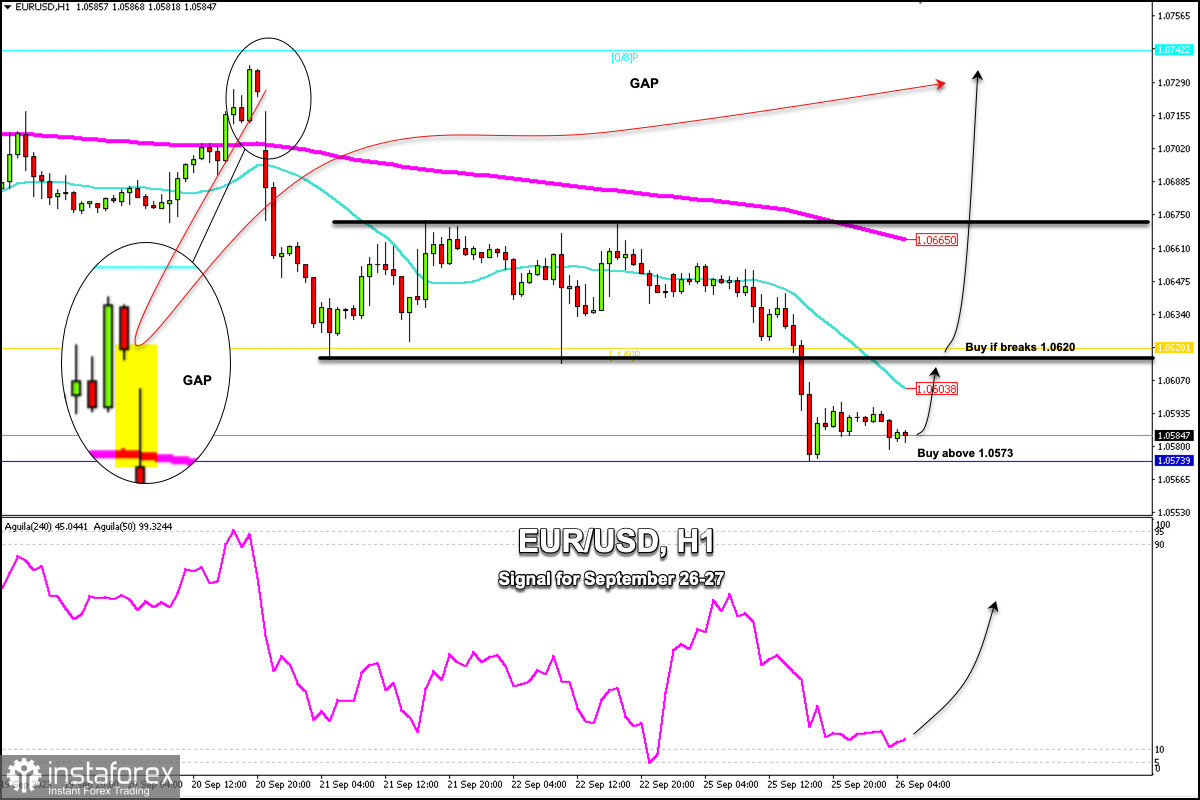

Early in the European session, the euro was trading around 1.0584. Yesterday during the American session, the euro broke sharply from the strong support of 1.0620 and reached the low of 1.05741.

In the H1 chart, we can see that the euro left a bearish gap at about 1.0725. EUR/USD is expected to return to this area in the coming days and cover this GAP.

Christine Lagarde, President of the European Central Bank, said that interest rates would remain high for as long as necessary to control inflation. The ECB rhetoric could favor the recovery of the euro in the next few days. For this, EUR/USD should consolidate above 1.0620.

The key level to watch for the next few hours is the strong resistance at 1.0620. In case the euro consolidates above this level, it could be seen as a clear signal to buy with targets at the 200 EMA located at 1.0665 and at 0/8 Murray located at 1.0743.

If the euro continues to trade below 1.0570 and falls below this level, a bearish acceleration is likely to occur and the instrument could reach the psychological level of 1.0500.

On the H1 chart, the S_1 daily support is located around 1.0560. This level could be seen as a clear zone of a technical rebound. In case the euro consolidates above this zone in the coming hours, we could expect it to reach the level of 1.0603 (21 SMA) and 1.0620 (-1/8 Murray).

The Eagle indicator on the 1-hour chart is reaching oversold levels. So, we expect the euro to consolidate above the 1.0560 support to buy with targets at 1.0620 and 1.0742 (0/8 Murray).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română