The U.S. Consumer Price Index (CPI) data for March will be released today at 12:30 GMT. This will significantly affect the strength or weakness of the dollar.

If the CPI data declines, it will indicate that inflation continues to decline. Consequently, the Fed will need to shift from an aggressive monetary policy to a pause in rate hikes at subsequent FOMC meetings after May. Currently, the Federal Reserve is expected to raise rates by a quarter percentage point in May.

Economic forecasts suggest that year-on-year inflation will decline from 6% to 5.2%. However, there are also assumptions that the core inflation rate will rise by 0.1%, from 5.5% to 5.6%. And the Federal Reserve focuses specifically on core inflation, which excludes food and energy costs.

Moreover, Friday's employment figures clearly showed that the labor market is shrinking.

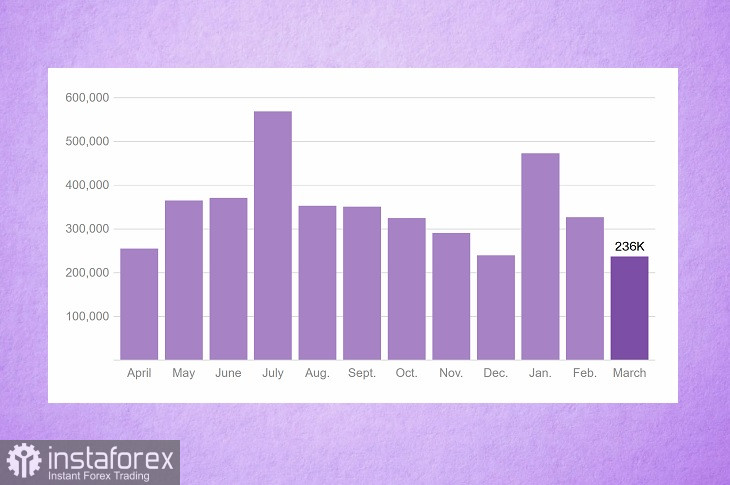

Since January, the number of new jobs has been declining, with only 517,000 new jobs added. Since the beginning of the year, the labor market has grown by 4.1 million jobs. New jobs added in March were the lowest monthly increase since December 2020.

The reduction in the number of jobs shows that the Federal Reserve's aggressive rate hikes are shrinking the economy and slowly reducing inflationary pressures.

According to the CME FedWatch tool, there is a 69.7% chance that the Fed will raise rates by a quarter percentage point at the next FOMC meeting, and a 30.3% chance that the Fed will pause rate hikes.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română