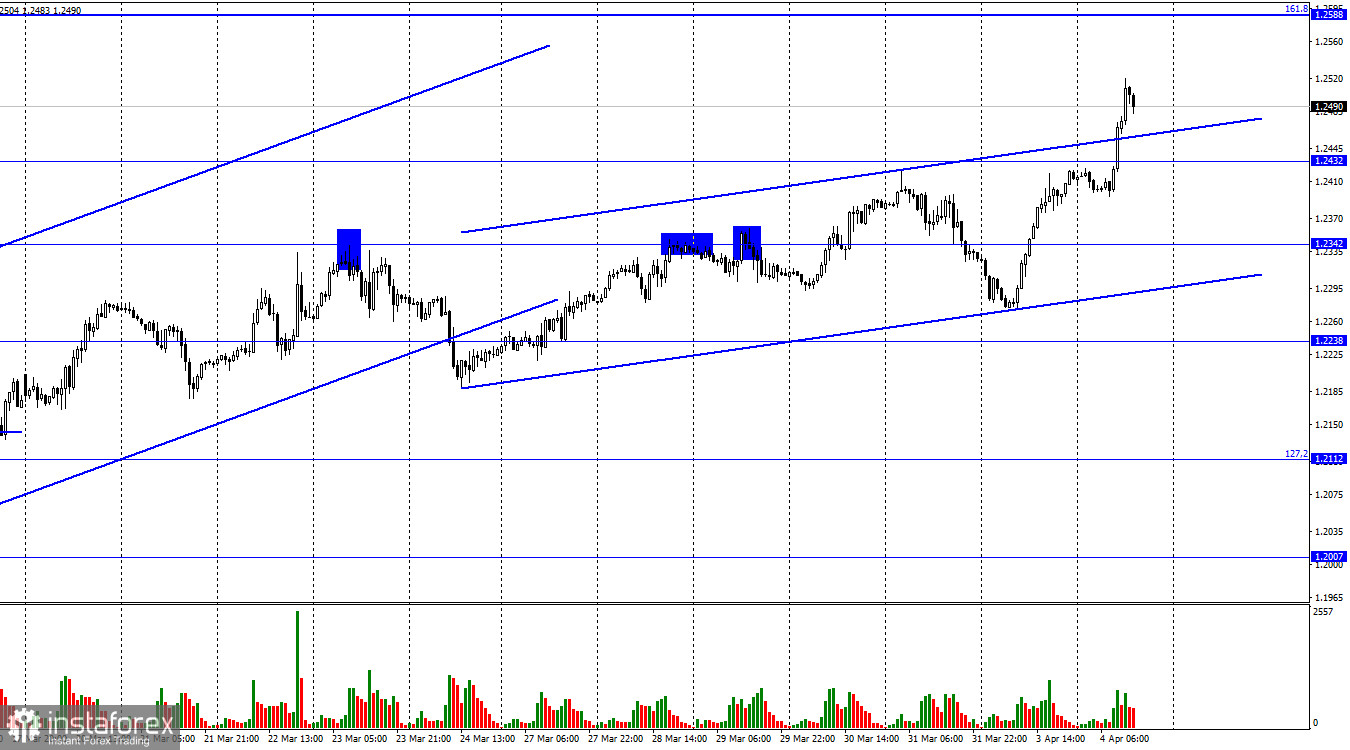

On Monday, the GBP/USD pair made a new reversal in favor of the British pound and increased by 250 points, according to the hourly chart. So Monday and Tuesday morning have passed. A new corridor with an upward trend has been built. Each following corridor remains "bullish" because the bears, which should have seized the initiative at such moments, are unaffected by the closures beneath them. Instead, we continue to see the growth of the British pound, and I continue to ponder its explanation.

As previously stated, a report on business activity in the manufacturing sector was released on Monday and Tuesday in the United Kingdom. The report was 0.1 points below market estimates, 2.4 points below the prior month, and remained below 50 regardless. Hence, it could not be responsible for the British currency's 250-point increase. Likewise, for the US ISM index. And there has been no news or economic update thus far today. The European currency has already begun to moderate, whereas the British pound continues to increase. The current movement cannot be explained in any way; it must be accepted without question. There is a perception that bears have just left for a holiday. Thus, the pair will not decline regardless of market conditions.

The current trend has nothing to do with the interest rates of the Bank of England and the Federal Reserve, which have dominated market discussion over the previous twelve months. A few weeks ago, regulators held their usual meetings, and it is unlikely that traders are already preparing for the next meeting. In recent days, the Fed's likelihood of raising interest rates by 0.25 percentage points in May has increased to over 70 percent, while the Bank of England has already reached 100 percent. In a month, both central banks will raise rates by the same amount. This factor does not now help the British pound, and its growth is a mystery.

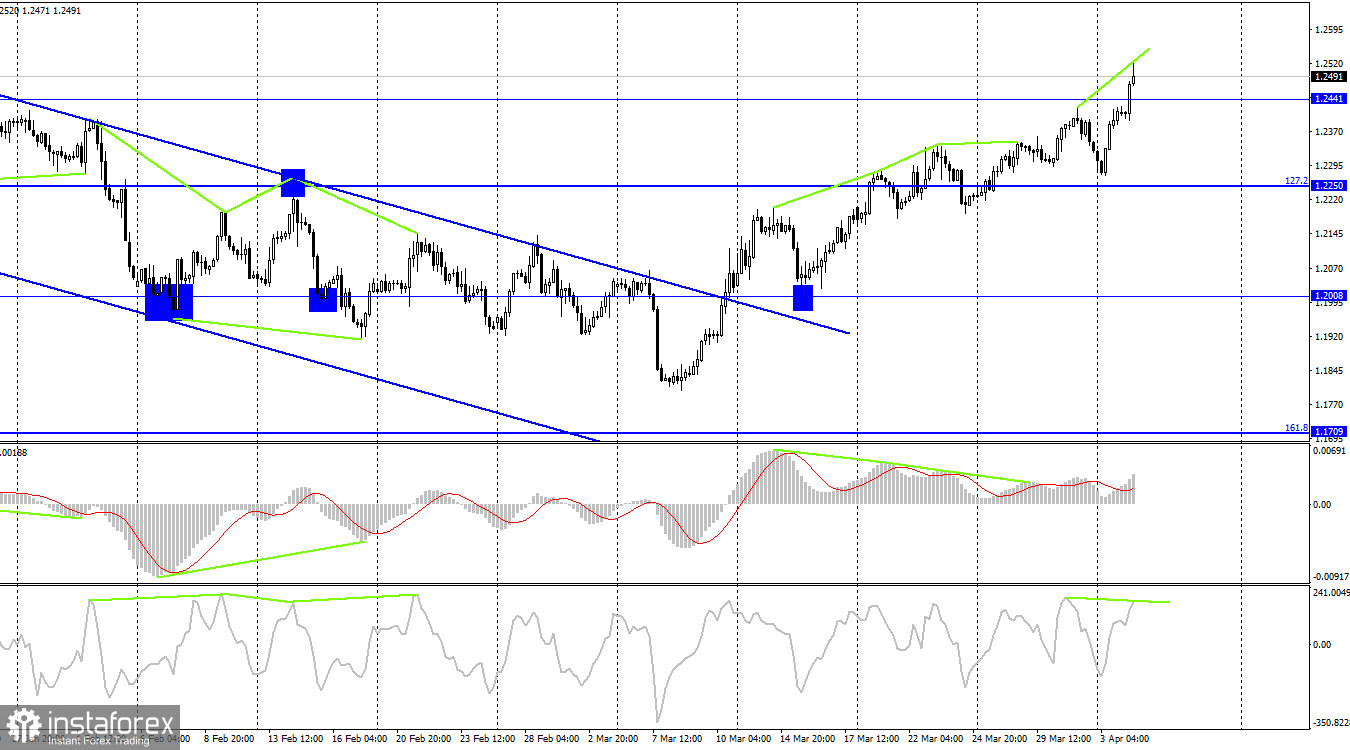

On the 4-hour chart, the pair reversed in favor of the British currency and maintained its rise, closing above the 1.2441 level. The CSI indicator is forming a new "bearish" divergence, but the three previous "bearish" divergences did not significantly decline the British pound. Many sell signals have been issued recently, but the bears are on holiday. Now the British pound can proceed to the Fibonacci level of 100% (1.2674).

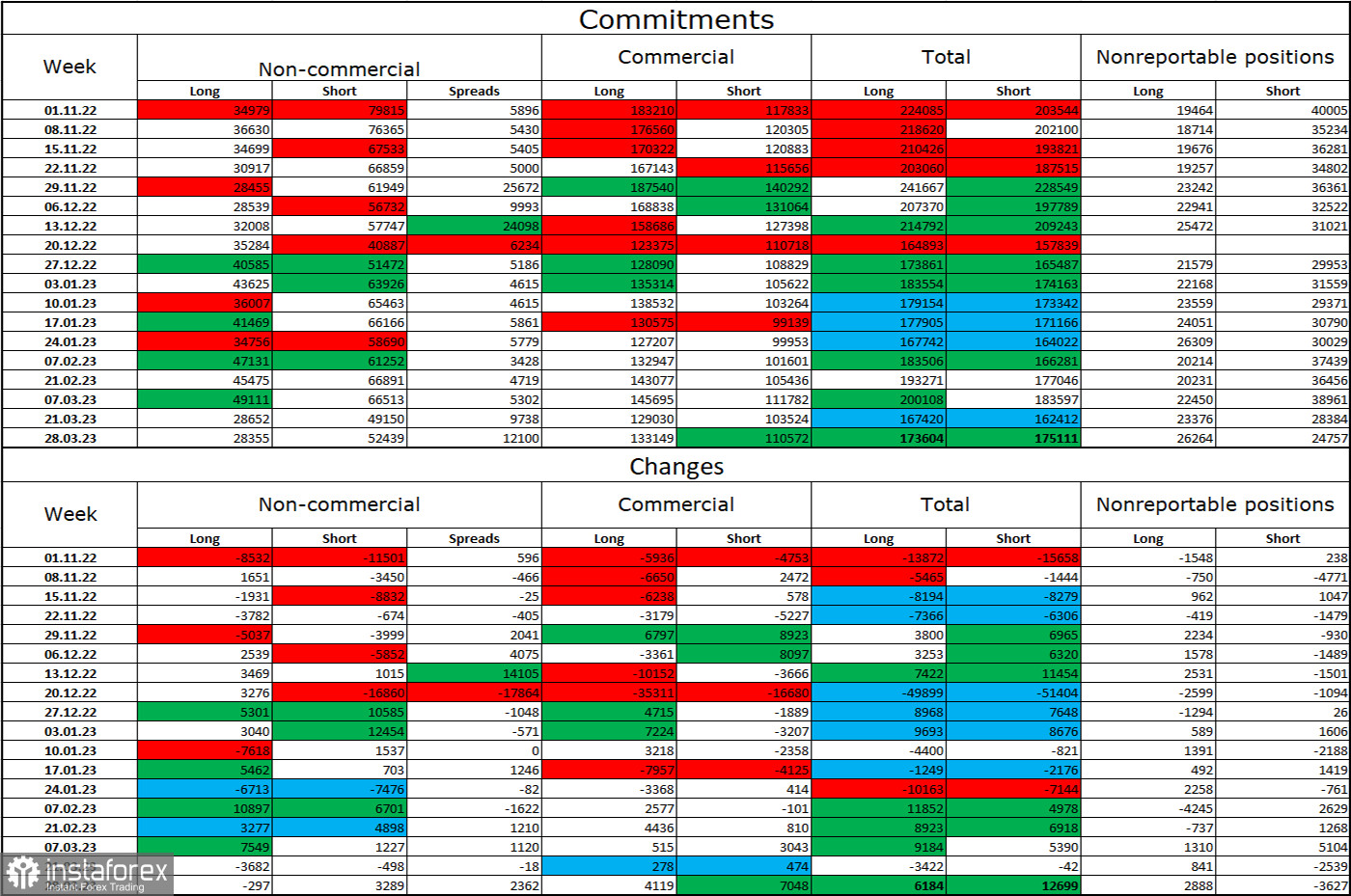

Report on Commitments of Traders (COT):

The sentiment of the "non-commercial" group of traders has moved slightly in the past week. The number of long contracts held by speculators declined by 297 units, while the number of short contracts grew by 3,289. The general sentiment of the key market participants remains "bearish," and the number of short contracts remains significantly greater than the number of long contracts. During the past few months, the situation has steadily shifted in favor of the pound. Still, the difference between the number of long and short positions speculators hold remains substantial. Consequently, the forecast for the pound is improving, yet the average British pound has not grown or decreased over the past few months. On the 4-hour chart, there was a breakout outside of the descending corridor; at this time, the pound can be supported. Yet, I observe that numerous elements contradict each other, and the information background does not offer much support to the pound.

News calendar for the United States and the United Kingdom:

US – number of open vacancies in the JOLTS labor market (14-00 UTC).

On Tuesday, the economic calendars of the United Kingdom and the United States have one event that could be more significant. Today, the impact of the information context on the sentiment of traders may be minimal.

GBP/USD forecast and trading suggestions:

Sales of the British pound are currently risky due to the pound's continual growth. Purchasing the British pound is risky because it has risen substantially, and we have recently received a huge amount of sell signals.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română