The currency pair GBP/USD also showed growth on Wednesday, but the growth was much weaker than the EUR/USD pair. Nevertheless, the subsequent consolidation of the price below the moving average line did not lead to any downward movement. In principle, the euro and pound are moving very similarly now, but the corrections in the euro are slightly stronger. The pound is moving upwards, seemingly with its last strength, but still moving. The euro currency updated its latest local maximum yesterday, while the pound did not. The pound still needs to leave the sideways channel on the 24-hour timeframe with confidence. As we have already said, the situation is difficult. Buying the pair is dangerous because the pound has already gone up 700 points without a single correction. Selling is not relevant because there are no corresponding signals, and all previous signals did not lead to a decline. Thus, it is also best to trade the British currency on the lowest timeframes. The US inflation report could be interpreted differently, so the market was again selling the dollar. Andrew Bailey's speech yesterday did not provide any new information, although it will be considered in more detail today. The fundamental and macroeconomic backgrounds are not the strongest now, and market participants often ignore them. Despite a strong trend, the trading situation could be more favorable.

In the 24-hour timeframe, the pair has a good chance of breaking out of the sideways channel, but for this, the price needs to consolidate above the 1.2440 level or, better yet, above the 25th level. However, even in this case, one cannot be 100% confident in growth. The pair has already risen 2100 points from last year's lows, and the maximum correction was 600 points. Further growth under such technical circumstances is still being determined. And if you recall the economic situation in the UK and the Bank of England's failed struggle with inflation, it is unclear what the pound's growth is based on.

The Fed is not going to back down from its mandate.

There was not much news from the US this week. Apart from the inflation report, there is little to remember. Nevertheless, one of the Federal Reserve's monetary committee representatives, Neel Kashkari, said on Tuesday night that inflation should drop to 3% by the end of this year and to 2% over the next year. The target inflation level has not changed, and the Fed will do everything possible to achieve it. He also noted that inflation might begin to slow down in its decline. The Fed is no longer aggressively raising rates, so inflation will react to the high rate level and the absence of a new increase.

At the same time, the head of the Philadelphia Federal Reserve, Patrick Harker, stated that inflation, in his opinion, is not decreasing fast enough, and he is ready to support new key rate hikes. He also noted that it takes about 18 months for the tightening of monetary policy to manifest fully. "If additional steps are needed to suppress inflation, we will do it," Harker said on Tuesday evening. He also noted that the American economy is now experiencing almost full employment, according to the latest reports on unemployment and the labor market. The Fed is intentionally slowing down the economy to reduce inflation.

On the contrary, Harker's colleague, the head of the Chicago Federal Reserve, Austan Goolsbee, stated that the Fed's further steps should be cautious as tensions in the financial and banking systems persist. Mr. Goolsbee believes that economic activity will decline in the near future because many American banks have faced deposit outflows following the collapse of Silicon Valley Bank and two others and are now lending less and reluctantly. Unfortunately, for the dollar, this information has little practical significance. Whether the Fed will raise the rate further or not, the dollar is under strong market pressure, and nothing can be done about it for now.

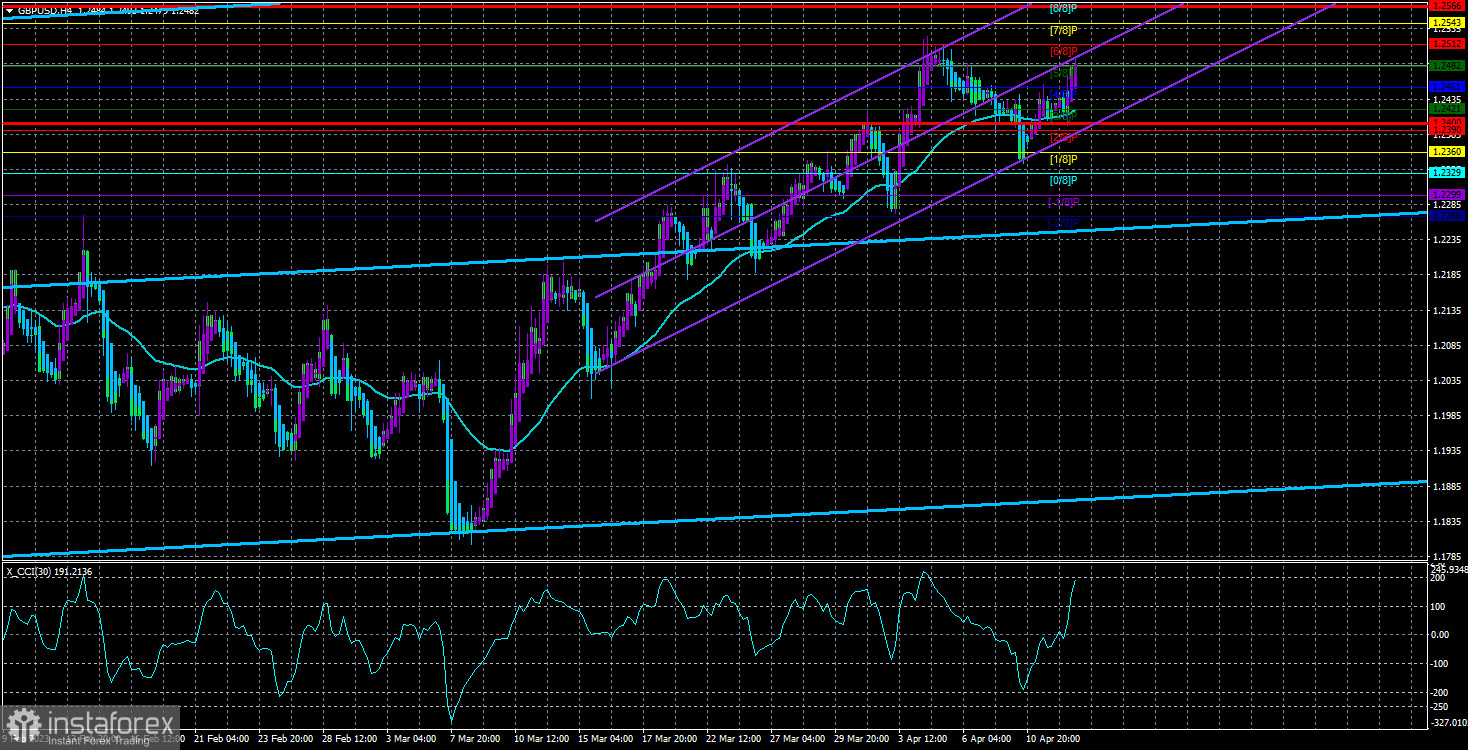

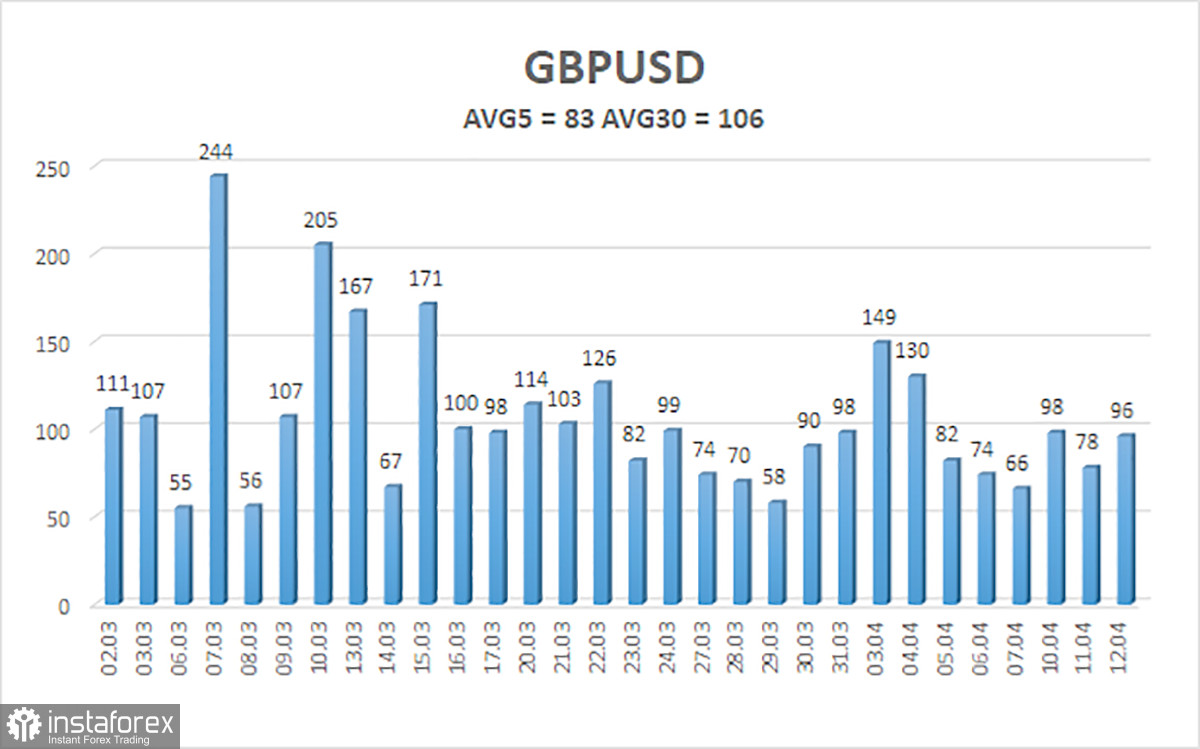

The average GBP/USD pair volatility for the last five trading days is 83 points. For the pound/dollar pair, this value is considered "average." On Thursday, April 13, we thus expect movement within the channel limited by 1.2400 and 1.2566. A downward reversal of the Heiken Ashi indicator will signal a new wave of downward movement.

Nearest support levels:

S1 – 1.2451

S2 – 1.2421

S3 – 1.2390

Nearest resistance levels:

R1 – 1.2482

R2 – 1.2512

R3 – 1.2543

Trading recommendations:

The GBP/USD pair in the 4-hour timeframe continues to be above the moving average. You can stay in long positions with targets of 1.2543 and 1.2566 until the Heiken Ashi indicator reverses downward. Short positions can be considered if the price consolidates below the moving average, with targets of 1.2360 and 1.2329.

Explanations for the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in one direction, the trend is strong.

Smoothed moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română