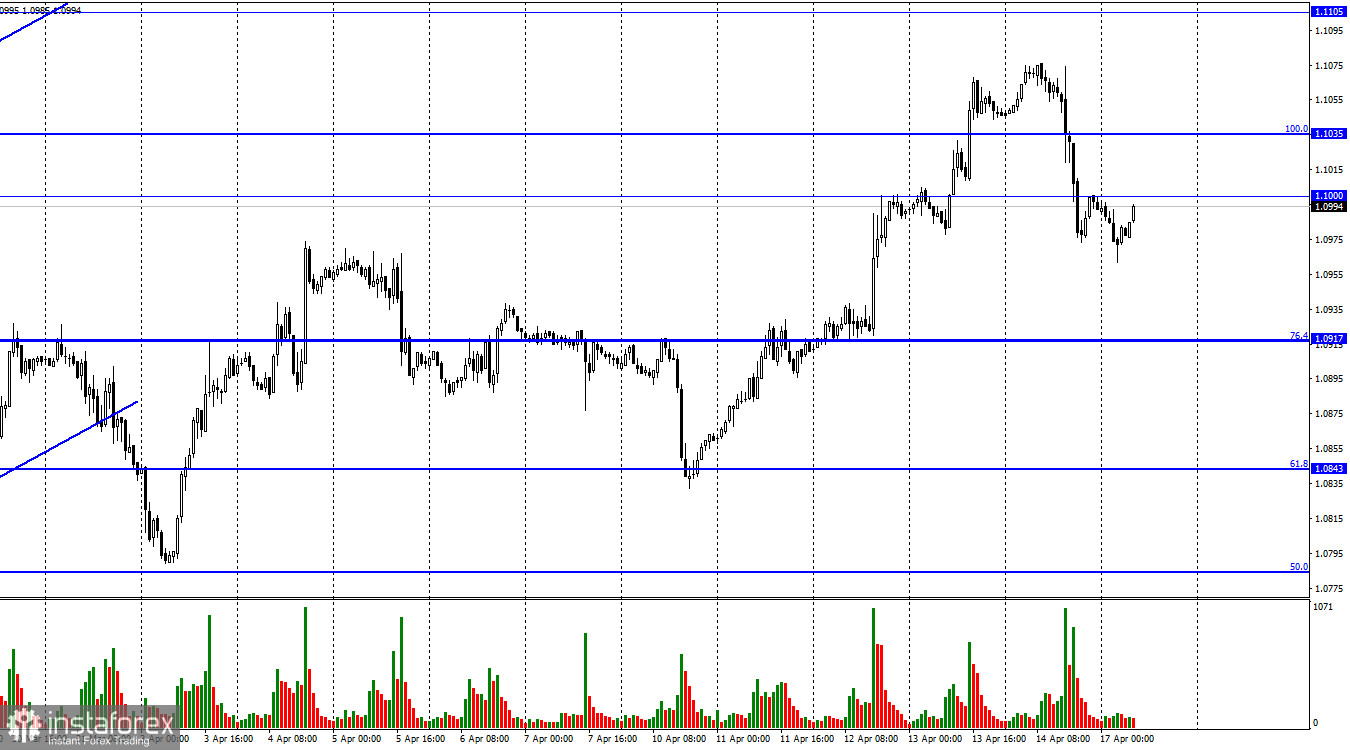

On Friday, the EUR/USD pair reversed in favor of the US currency and experienced a sharp drop below the 1.1000 level. Thus, the quote decline may continue toward the next corrective level of 76.4% (1.0917). Consolidation above the 1.1000 level will favor the European currency and a resumption of growth towards the 1.1100 level.

On Friday, the news background was quite interesting, although there were no reports from the European Union. But now, I want to draw traders' attention to a Bloomberg survey among economists, which indicates that the ECB rate will increase by 0.25% in May and that there will be no more than three rate hikes in 2023. Most survey participants agreed with this opinion. In their view, the rate will rise to 4.25%, after which the regulator will take a break or even stop the monetary policy tightening altogether. Economists believe the banking crisis in the US and the European Union will prompt the ECB to be more cautious about raising rates. They also think that core inflation is close to its peak but will not start to decline in the coming months. The main inflation indicator may go below the core level.

In my opinion, this survey indicates a decrease in the market's "hawkish" expectations. If earlier many expected another increase of 0.50% in May and several increases of 0.25% in the future, now the ECB is expected to complete the tightening process. Thus, bearish traders may become more active as bulls no longer have grounds for new purchases. The euro currency's growth may continue for some time, but over the next few months, the US currency's strengthening will begin. The current news background allows for such a conclusion.

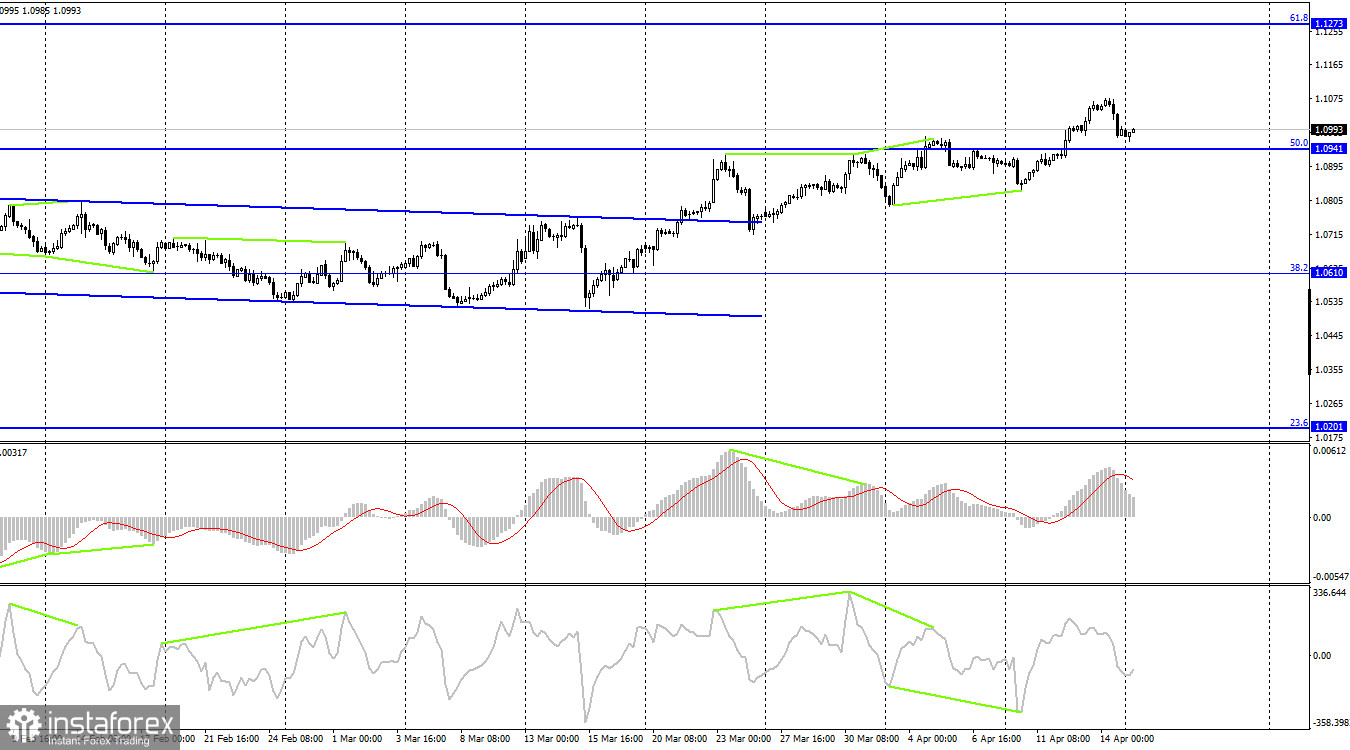

On the 4-hour chart, the pair has consolidated above the sideways corridor, allowing for the expectation of continued growth toward the corrective level of 61.8% (1.1273). Consolidation above the corrective level of 50.0% (1.0941) was also achieved, increasing the chances of further growth. The "bullish" divergence at the CCI indicator similarly favored the euro. No new emerging divergences have been observed yet.

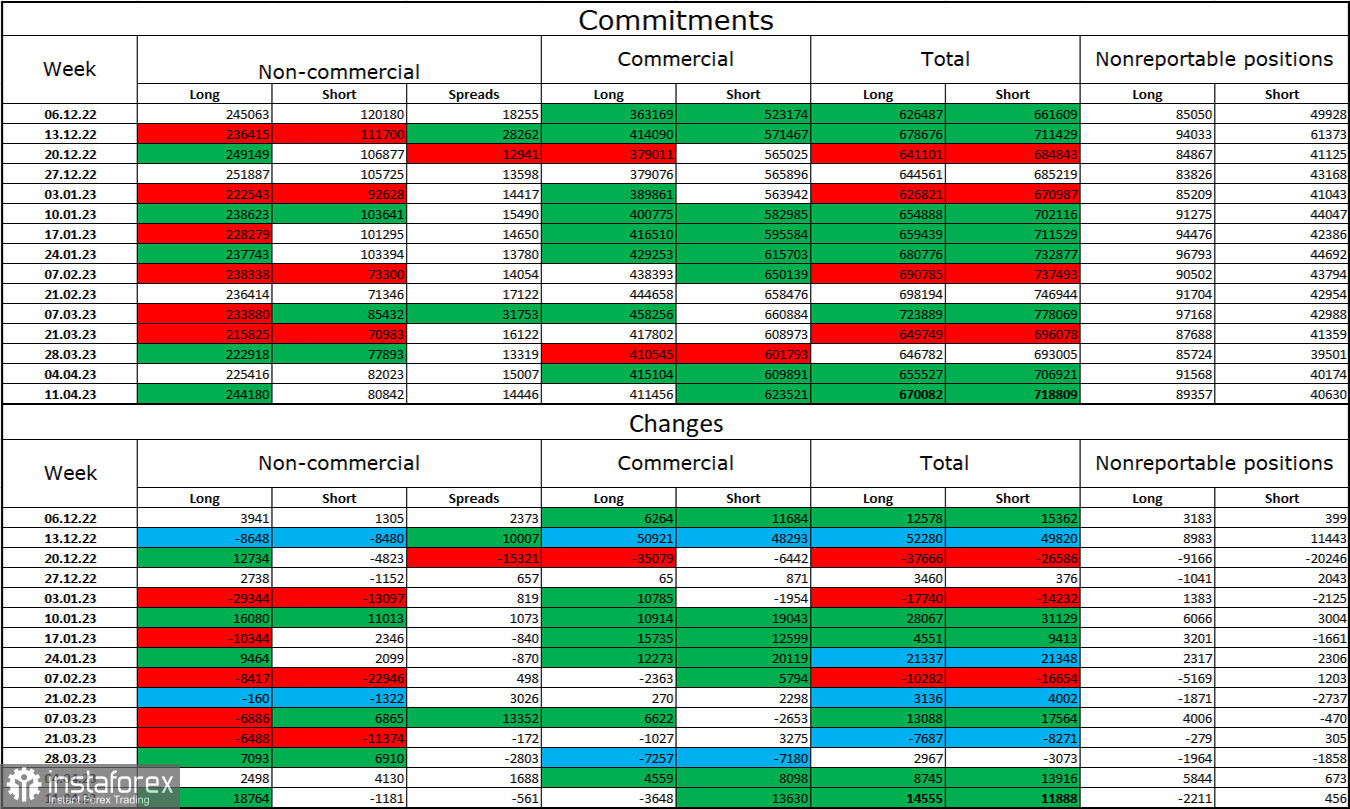

The Commitments of Traders (COT) report:

During the last reporting week, speculators opened 18,764 long contracts and closed 1,181 short contracts. The sentiment of major traders remains "bullish" and continues to strengthen overall. The total number of long contracts concentrated in the hands of speculators now stands at 244 thousand, while short contracts are at 81 thousand. The European currency has been growing for over half a year, but the news background is starting to change, which could lead to a drop in the EU currency. The ECB may already reduce the pace of rate hikes to 0.25% at its next meeting, which could lead to a decline in demand for the euro. The difference between the number of long and short contracts is threefold, indicating the proximity of the moment when bears will be activated. So far, a strong "bullish" sentiment remains, but I think the situation will change soon.

News calendar for the US and EU:

EU – ECB President Lagarde will deliver a speech (15:00 UTC).

On April 17th, the economic events calendar contains one entry. The entry is important, as Lagarde's speech is a significant event. The influence of the news background on traders' sentiment today may be moderate in strength.

Forecast for EUR/USD and advice for traders:

New sales of the pair can be opened when bouncing off the 1.1000 level on the hourly chart with a target of 1.0917. Purchases of the pair are possible upon closing above the 1.1000 level on the hourly chart with targets of 1.0035 and 1.1105. Or when bouncing off the 1.0941 level with the same targets.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română