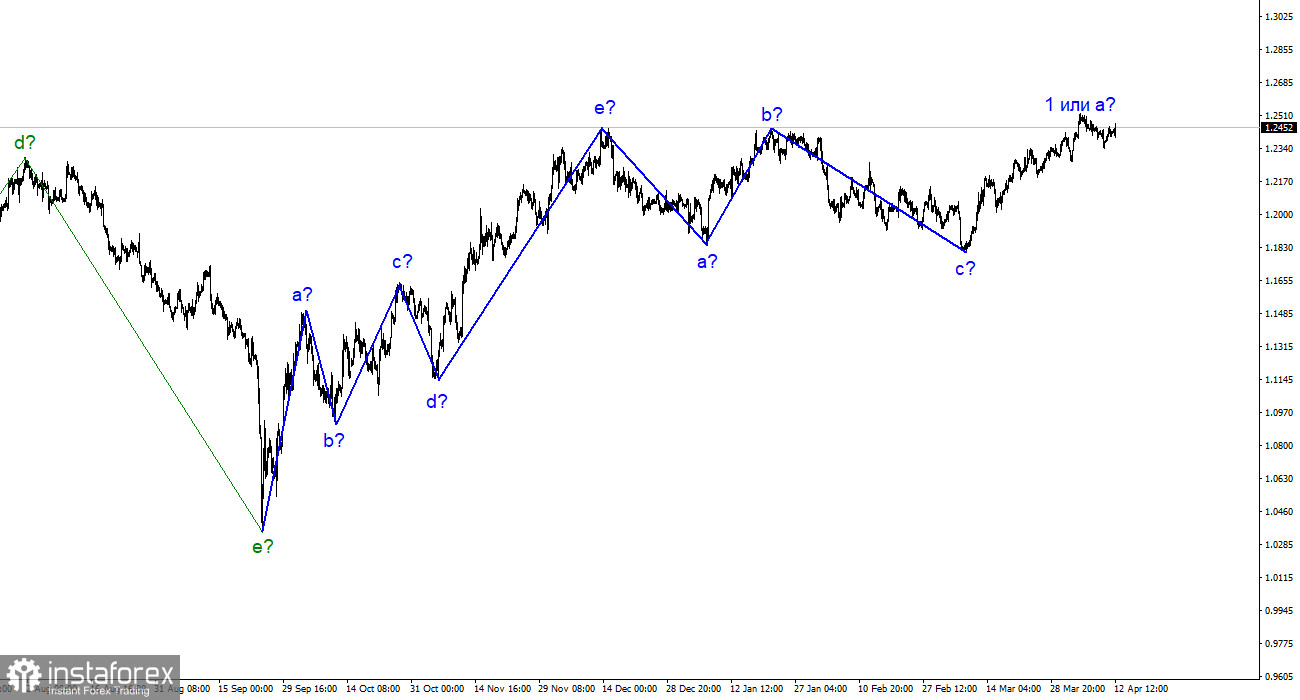

The wave markup for the GBP/USD pair must still be simplified. Since the current upward wave has exceeded the peak of the last wave b, the entire downward trend segment consisting of waves a-b-c can be considered complete. Although it barely resembles the trend segment for the same period in the euro currency's performance, it must be acknowledged that both pairs have built downward three-wave sets of waves. If true, a new upward trend segment has begun for the pound. Since I can only single out one wave from March 8, there is every reason to assume that the British currency's rise will be prolonged. It is difficult to say how it will be for the euro simultaneously. Both pairs should build similar wave formations, but there have been problems lately. In the near future, wave b may begin for the pound, after which the rise in quotes should resume with targets up to the 30-figure level. Unless wave c turns out to be the same as in the case of the descending wave set. But the news background is currently ambiguous, and I would not bet on the strong pound growth relying solely on it.

The dollar remains weak.

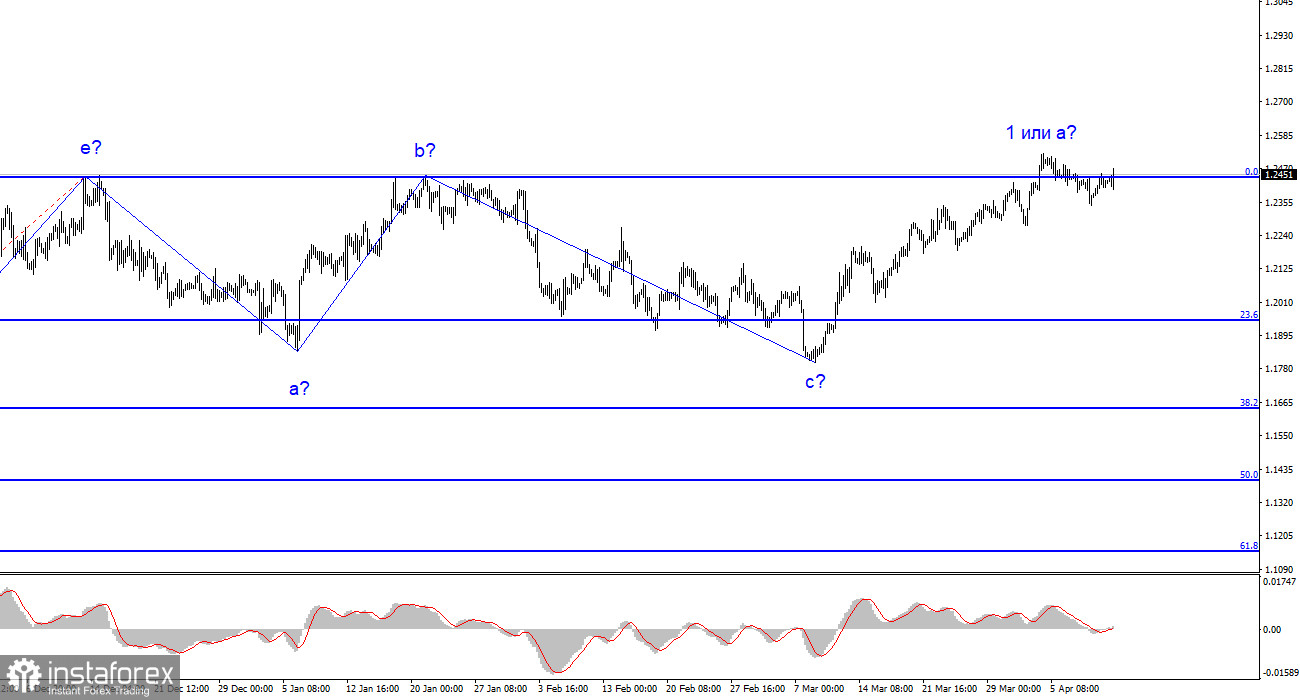

The GBP/USD pair's exchange rate increased by only 25 basis points on Wednesday. At the same time, the European currency added almost 100 points. Such a difference can be explained by the formation of the upward wave for the pound has already been completed, and the market is adjusting to the pair's decline. At the same time, the formation of the upward three-wave set for the euro may also end soon, so it's not worth getting upset about it prematurely. Both pairs can equally start declining in the coming days.

Today's report on US inflation caused a decline in the US currency against the pound. However, it is becoming apparent that the market needs new reasons to maintain high demand for the pound. Such a reason could be strengthening the "hawkish" rhetoric from the Bank of England. Governor Andrew Bailey's speech will occur today, and the market will closely monitor every word spoken. If Bailey speaks vaguely and non-specifically, there may be no reaction. Hints of an imminent end to the monetary policy tightening procedure will reduce demand for the pound. Words about a possible long-term rate hike until inflation begins to show a significant decline, will support demand for the pound. However, I expect something other than the latter from Bailey, as the Bank of England's last meeting decided to raise the rate by only 25 basis points. The rate hike pace has been reduced to a minimum.

General conclusions.

The wave pattern of the GBP/USD pair suggests the completion of the downward trend segment. The wave markup is currently ambiguous, as is the news background. I do not see factors supporting the pound in the long term, and now the formation of wave b may also begin. A decline in the pair is more likely since all the recent waves are roughly the same in size. Trading is possible from the 1.2440 level, corresponding to 0.0% Fibonacci. Below it – sell; above it – cautiously buy.

The picture is similar to the EUR/USD pair on a larger wave scale, but some differences remain. At this time, the upward correction segment of the trend has been completed. However, the three-wave downward segment may also be completed. And the new upward trend segment can also be three-wave and horizontal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română