Global stock markets closed on a positive note last trading week. Market sentiment depended on the inflation data released last Wednesday and the likelihood of an economic downturn in America. These factors are still looming over the markets, having a broad impact.

Inflation eased notably in March with an annual rate slipping to 5.0% from 6.0%, which turned out to be the lowest reading in the last two years. Nevertheless, the market rekindled the fears, generated by the published minutes of the last Federal Reserve meeting. The Fed's policymakers did not rule out a recession scenario which could hit the domestic economy by the year's end in 2023. Such prospects significantly dampened the mood of market participants, restraining the growth of stock indices.

What to expect this week?

Among the important events, the report of major importance is China's GDP data which is due on Tuesday. GDP is expected to log strong growth both quarterly and annually. If the figures are not lower than expected, this may bring a positive outlook back to the market and weaken negative sentiment about global economic growth as the impact of the Chinese economy on the world is enormous. On this wave, market sentiment may improve, thus reviving demand for stocks. Additionally, the upcoming retail sales data in China can reinforce the risk-on mood. According to the consensus, China's retail sales should also increase considerably last month.

Will the dollar carry on with its decline?

We believe that we should not expect significant depreciation in the greenback. In fact, the US dollar has already undergone most of its decline. The situation with the yields of US Treasury bonds will play an important role here. For now, the yields are increasing against the backdrop of persistent fears of a recession in the US this year. This, in turn, restrains the decline of the US dollar's exchange rate on Forex. Therefore, it is highly unlikely that it will decline against a basket of major currencies this week. Most likely, we will observe the consolidation of the US dollar index around 101.00 points. Only the economic statistics data from the US coming out this week and the statements of the Federal Reserve policymakers, expected by the end of the week, will be able to trigger either its slump or significant recovery.

Intraday outlook

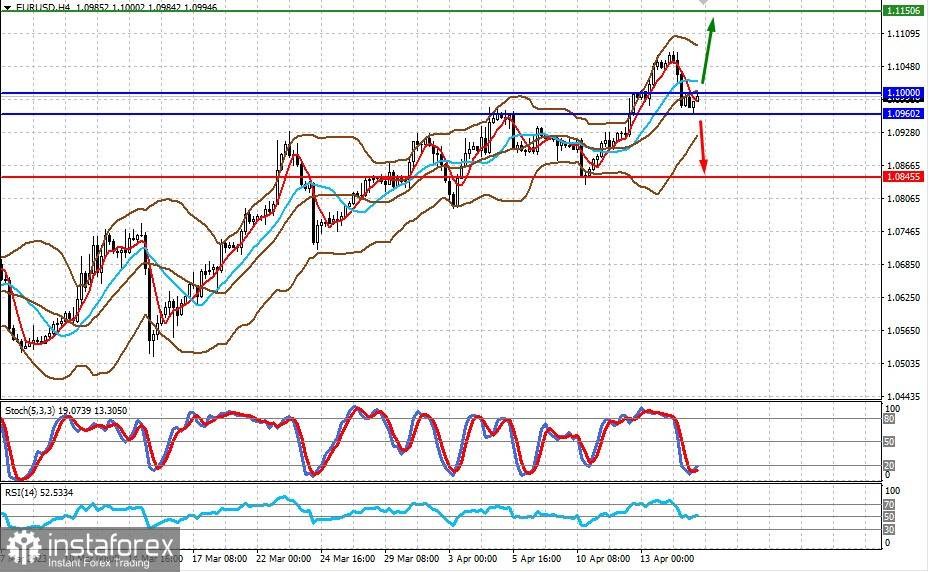

EUR/USD

EURUSD is consolidating in a very narrow range of 1.0960-1.1000, awaiting fresh news this week on inflation in the eurozone, US statistics data, and a speech by ECB President Christine Lagarde. Depending on these events, the instrument may break out of this range and either fall to 1.0845 or rise to 1.1150.

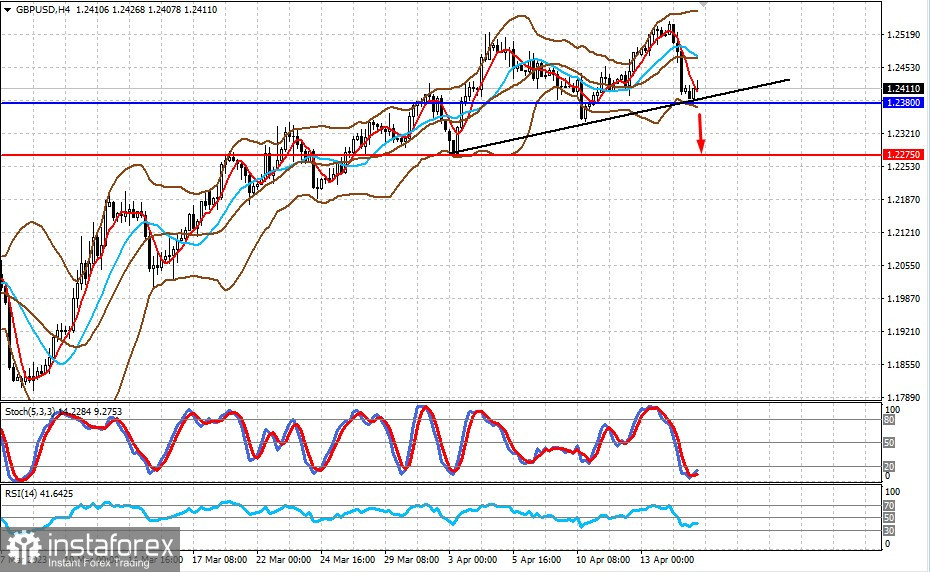

GBP/USD

GBPUSD is now trading above the support line, the level of 1.2380. If the projected inflation decline in the UK is confirmed by the actual CPI, the instrument may drop to 1.2275.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română