During today's meeting, the Reserve Bank of Australia kept the parameters of its current monetary policy unchanged. The key interest rate remained at 3.6%. The accompanying statement said that the situation in the global economy remains quite tense. At the same time, the leaders of the RBA did not rule out the possibility of a further increase in the rate. They are concerned that a wage price spiral could emerge, and confirmed they will be paying close attention to labor cost dynamics and firms' price-setting behavior, signaling that the rate hike cycle is not over yet.

Immediately after the decision of the RBA, the Australian dollar fell, remaining under pressure today in the main cross-pairs. However, this decline looks limited and quite moderate. Nevertheless, market participants take into account rather hawkish statements of the RBA leadership, expressed in accompanying statements.

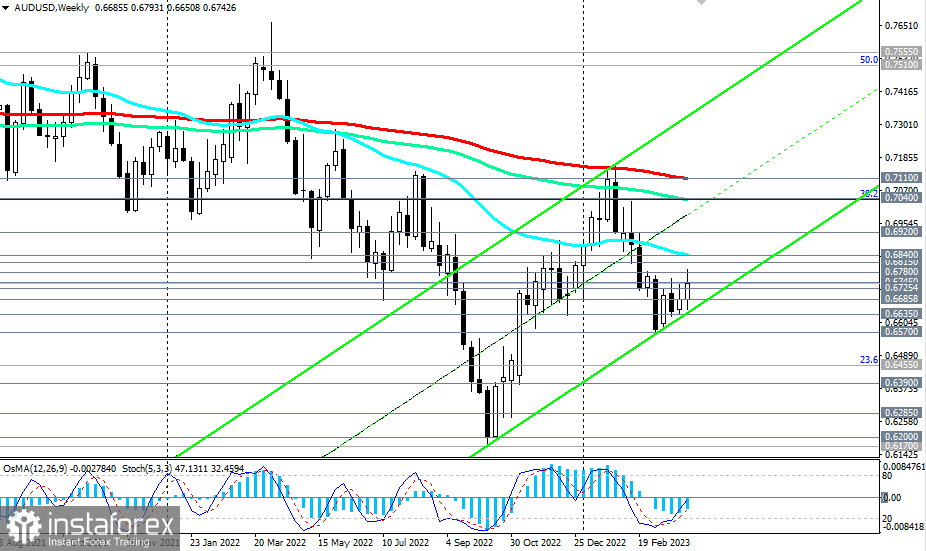

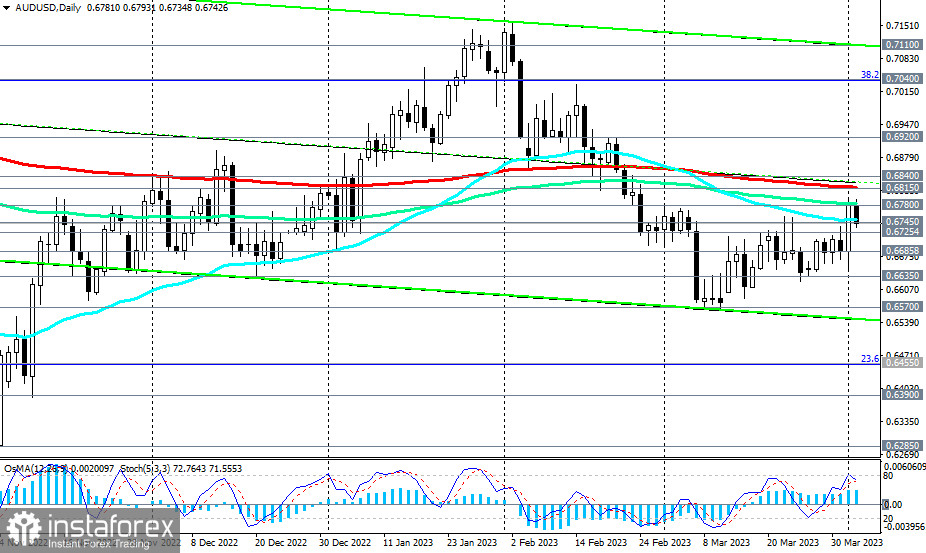

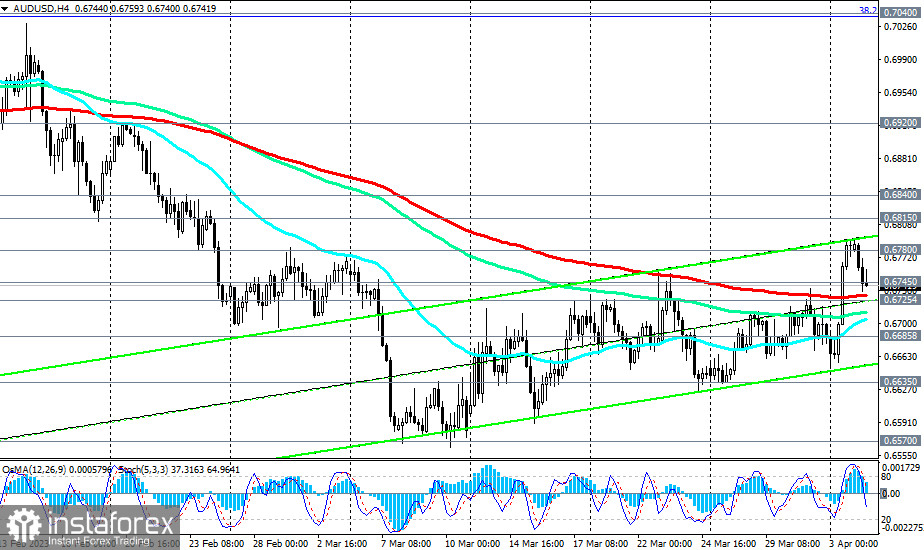

As we suggested in our yesterday's review, a breakdown of the strong short-term resistance level 0.6725 (200 EMA on the 4-hour chart) and the resistance level 0.6745 (50 EMA on the weekly chart) may trigger further growth in AUD/USD towards the key resistance level 0.6815 (200 EMA on the daily chart). But the breakdown of the resistance level 0.6840 (50 EMA on the weekly chart) can open the way towards the key resistance levels 0.7040 (144 EMA on the weekly chart), 0.7100, 0.7110 (200 EMA on the weekly chart), separating the long-term bull market from the bear market.

Our forecast came true by half: after breaking through the resistance levels 0.6725, 0.6745, the pair reached the 0.6780 resistance level (144 EMA on the daily chart). Here the growth of AUD/USD stopped, given today's decision of the RBA.

In general, the upward short-term dynamics of the pair remains: we are waiting for a breakdown of the resistance levels 0.6815, 0.6840, which will bring it into the zone of the medium-term bull market.

In an alternative scenario, a breakdown of support levels 0.6725 (200 EMA on the 4-hour chart), 0.6685 (200 EMA on the 1-hour chart) will return the bearish mood to the pair. A breakdown of the local support level 0.6570 will finally revive the bearish sentiment for AUD/USD.

Support levels: 0.6745, 0.6725, 0.6700, 0.6685, 0.6635, 0.6600, 0.6570, 0.6500, 0.6455, 0.6390, 0.6285, 0.6200, 0.6170

Resistance levels: 0.6780, 0.6800, 0.6815, 0.6840, 0.6900, 0.6920, 0.7040, 0.7110

Trading scenarios

Sell Stop 0.6720. Stop Loss 0.6790. Take-Profit 0.6700, 0.6685, 0.6635, 0.6600, 0.6570, 0.6500, 0.6455, 0.6390, 0.6285, 0.6200, 0.6170

Buy Stop 0.6790. Stop Loss 0.6720. Take-Profit 0.6800, 0.6815, 0.6840, 0.6900, 0.6920, 0.7040, 0.7110

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română