Macroeconomic calendar from March 30

US GDP expanded less than expected in the 4 quarter. The American economy rose by 2.6%, slightly less than 3.2% in the 3 quarter. According to the US Bureau of Economic Analysis, the slower-than-previously-estimated growth reflected downward revisions to exports and consumer spending. Meanwhile, spending on services increased at a slower rate than previously estimated.

At the same time, US weekly jobless claims rose slightly more than expected, which is a negative factor for the jobs market. Continuing claims increased to 1,689,000 from 1,685,000. Initial claims soared to 198,000 from 191,000.

The greenback showed weakness after the release.

Overview of technical charts from March 30

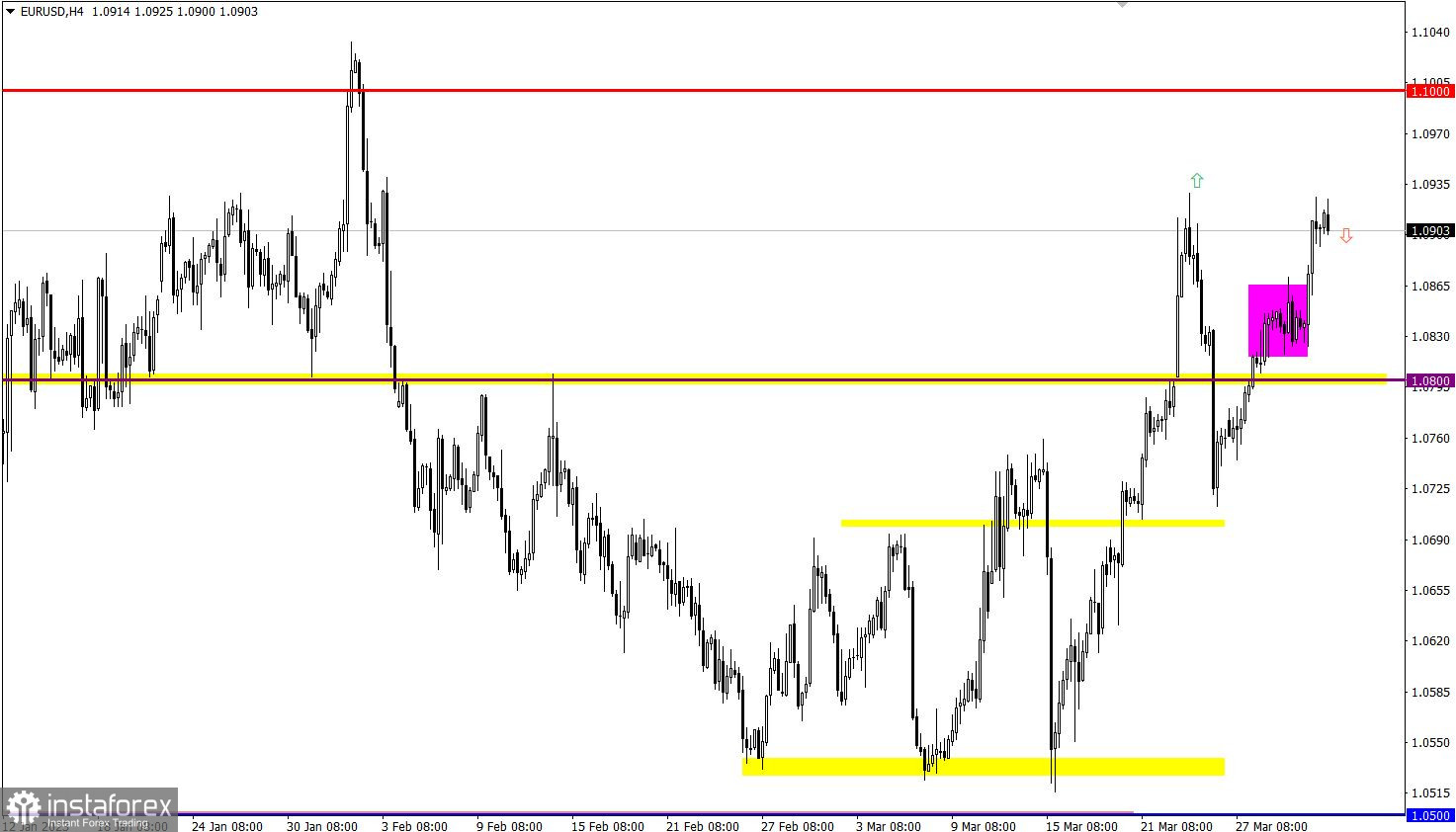

The flat market on EUR/USD ended, and the price went up. The pair recovered after the recent fall and approached the high of last week.

Moving up, GBP/USD reached the swing high of the medium-term trend, 1.2400/1.2450. Between March 9 and March 31, the pair grew by about 5% or over 600 pips.

Macroeconomic calendar on March 31

Macro data in the eurozone will draw traders' attention today. The flash estimate for inflation should reveal a decrease to 7.1% from 8.5. However, if actual results come different from preliminary estimates, this may trigger speculative swings, depending on the outcome.Trading plan for EUR/USD on March 31

If EUR/USD consolidates above 1.0930 and updates the high of last week, we will likely see a bullish continuation toward 1.1000. However, should the uptrend stop, the price would pull back, targeting 1.0850-1.0800.

Trading plan for GBP/USD on March 31

With the pound being overbought, there is a likelihood of a decrease in buying volumes, especially if the price encounters strong resistance in the area of the swing high of the medium-term trend. A pullback may follow afterward.

However, should technical signals be ignored and the quotes consolidate above 1.2450 in the daily time frame, inertial growth would follow.

What's on technical charts

The candlestick chart shows graphical white and black rectangles with upward and downward lines. While conducting a detailed analysis of each individual candlestick, it is possible to notice its features intrinsic to a particular time frame: the opening price, the closing price, and the highest and lowest price.

Horizontal levels are price levels, in relation to which a stop or reversal of the price may occur. They are called support and resistance levels.

Circles and rectangles are highlighted examples where the price reversed in the course of its history. This color highlighting indicates horizontal lines which can exert pressure on prices in the future.

Upward/downward arrows signal a possible future price direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română