The Australian dollar collapsed against the US dollar even after it became known that the decision of the Australian central bank to keep interest rates unchanged this week does not mean the end of the tightening cycle.

The regulator is ready to review its policy at any time, if necessary. It is a conclusion that can be drawn from today's speech by RBA Governor Philip Lowe.

Lowe stated that the impact of banking stresses abroad was limited in Australia, but this did not mean that Australia was immune to them. When asked what set Australia apart from other countries, which were still tightening policy, Lowe pinpointed three factors: slower wage growth, rapid increases in mortgage lending, and the desire to maintain some labor market achievements made during the pandemic era. He emphasizes that at the moment, they believe that if they can return inflation to 3% by mid-2025 and maintain many of the jobs created in recent years, it would be a better outcome than returning inflation to 3% a year earlier and losing jobs with a sharp increase in unemployment.

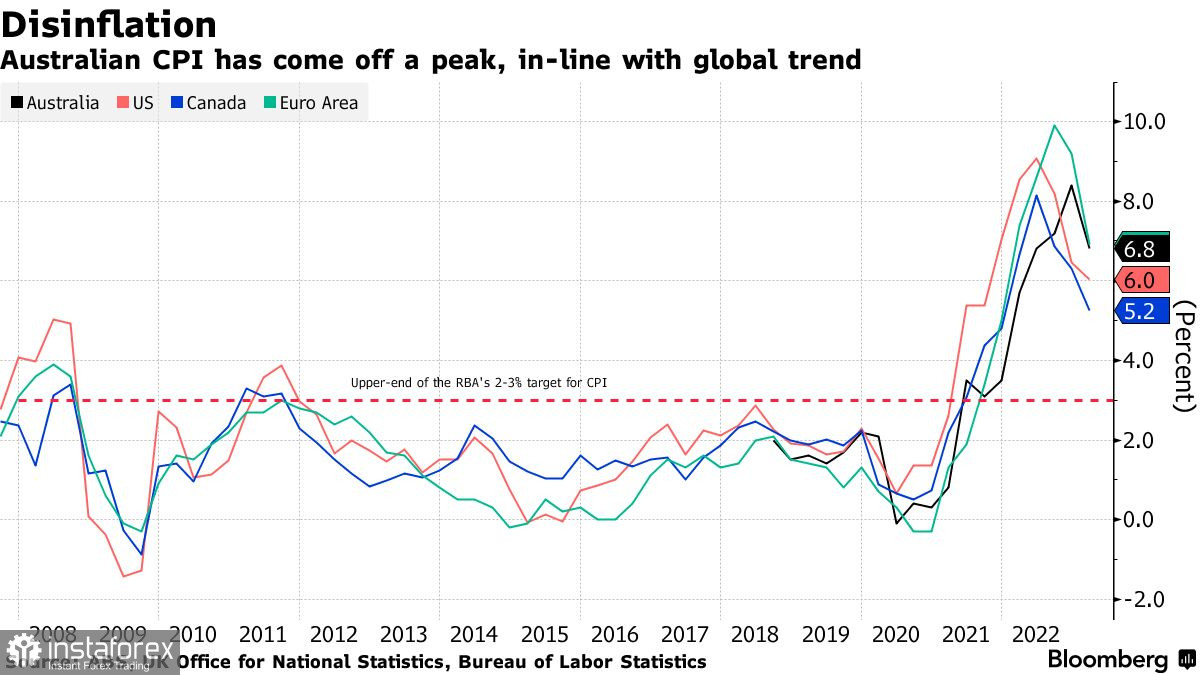

Notably, the RBA targets inflation of 2-3%, and the latest monthly figure was 6.8% in February compared to 7.4% in January.

Regarding the technical picture of AUD/USD, bears are currently aiming to reach a new low near 0.6655. Only there, buyers of risk assets may become active. A breakout of this range will open the way to 0.6630 and 0.6580.

As for the technical picture of GBP/USD, bulls continue to control the market. To develop the trend, it is necessary to stay above 1.2460 and break above 1.2520. Only a breakout of this level will strengthen hope for further recovery to the area of 1.2560. After this, it will be possible to talk about a sharper upward move to around 1.2590. If the pair falls, bears will try to take control of 1.2460. If they succeed, a breakout of this range will affect bulls' positions and push GBP/USD to a minimum of 1.2390 with the prospect of reaching 1.2330.

As for the technical picture of EUR/USD, bulls still have a chance to push the price higher and update the highs recorded in March. To do this, it is necessary to stay above 1.0930, which will allow a breakout of the 1.0975 limit. From this level, it is possible to climb to 1.1000 with the prospect of updating 1.1035. In case the trading instrument declines, large buyers will become active around 1.0920. Otherwise, it would be good to wait for the update of the 1.0880 minimum or open long positions from 1.0840.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română