The US industrial production report may put pressure on the dollar. It is expected that the 0.3% growth may be replaced by a -0.9% decline. At the same time, US retail sales are forecast to decline, as their growth rates are expected to slow down from 5.4% to 3.2%.

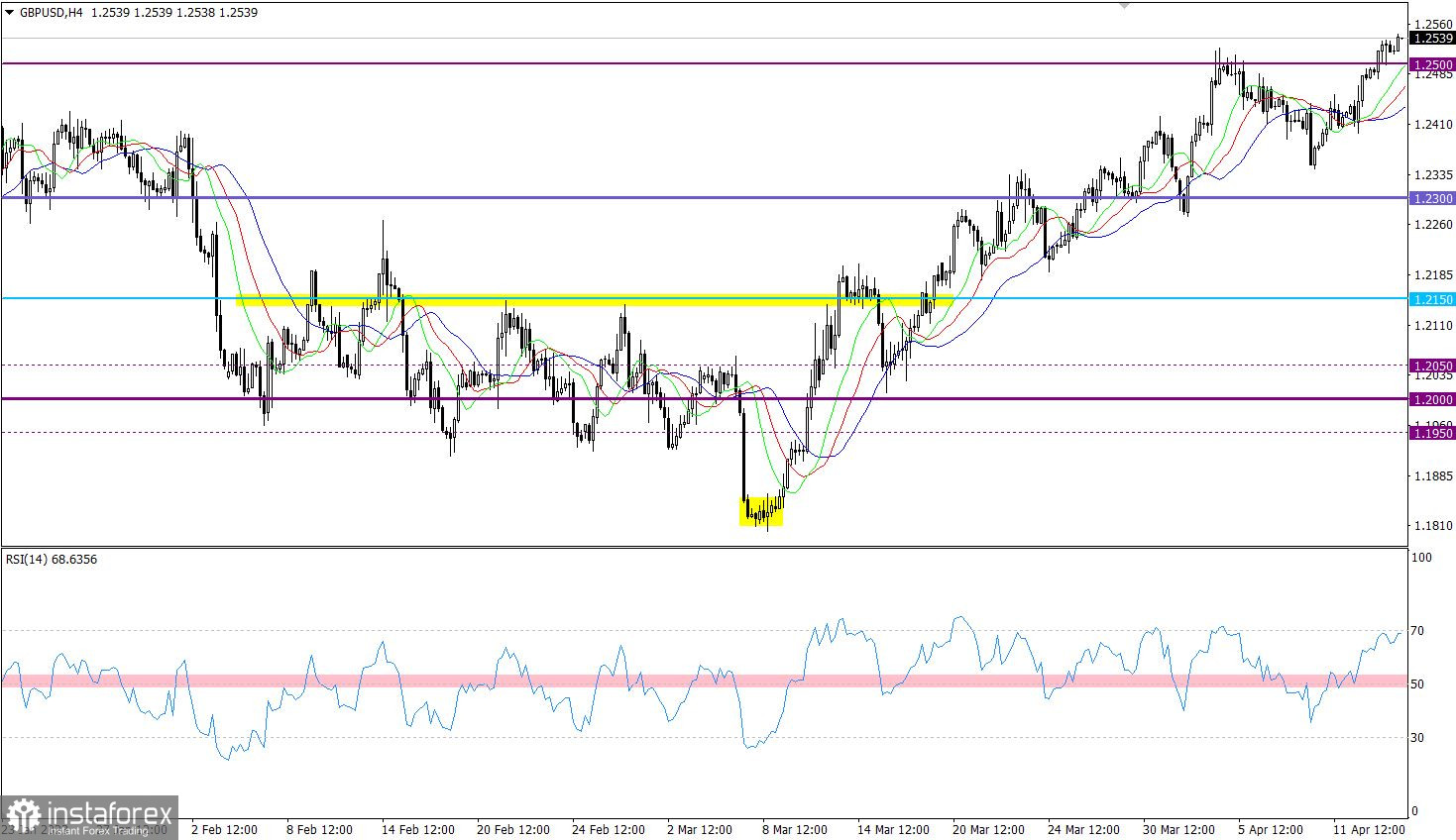

The British pound holds steady above the resistance level of 1.2500. This indicates a number of important technical factors: First - the extension of the uptrend in the mid-term; And second - the increase in the volume of long positions, which can stimulate further growth in the value of the British currency.

On the four-hour chart, the RSI technical indicator is hovering in the upper area of 50/70, which points to the growth in the volume of long positions. Take note that the indicator isn't crossing the overbought area upwards. This suggests that the volume is not excessive.

On the four-hour and daily charts, the Alligator's MAs are headed upwards, which reflects the quote's movement.

Outlook

Based on the increasing number of longs, there is a possibility for GBP to trade around the values of 1.2670/1.2720. In this case, the bulls can provide support to the mid-term trend, which may indicate even stronger price changes in the future.

As for the alternative scenario, traders consider a pullback that does not violate the structure of the mid-term trend. A pullback may occur relative to the current values if the price falls below 1.2500. At the same time, trading at 1.2670/1.2720 will definitely put pressure on long positions, which also allows the possibility of a technical pullback.

The complex indicator analysis points to an upward cycle in the short-term, mid-term and intraday periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română