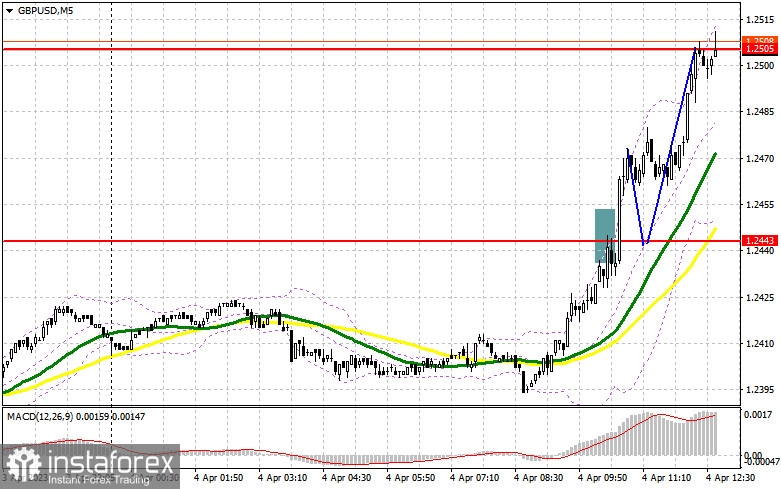

In my morning forecast, I paid close attention to level 1.2443 and recommended making entry decisions there. Let's analyze the 5-minute chart to see what happened. Growth and a false breakdown at this level resulted in a sell signal, which unfortunately led to losses. It was impossible to open long positions following the collapse of 1.2443 because there was no reverse test of this level. Throughout the second half of the day, the technical situation shifted a little.

To establish long positions on the GBP/USD, you must:

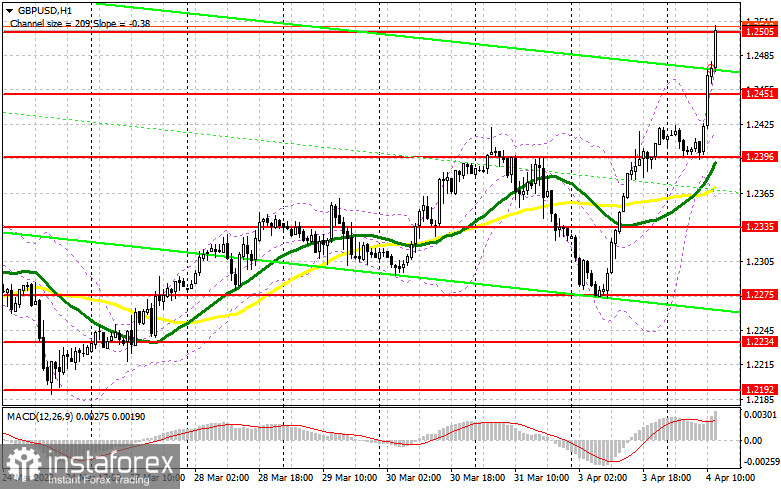

The continued strong growth of the pound indicates the emergence of a new bull market. It is unlikely that the afternoon data from the Bureau of Labor Statistics on the level of vacancies and labor turnover, as well as changes in the volume of production orders in the United States, will provide any support for the dollar, so after trading at the level of 1.2505, we can expect the bullish trend to continue. The speech of FOMC member Lisa D. Cook will also be meaningless, as she will say nothing new. Under the current market conditions, the ideal buying scenario would involve a decline and the formation of a false collapse in the area of the newly established support at 1.2451, which was established by the results of the first half of the trading day. This will provide an entry point with the capacity to exit over 1.2505. A breakout and a top-down test of this area will constitute an extra buy signal, strengthening the bullish trend and driving GBP/USD to 1.2552. In the event of an exit above this range against the backdrop of extremely negative fundamental indicators for the United States, we can discuss a rise to 1.2594, where I will set my profit target. If GBP/USD falls and there are no buyers at 1.2451, which is doubtful, sellers may regain control over the pound. If this occurs, I will delay opening long positions until the 1.2396 test, where bullish moving averages will be tested. I will only purchase if there is a false breakout. It is possible to immediately begin long positions on GBP/USD for a rebound from 1.2335 to correct 30-35 points in a single trading day.

To open short GBP/USD positions, you must have the following:

The sellers are still trying to determine what may be done to oppose such active purchases. Because of this, I advise you not to waste your time with sales. Only a false breakout of the 1.2505 resistance area will provide a good entry point for short positions. The US data may help the bears dump the pound below the newly formed support level of 1.2451 at the end of the first half of the trading day, but additional declines are doubtful. Only a breakout and a reverse test from the bottom up of this range will lead to the entry point for selling with the update of the minimum of 1.2396, restoring seller control over the market. I will set my profit target at the 1.2335 area, the farthest target. Considering the possibility of GBP/USD growth and the absence of bears at 1.2505, which is more plausible given the current bull market, it is advisable to wait for the 1.2552 level to be tested. A false breakout at this level provides an entry point into short positions based on the pound's downward movement. If there is a lack of activity, I recommend selling GBP/USD at 1.2594, anticipating a 30-35-point intraday decline.

Signals from indicators:

Moving Averages

The fact that trading occurs above the 30-day and 50-day moving averages implies a bull market.

The author considers the period and prices of moving averages on the hourly chart H1, which differ from the standard definition of daily moving averages on the daily chart D1.

Bollinger Bands

In the event of a decline, the indicator's lower limit near 1.2375 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română