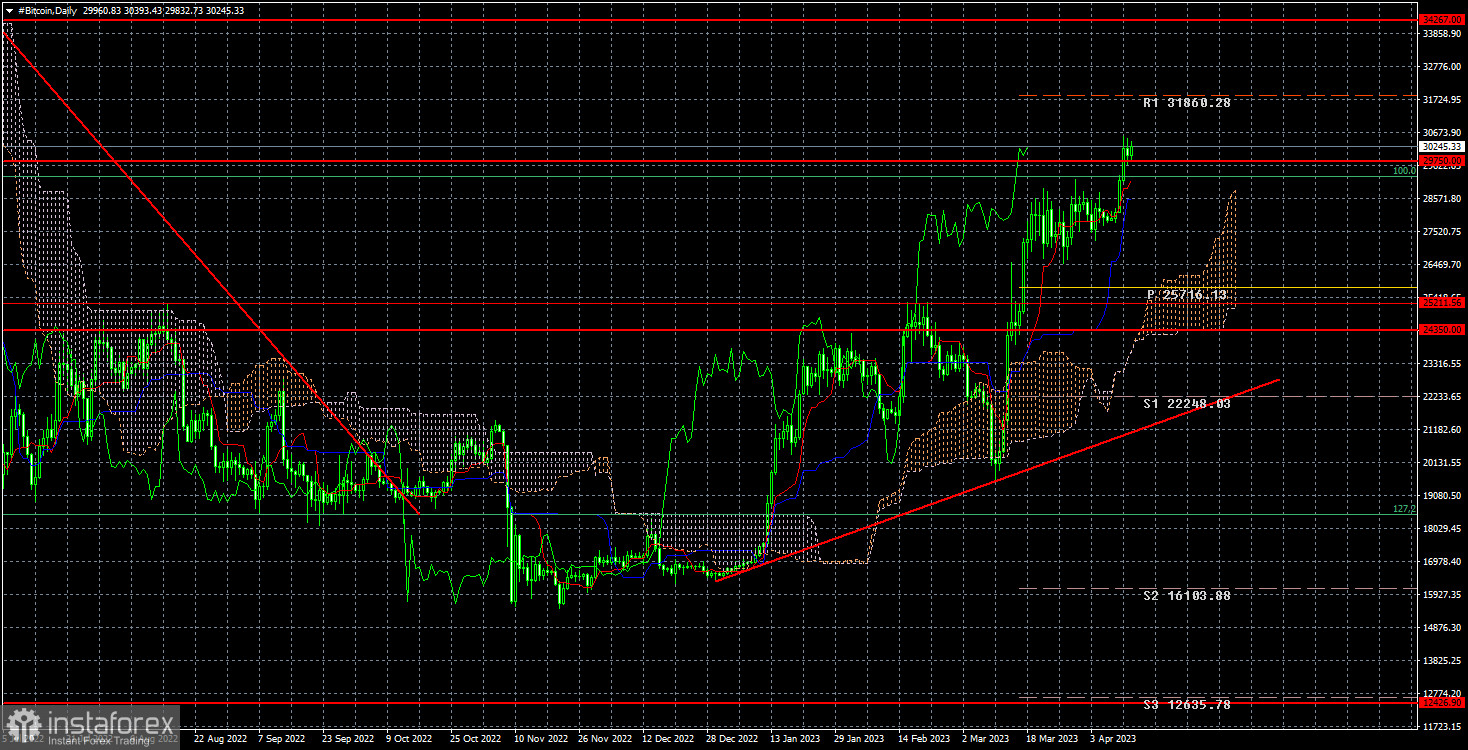

Bitcoin has risen to the $29,750 mark, as we predicted. At the moment, the price has consolidated just slightly above this level, but this is enough for traders to lock in profits or even stay in long positions. The uptrend continues, and the ascending trend line remains relevant. So as long as the price doesn't fall below the $29,750 mark, long positions remain valid.

I have already mentioned that the essence of Bitcoin remains very simple for investors. Various "experts" call it a "digital currency," "gold equivalent," "diversification tool," or "inflation hedge." We believe that all these "titles" are fundamentally wrong and exist only to increase demand for Bitcoin. You should understand that many people in this world are interested in Bitcoin's growth because their own profits depend on it. Therefore, these people will practically say anything and promise any Bitcoin value just to attract more investors. In essence, Bitcoin remains an investment instrument with no intrinsic value. In 90% of cases, people buy it with only one goal – to make a profit. No one uses Bitcoin to pay for a taxi or buy bread at the store. Even Tesla quickly abandoned the idea of selling their cars for cryptocurrency.

Warren Buffett, who is considered one of the most brilliant investors in the world, has the same opinion. He called Bitcoin a "gambling token" and compared its investors to those playing roulette. "Something like Bitcoin, it is a gambling token and it doesn't have any intrinsic value," Buffett said. "The urge to participate in something where it looks like easy money is a human instinct which has been unleashed," Buffett said. Therefore, Bitcoin can grow on this factor alone, as many believe in its growth and continue to buy. In any case, there are no sell signals at this time, and the value of Bitcoin has always been determined by the market's faith in it. Now faith is growing, so Bitcoin can continue to appreciate. The fundamental background also supports cryptocurrency at this time, as the Federal Reserve is close to completing its monetary tightening cycle. We might see a rate cut by the end of the year. And next year – a halving.

On the 24-hour chart, Bitcoin has overcome another important level at $29,750, so traders can stay in long positions with $34,267 as the target. For now, there are no signs of a correction. Consolidation below the $29,750 level would be a sell signal and can lead to a correction. You can also sell Bitcoin when there is such a signal, but the trend is currently bullish, and with the presence of an ascending trendline, we don't expect a significant drop from Bitcoin.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română