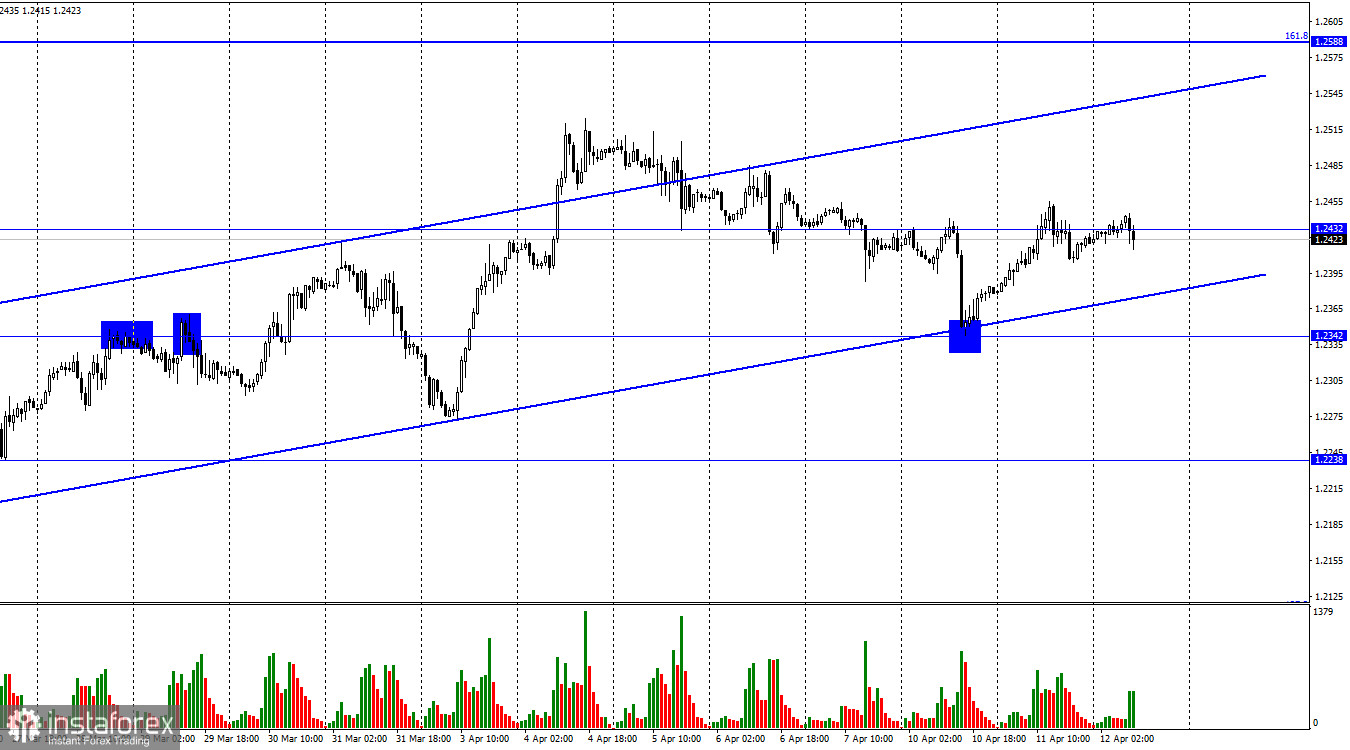

On the hourly chart, the GBP/USD pair rose on Tuesday but failed to consolidate above the 1.2432 level. A decline in the pair would be more appropriate now, as bullish traders are gradually exhausting their potential. The British currency has been rising quite actively in recent weeks, but in recent days it has not been able to continue in the same direction. A consolidation of the pair's exchange rate below the ascending trend corridor will favor the US currency and start a decline toward the 1.2342 and 1.2238 levels.

In addition to the US inflation report, there will be several other very important events for the pound today. Speeches by Andrew Bailey will attract traders' attention, as the Bank of England is now a dark horse. While inflation is noticeably decreasing in the European Union and the US, it is not in the UK. In such conditions, it is still being determined whether the British regulator will continue to raise rates until inflation begins to fall or whether it will prefer to maintain minimal economic growth rates. Andrew Bailey is expected to answer these questions.

Also, in the evening, the FOMC minutes of the March meeting will be released. I remind you that the FOMC ignored the bankruptcy of three banks in the US and raised the interest rate again to 5%. Along with this decision, the regulator launched a program to stimulate the banking sector, but the key monetary policy instrument (the rate) still increased. The wording in the final communique changed slightly towards the "dovish" side, but this does not surprise anyone now. The Fed can already adopt a policy of holding the rate at a high level, and there is no need to raise it at the previous pace. Therefore, I do not expect anything "hawkish" from the minutes, which means the dollar can only rely on inflation for support. And the British currency can only rely on tough statements from Andrew Bailey. By the end of today, the pair could be much higher or much lower than the current levels with equal probability.

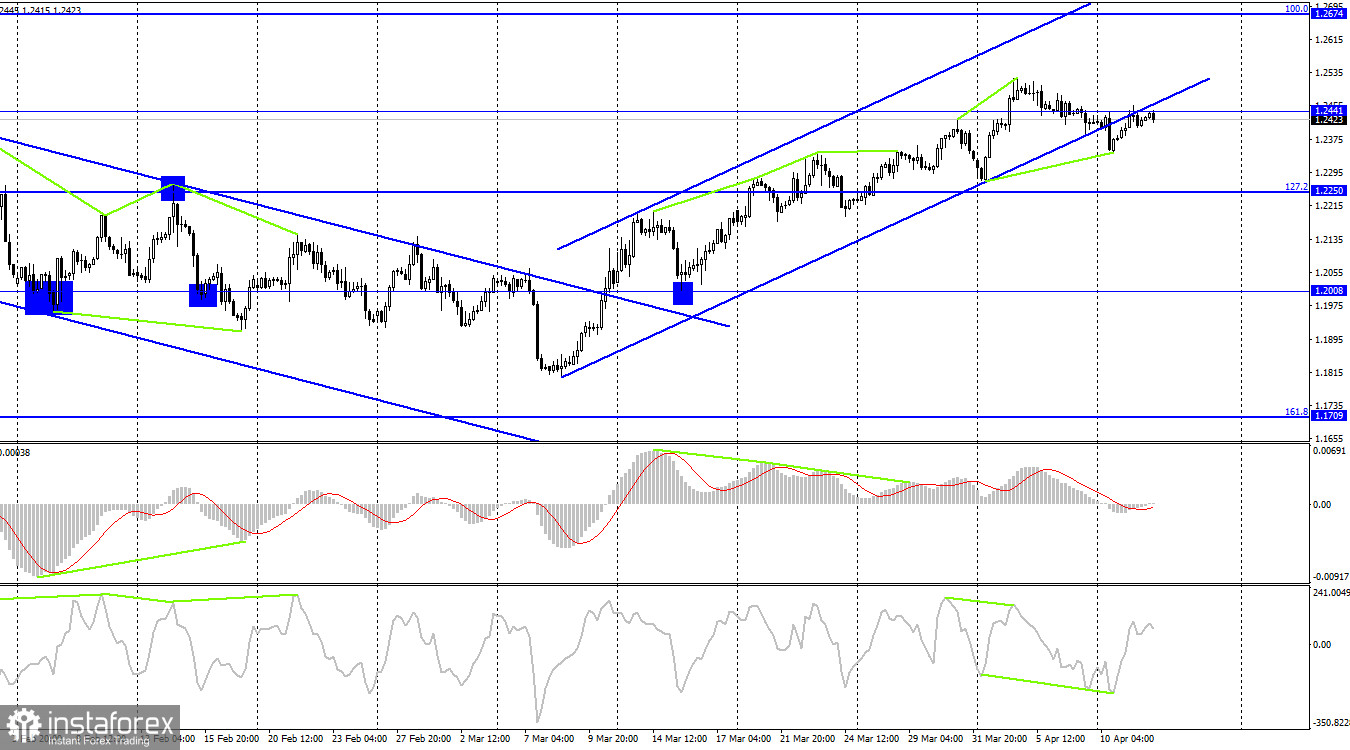

On the 4-hour chart, the pair has consolidated below the ascending trend corridor, but the "bullish" divergence at the CCI indicator allowed a return to the 1.2441 level. A rebound in quotes from this level will favor the US currency and the resumption of the decline toward the Fibonacci level of 127.2% (1.2250). Consolidation of the pair's exchange rate above the 1.2441 level will bring the bulls back to the market and allow for the continuation of growth towards the corrective level of 100.0% (1.2674).

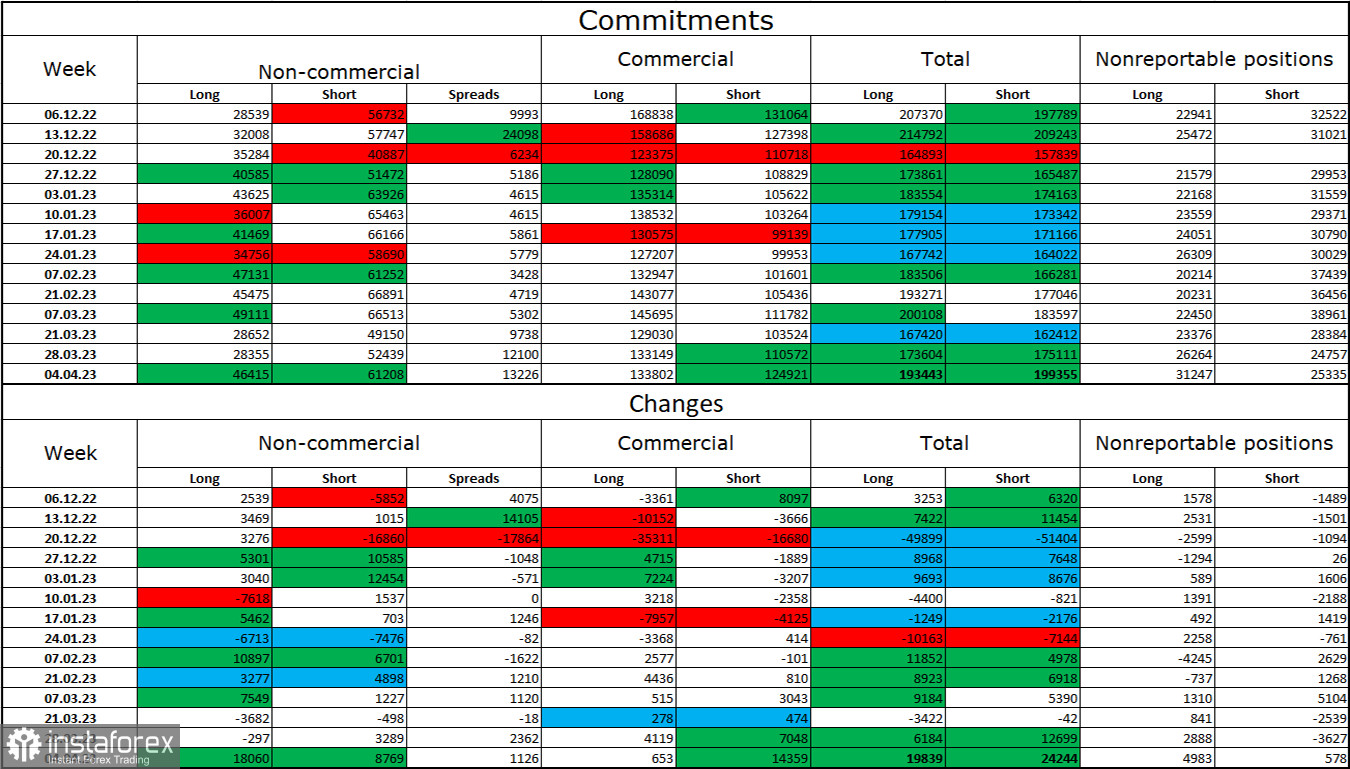

Commitments of Traders (COT) report:

The sentiment of the "non-commercial" category of traders changed significantly during the last reporting week. The number of long contracts held by speculators increased by 18,060 units, while the number of short contracts increased by 8,769. The overall sentiment of major players remains "bearish," and the number of short-term contracts still exceeds the number of long-term contracts. Over the past few months, the situation has constantly changed in favor of the British currency. However, the difference between the number of long and short contracts speculators hold remains significant. Thus, the prospects for the pound are constantly improving, but the British currency has not been growing or falling in recent months. The 4-hour chart had an exit beyond the descending corridor, which may support the pound. However, many factors contradict each other, and the informational background needs more support for the British currency. On the same 4-hour chart, the pair may close below the ascending corridor.

News calendar for the US and the UK:

US – core consumer price index (CPI) (12:30 UTC).

UK – speech by the Bank of England Governor Bailey (13:00 UTC).

US – FOMC minutes publication (18:00 UTC).

UK – speech by the Bank of England Governor Bailey (19:15 UTC).

On Wednesday, the economic events calendar contains four important entries. The impact of the background information on traders' sentiment today may be strong.

GBP/USD forecast and advice for traders:

I recommend selling the British currency upon closing below the ascending corridor on the hourly chart or in case of a rebound from the 1.2441 level on the 4-hour chart, with targets at 1.2342 and 1.2250. Purchasing the British currency is possible upon closing above the 1.2441 level on the 4-hour chart with a target of 1.2588.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română