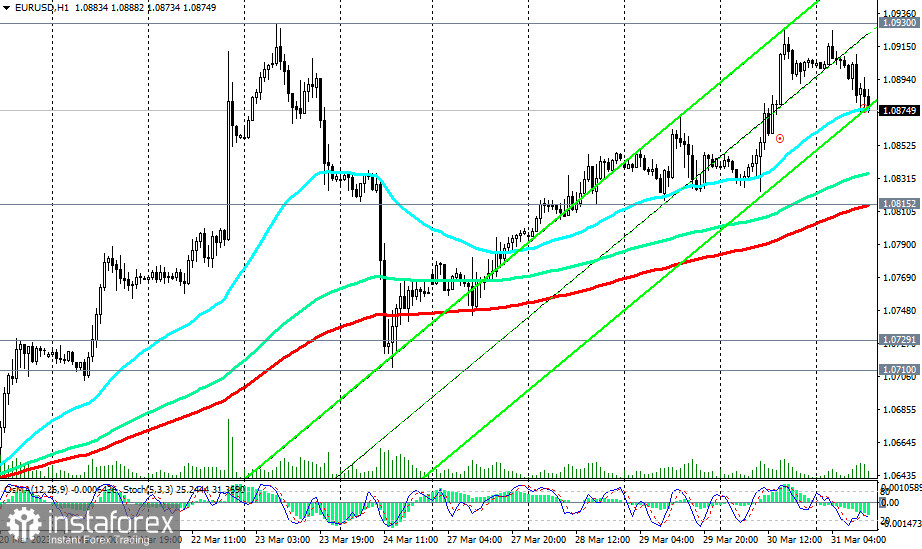

Today is the last day of the week, month, and quarter, and EUR/USD ends it on a positive wave. Despite a noticeable decline in February, the pair managed to fully recover its losses in March and strengthen to the level of 1.0900.

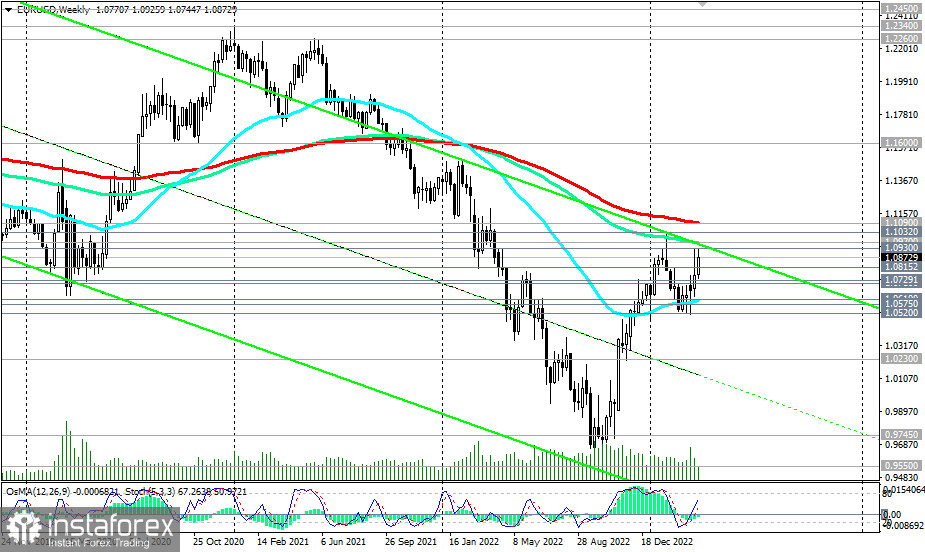

Economists are optimistic about the pair's prospects. To enter the long-term bull market zone, EUR/USD must overcome two key resistance levels at 1.0970 (144 EMA on the weekly chart) and 1.1090 (200 EMA on the weekly chart). A couple of weeks may be enough for this, given the continuing trend in the market.

The first signal to build up long positions will be the rise above the short term resistance at 1.0875, and the confirmation signal is a breakout of the local resistance at 1.0930.

In the alternative scenario, and with a new deterioration in the mood of stock market participants, we should expect the dollar to strengthen and the EUR/USD to fall.

The breakdown of the important short-term support level 1.0815 will be the first signal for the resumption of short positions. The downside target is support levels 1.0600 and 1.0575. The breakdown of the local support level 1.0520 will resume the bearish trend of EUR/USD.

Support levels: 1.0815, 1.0800, 1.0729, 1.0710, 1.0610, 1.0575, 1.0520

Resistance levels: 1.0875, 1.0900, 1.0930, 1.0970, 1.1030, 1.1090

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română