For the gold market, the $2,000 level remains a tough nut to crack. But retail investors do not expect significant sell-offs this week.

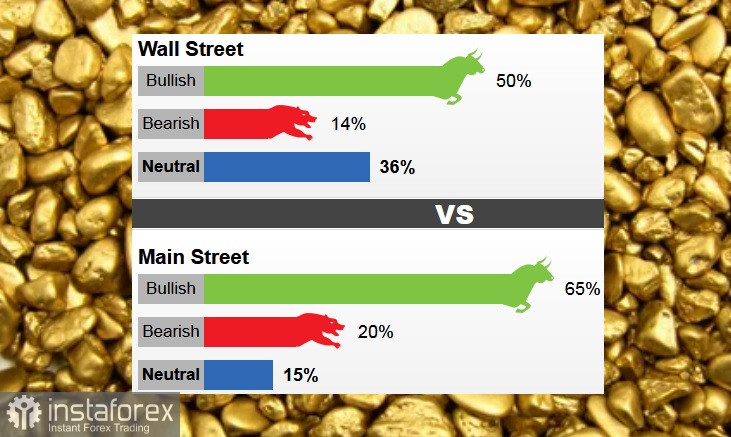

While Main Street investors remain firmly optimistic, Wall Street analysts are a little doubtful, with bullish sentiment making up a slight majority.

Even those analysts who are neutral on gold for the near term noted that several factors are present for the attractiveness of the precious metal as it falls.

Growing recession fears and the weakening influence of the U.S. dollar as the world's reserve currency were the main drivers behind the recent price rally to $2,000 an ounce.

The week before last, news broke that China had made its first trade through the Shanghai Stock Exchange in yuan. Last week, China and Brazil announced that they would conduct trading and financial transactions in yuan and real, excluding the U.S. dollar.

Also, central banks that buy gold to diversify their reserves are buying gold, providing very strong long-term support for gold prices.

Last week, 22 Wall Street analysts took part in the gold survey. Among the participants, 11 analysts, or 50%, were optimistic. At the same time, three analysts, or 14%, are bearish, and eight analysts, or 36%, believe prices are trading sideways.

There were 782 votes cast in online polls. Of these, 507 respondents, or 65%, expect gold prices to rise. Another 158 voters, or 20%, said the price would go down, while 117 voters, or 15%, were neutral in the short term.

While the positive sentiment among retail investors is down, compared with the annual high observed the week before last, in general, they still remain elevated. According to the survey, it is clear that by the end of the week, prices will remain at the $1,984 per ounce level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română