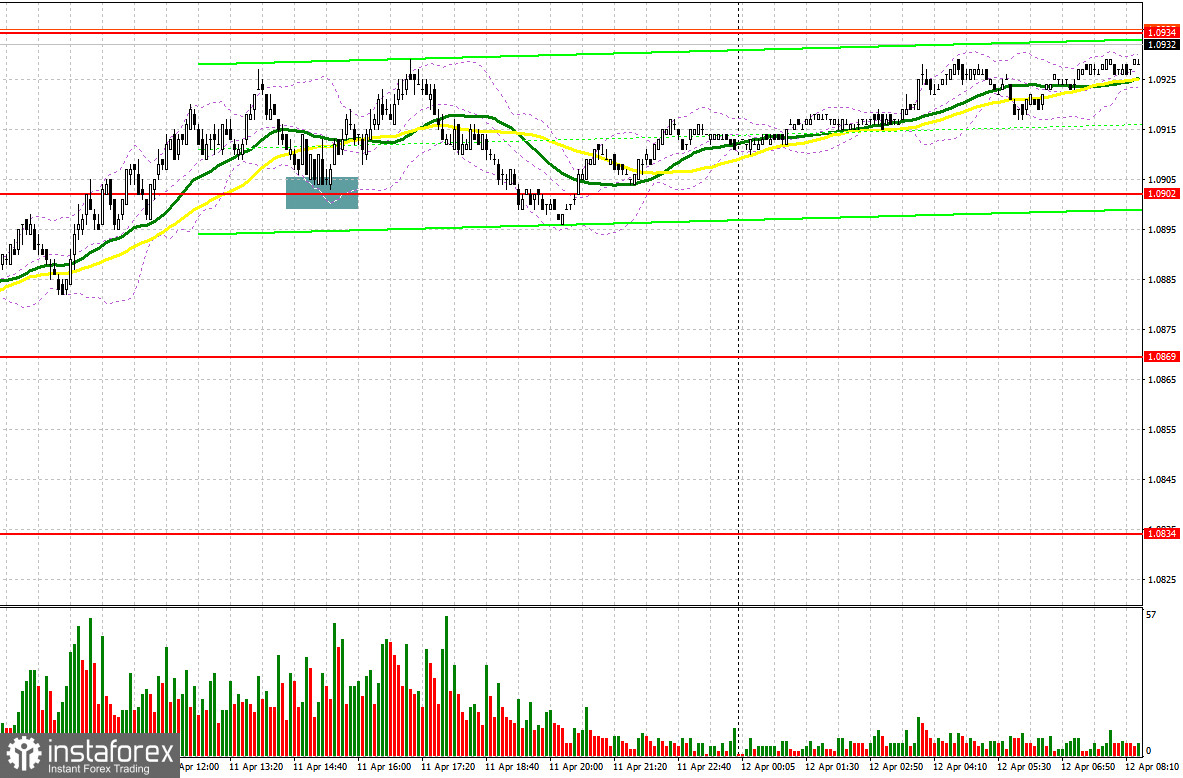

Yesterday, EUR/USD offered several market entry signals. Let's take a look at the 5-minute chart and figure out what happened. In my morning forecast, I pointed out the level of 1.0906 and recommended making market entry decisions based on it. The instrument grew and formed a false breakout there which suggested planning short positions on EUR/USD. In practice, the pair didn't drop. In the second half of the day, the decline and false breakout at 1.0902 provided an excellent entry point for long positions. As a result, EUR/USD rose by more than 20 pips.

What is needed to open long positions on EURUSD

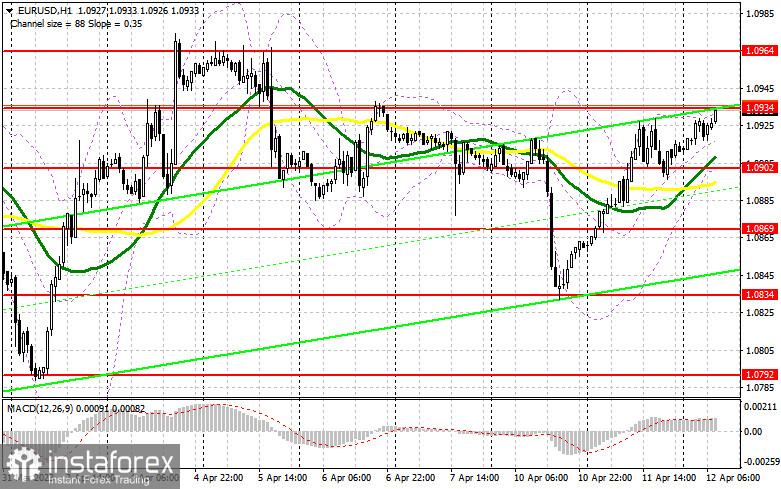

Today, the market is set to trade quietly in the first half of the day due to the lack of any significant data. I expect EUR/USD to continue trading sideways, making an attempt to break above the resistance at 1.0934, which will be quite a challenge because the US is due to release the inflation data in the second half of the day. For this reason, in my opinion, the reasonable scenario for opening long positions is a decline and formation of a false breakout in the area of the nearest support at 1.0902, where the moving averages are playing on the side of the bulls. This will provide a buy signal. We could set a target, reckoning a rebound to the resistance at 1.0934, formed on Friday. A breakout and top-down test of this area will invite the buyers back to the market, forming an additional entry point for opening long positions with a rebound to the high of 1.0964. The area around 1.1002 will remain the ultimate target where I will be locking in profits. However, the price will be able to reach this level after the US inflation data, which we will discuss in more detail in the forecast for the second half of the day. In case EUR/USD declines and the buyers don't assert themselves at 1.0902, which is unlikely, pressure on the euro will increase, and we will see a downward movement towards 1.0869. Only a false breakout there will provide a buy signal for the euro. I will open long positions immediately on the drop from the low of this week at 1.0834, reckoning a 30-35 point upward correction within the day.

What is needed to open short positions on EUR/USD

Yesterday, the sellers tried several times to notch a correction in the euro, but apparently, everyone believes that EUR/USD will extend its growth after today's news and the FOMC minutes. So, traders are not eager to sell the euro even at its current high price. In case the euro grows in the first half of the day amid the speech by ECB representative Mr. De Saguin, an important task for sellers in the first half of the day will be to protect the new resistance at 1.0934. There, I expect to see the formation of a false breakout, which may push the pair down to the nearest support at 1.0902. However, only a breakout and a reverse test of this range will increase the pressure, pushing EUR/USD to 1.0869. The price will consolidate below this range only after strong inflation data in the US. If this happens, it will open the way to 1.0834, reviving the bearish sentiment on EUR/USD. There, I will fix the profit. In the case of an upward movement of EUR/USD during the European session and in the case the bears don't assert themselves at 1.0934, which is also quite a realistic scenario, I would advise postponing short positions until 1.0964. There, you can sell only after an unsuccessful consolidation. I will open short positions immediately on the rebound from the high of 1.1002 with the aim of a downward correction of 30-35 points.

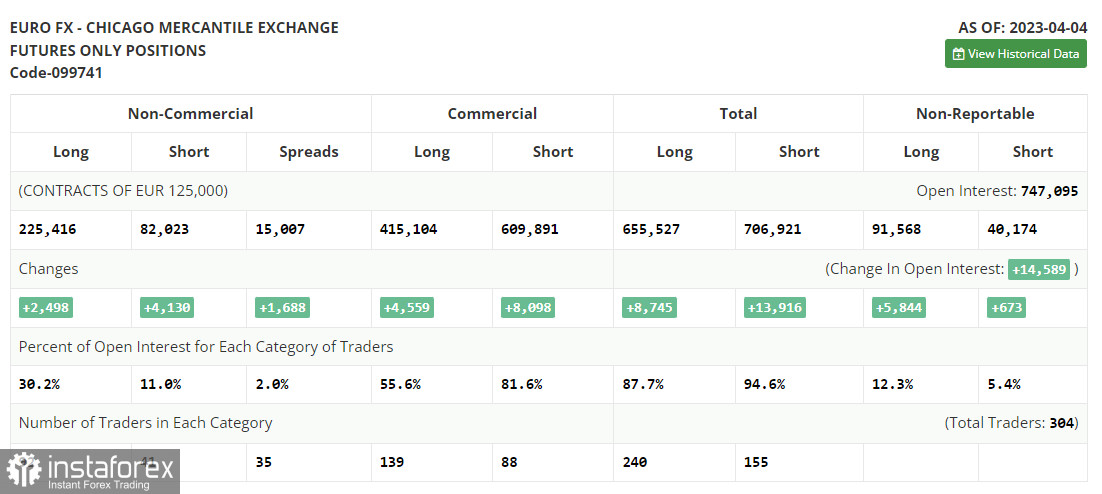

The COT report (Commitment of Traders) for April 4 logged growth in both long and short positions. Nothing interesting happened last week because the US nonfarm payrolls didn't come as a bombshell. Now buyers of risky assets, including the euro, are looking forward to crucial economic data such as US inflation data and retail sales for March. The FOMC's March meeting minutes will also matter a lot to market sentiment. If all this indicates the need for further interest rate hikes, the US dollar may recoup some of the losses incurred last month. However, if in the macroeconomic data and the minutes, investors discover the signs that the US Fed could moderate its aggressive monetary tightening, the euro will have arguments to cement its growth. The COT report states that non-commercial long positions increased by 2,498 to 225,416, while non-commercial short positions jumped by 4,130 to 82,023. As a result of the week, the overall non-commercial net position decreased and amounted to 143,393 against 145,025. EUR/USD closed last week higher at 1.1 against 1.0896 a week ago.

Indicators' signals

Moving Averages

The instrument is trading above the 30 and 50-day moving averages, proving the euro's growth.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case EUR/USD declines, the lower indicator's border around 1.0902 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română