Yesterday's rise in the dollar index by 0.57% and the euro's rise by 0.49% were largely based on expectations for today's quarterly reports from the biggest US banks. As expected, JPMorgan Chase, Wells Fargo, Citigroup, and PNC Financial Services will show good profits, which is important for demonstrating the resilience of the banking sector. Meanwhile, there may be some difficulties with the world's largest asset management company, BlackRock, which is also set to report today, since its in a haste to get rid of bad Credit Suisse assets.

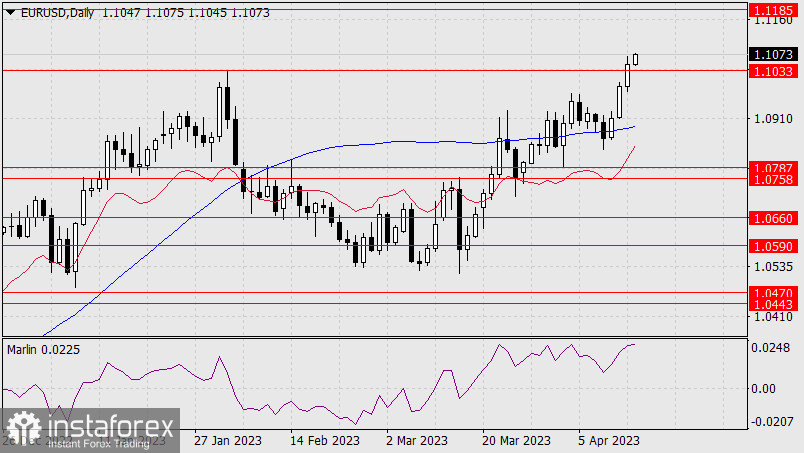

Overall, investors have an appetite for risk, and the euro may reach the target level of 1.1185 – which is the peak of March 31, 2022, and the low of November 24, 2021. Yesterday, the price overcame the first resistance at 1.1033, and the Marlin oscillator slightly turned downward. EUR may take a quick break and consolidate at this level as it braces to rise further.

On the four-hour chart, the price is vigorously growing above the rising indicator lines, the Marlin oscillator has slowed down and is ready to edge down, discharging before further growth.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română