Japan's investors are cutting bets on a weaker yen, especially against Europe's major currencies, amid expectations that the country's central bank will inevitably normalize its ultra-loose policy.

Data from Tokyo Financial Exchange Inc.'s Click 365 shows individual investors cut euro-yen long positions to the lowest level since June 2021, while long positions on the pound against the Japanese currency fell to the lowest level since 2020.

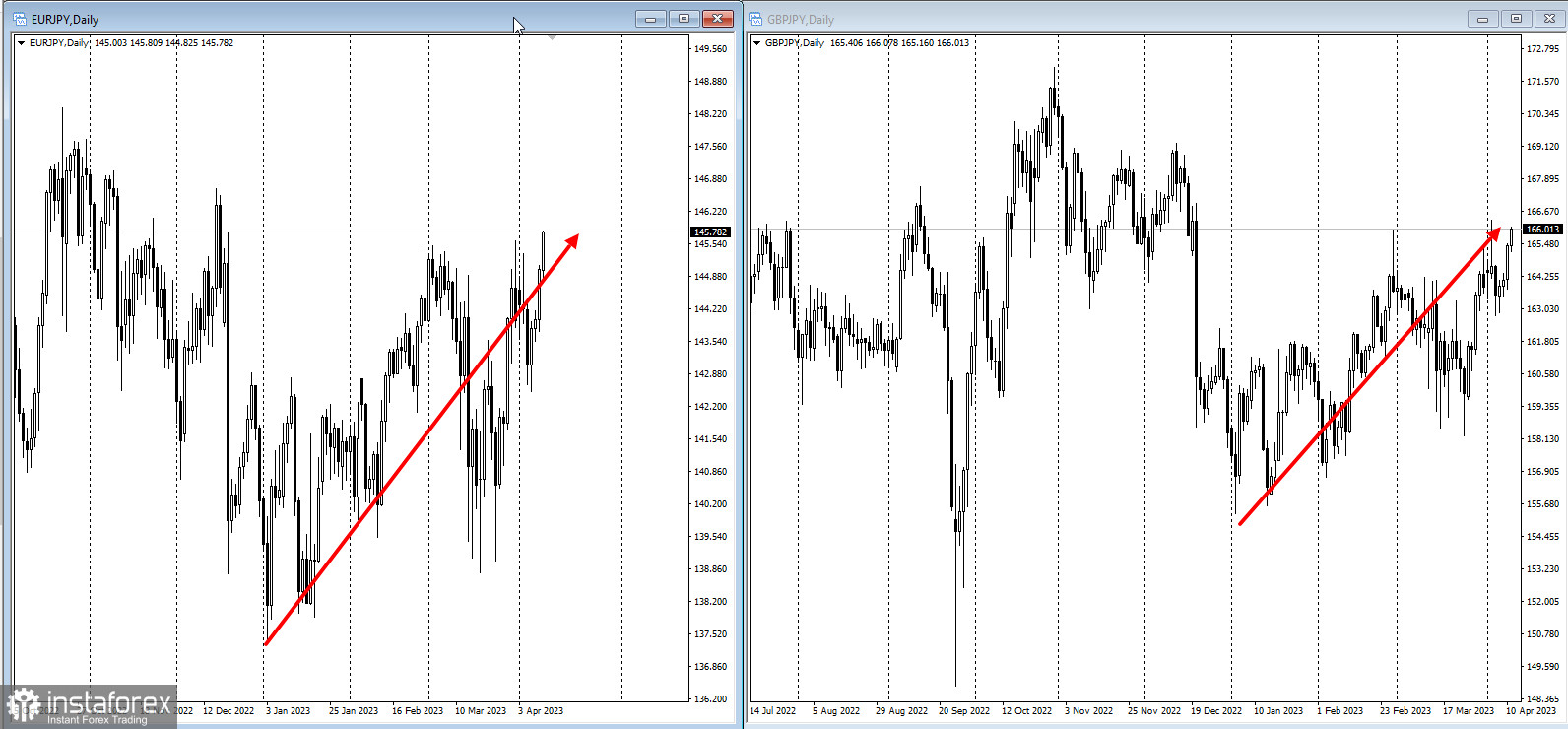

This year, the yen has fallen more than 3% against the euro and more than 4% against the pound.

"A growing number of individuals see the yen rising on speculation of policy normalization by the new BoJ governor," said Tetsuya Yamaguchi, chief technical analyst at Fujitomi Securities Co. He also added that central banks could follow suit.

Although Bank of Japan Governor Kazuo Ueda hinted that any significant policy adjustments might be unlikely at this time, at his inaugural press conference on Monday, market participants still see a policy change as inevitable in the face of rising inflation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română