Overview :

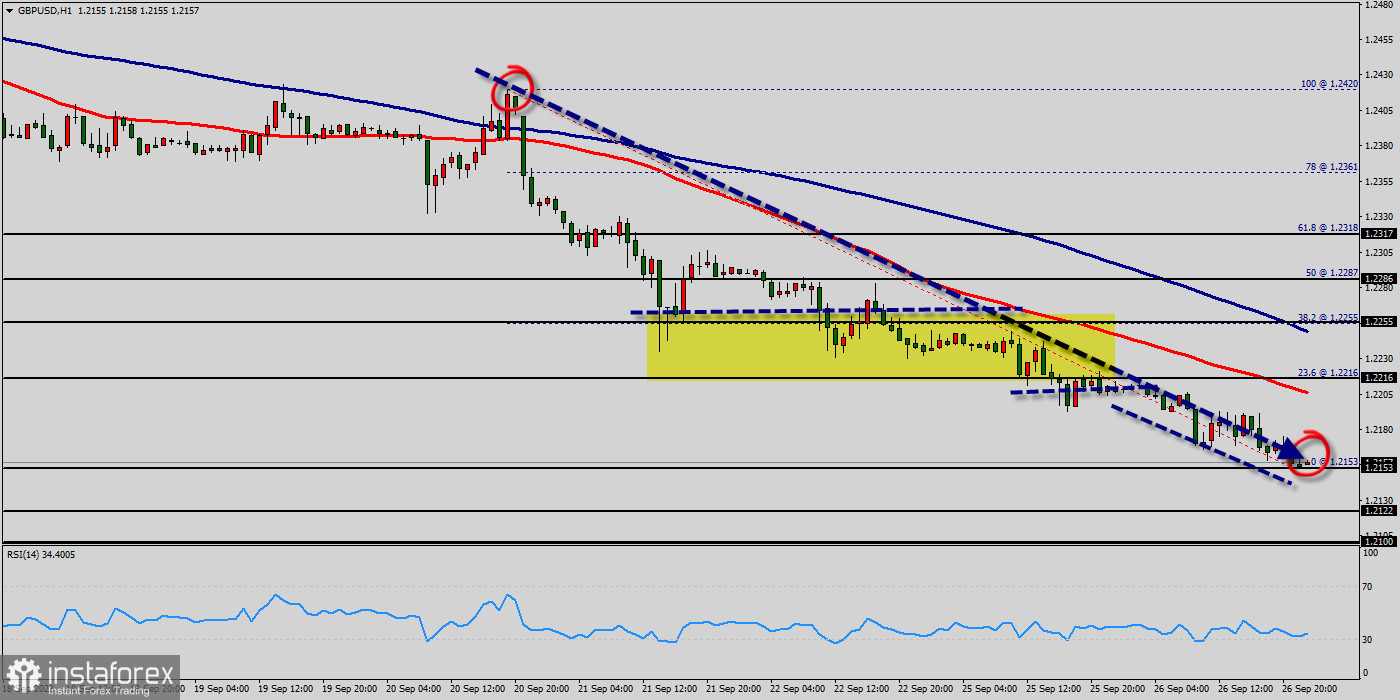

The GBP/USD pair continues to move downwards from the level of 1.2216. According to the previous events, the GBP/USD pair is still moving between the levels of 1.2216 and 1.2122; for that we expect a range of 94 pips (1.2216 - 1.2122).

On the one-hour chart, immediate support level is seen at 1.2153, which coincides with a ratio of 00% Fibonacci retracement - last bearish wave.

Currently, the price is moving in a bearish channel. This is confirmed by the RSI indicator signaling that we are still in a bearish trending market.

The price is still above the moving average (100) and (50). Therefore, if the trend is able to break out through the first support level of 1.2153, we would see the pair climbing towards the daily support at 1.2122 to test it.

It would also be wise to consider where to place stop loss; this should be set below the second support of 1.2343.

It should always be noted that : If the trend is up ward, the strength of the currency will be defined as follows: GBP is in an uptrend and USD is in a downtrend. The stop loss should never exceed your maximum exposure amounts. The market is highly volatile if the last day had huge volatility.

Signal :

According to the previous events, the price of the GBP/USD pair has been still trading between the levels of 1.2153 and 1.2100. The level of 1.2153 is representing the double bottom and the weekly support one has set at the same price.

Sell below the spot of 1.2216 with the targets 1.2122 and 1.2100. On the other hand, the daily strong resistance is seen at 1.2216. If the GB/USD pair is able to break out the level of 1.2216, the market will decline further to 1.2255.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română