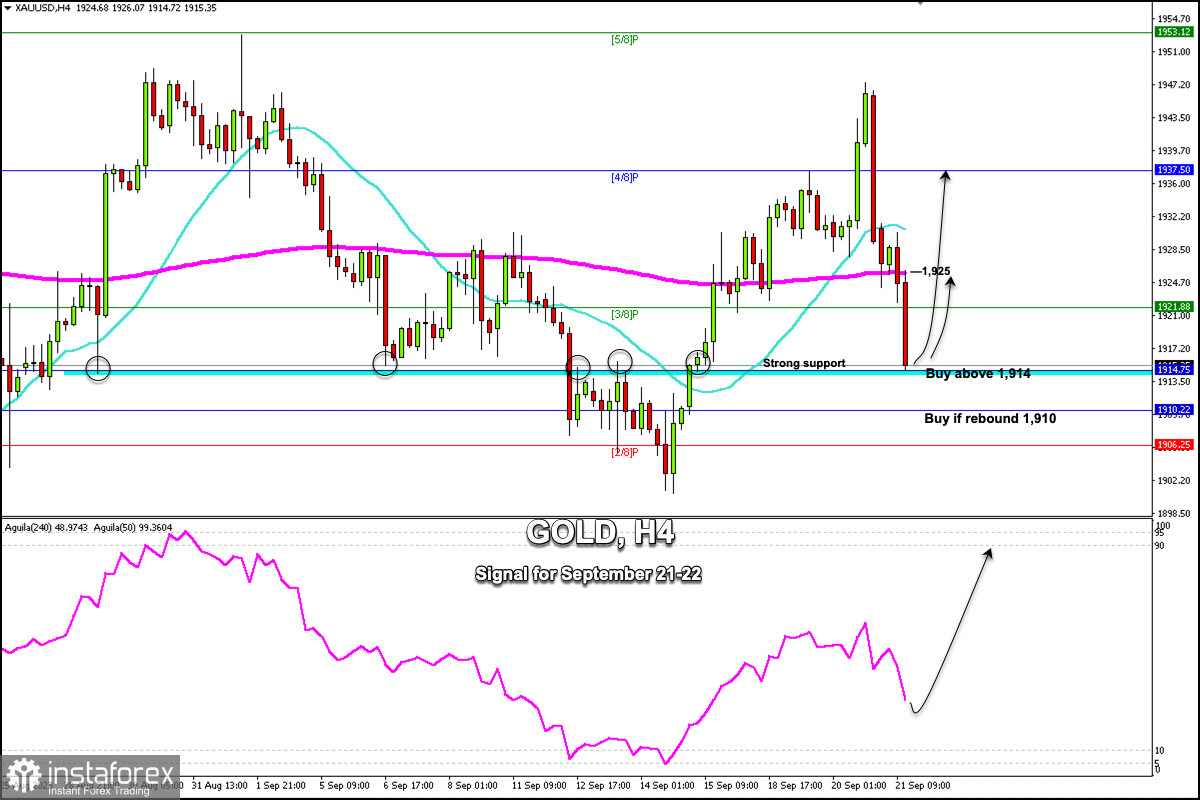

Early in the American session, gold is trading around 1,915.35 below the 200 EMA and below the 21 SMA. On the 4-hour chart we can see that gold is approaching the daily S_2 support located at 1,914, a technical rebound is expected to occur around this level due to the sharp decline that it accumulates.

Yesterday, after the release of US interest rate data, gold fell from the 1947 high to 1,914 lows. This pullback of more than $30 may mean that gold in the short term could resume its bearish cycle and it could reach the psychological level of 1,900 or even fall towards the key support of 1,867.

The Federal Reserve kept the interest rate unchanged at 5.50%. The US dollar strengthened as Chairman Jerome Powell reiterated his commitment to achieving his inflation target at 2%.

This speech favored the recovery of bonds and weighed on the price of Gold. The yield on 10-year US Treasury bonds rose above 4.55%, a level seen since November 2007. Gold and US bonds have a negative correlation forcing the XAU/USD to remain downward.

These fundamental data suggest that in the medium term it could continue to decline. However technically it needs a recovery which could be seen as an opportunity to buy at the current price levels around 1,914 or in case of a bounce at 1,910 with targets at 1,925.

If gold returns above 1,930 again, it could resume its bullish cycle and it could reach 1,937 and 1,953. On the contrary, as long as it trades below the 21 SMA located at 1,929, any technical rebound could be seen as an opportunity to sell.

Our trading plan for the next few hours is to buy gold above 1,914 with targets at 1,921 and 1,925. The eagle indicator on H-1 charts is showing oversold signals which is expected to have a recovery in the next few hours.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română