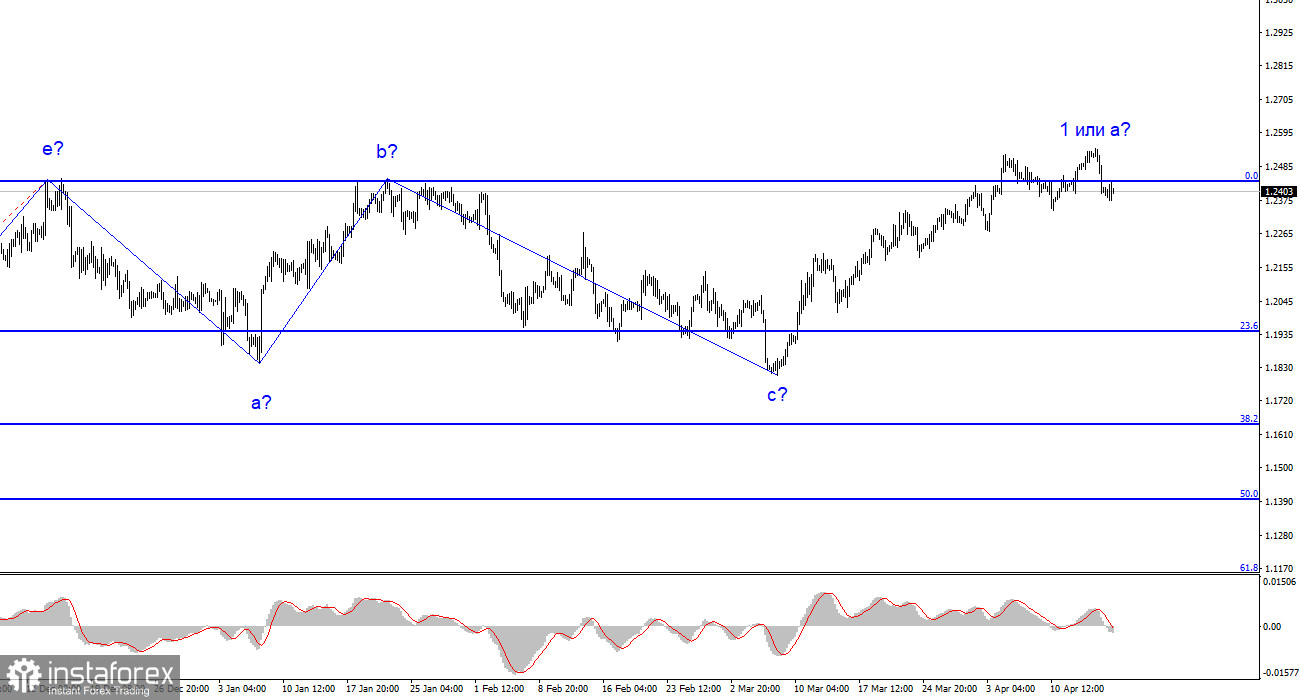

The wave pattern of the pound/dollar pair suggests the completion of the downward trend section. The wave pattern is now ambiguous, as is the news background. I do not see factors supporting the British currency in the long term, and now the formation of wave b may begin. A decline in the pair is more likely, as all waves recently have been approximately the same size. Trading can now be done from the 1.2440 level, corresponding to a 0.0% Fibonacci retracement. Below it - we sell; above it - we cautiously buy.

The picture is similar to the euro/dollar pair on the larger wave scale, but there are still some differences. At the moment, the ascending corrective section of the trend is completed. However, the three-wave downward section might have already been completed as well. And the new ascending trend section can also be three-wave and horizontal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română