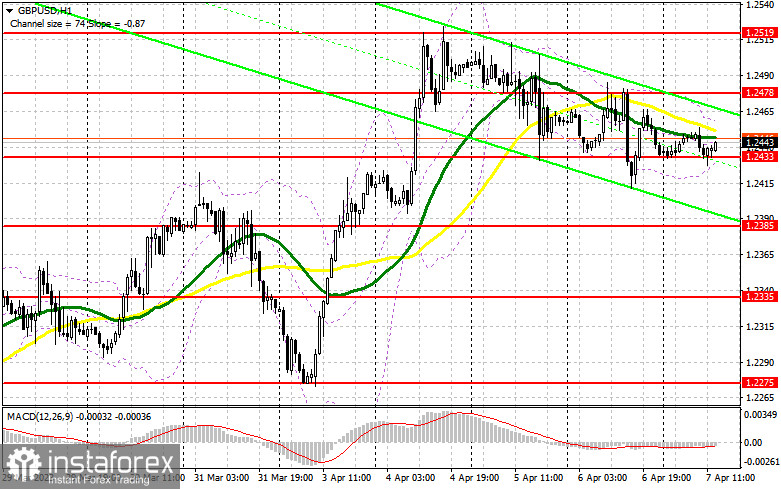

In my morning forecast, I focused on the level of 1.2433 and recommended making decisions about entering the market from there. Let's look at the 5-minute chart and figure out what happened there. The decline and formation of a false breakout at 1.2433 provided a buying signal. However, as you can see on the chart, the signal was only partially realized, as no one objectively wanted to buy the pound before the US data release.

To open long positions on GBP/USD:

The data on the unemployment rate and the change in the number of employed in the non-agricultural sector of the US will somehow shake the market. Still, it will unlikely lead to a strong appreciation of the British pound. Bulls must see bad news about the labor market at the end of the week before Easter to feel confident and buy more stocks. Considering that the technical picture has not changed compared to the first half of the day, I advise sticking to the following scenario: A decline and formation of a false breakout at 1.2433, similar to what I discussed above, will once again show the presence of buyers in the market, providing a good signal to open long positions with a return to 1.2478 - resistance formed as a result of yesterday. A breakout and test of this area from top to bottom will form another entry point for long positions, with the prospect of returning to the monthly maximum of around 1.2519, where I recommend fixing the profit. The ultimate target is an area of 1.2551. In a scenario of a decline to 1.2433 and a lack of activity from bulls in the second half of the day, which is most likely the case, it is best not to rush into purchases. In this case, I will only open long positions on a false breakout in the area of the next support at 1.2385. I plan to buy GBP/USD immediately on a rebound from a minimum of 1.2335 with a 30- to 35-point correction target within the day.

To open short positions on GBP/USD:

Sellers need to show themselves around 1.2478, as only this will allow them to keep the market under their control. The upward movement may occur precisely after the US data release. However, only a false breakout at 1.2478 will allow a continuation of the downward correction with the prospect of breaking through 1.2433, which could not be done in the first half of the day. A reverse test from the bottom to the top of this range will increase pressure on the pound, forming a sell signal with a drop to 1.2385. This will be a strong enough correction to break the upward trend. The ultimate target remains a minimum of 1.2335, the test of which will nullify all buyers' plans for further pound growth. In case of a GBP/USD increase and a lack of activity at 1.2478 during the American session, which is likely if the US labor market disappoints significantly, it is best to postpone sales until testing the monthly maximum of 1.2519. Only a false breakout will provide an entry point for short positions. Without a downward movement there, I will sell GBP/USD on a rebound immediately from the maximum of 1.2551, but only with the expectation of a pair correction down by 30-35 points within the day.

Indicator signals:

Moving averages

Trading occurs near the 30- and 50-day moving averages, indicating a sideways market trend.

Note: The author considers the period and prices of moving averages on an hourly chart H1 and differs from the general definition of classical daily moving averages on a daily chart D1.

Bollinger Bands

In case of a decrease, the lower boundary of the indicator will act as support at around 1.2430.

Indicator descriptions

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

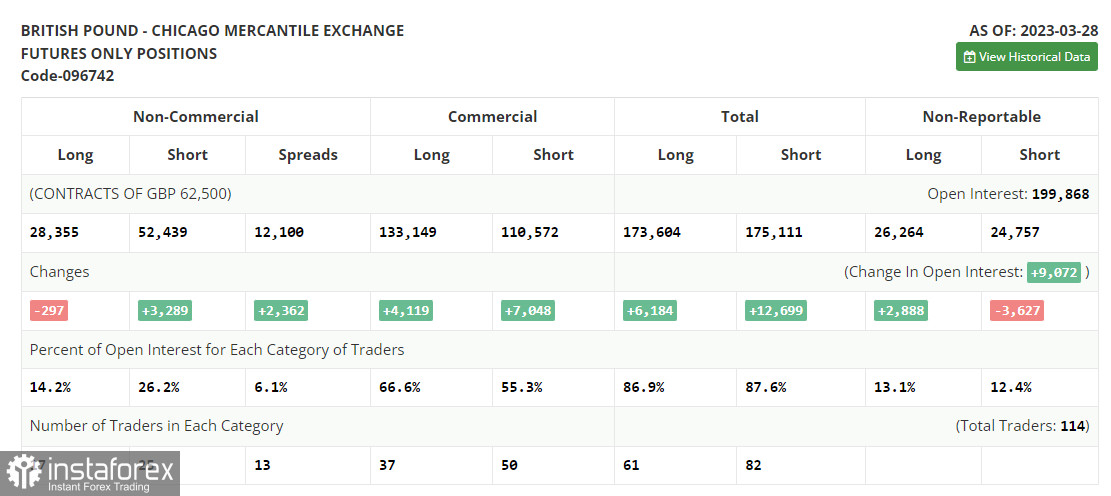

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română