Frank Elderson has become the latest senior European Central Bank official to explicitly state the need for further interest rate hikes. Yesterday, he gave an interview in which, when asked if a higher rate would do serious damage to the economy as a whole, he said that high inflation has far more damaging consequences. And if you have to choose between high inflation and tight monetary policy, the second is preferable. And as soon as the text of this interview was published on the ECB's website, the euro began to grow vigorously. And it kept going upward during the whole trading day.

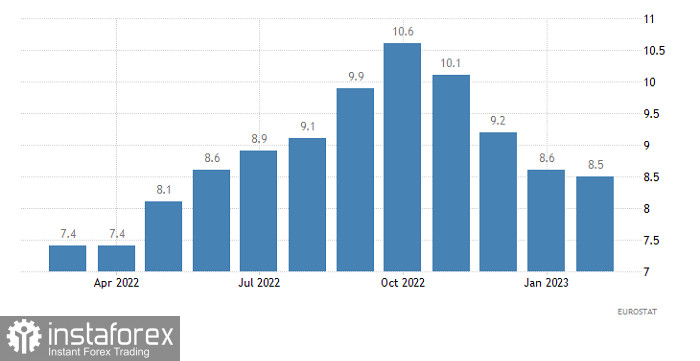

The single currency is only likely to fall today. And again for reasons related to inflation. This time directly, because a preliminary estimate of the growth rate of consumer prices in the euro area should show a slowdown from 8.5% to 7.4%. If these forecasts are confirmed, the ECB will start to slow down the growth rate of interest rates in the near future, which will be the reason for a small local correction.

Inflation (Europe):

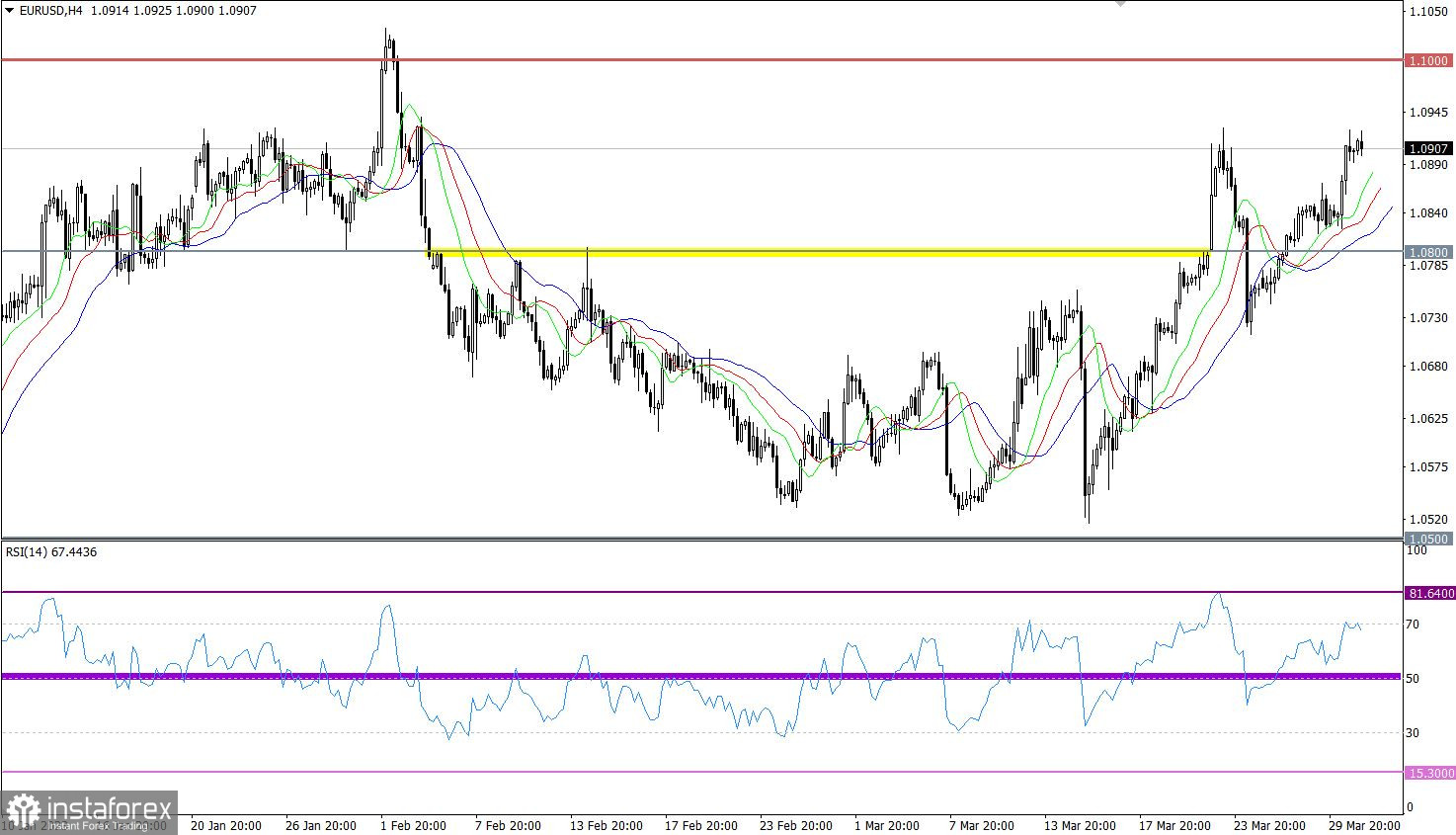

EUR/USD is finally done with being stagnant. As a consequence, the euro exchange rate was completely restored relative to the recent decline, where the quote reached last week's highs.

On the four-hour chart, during the rapid price movement, the RSI signals the euro's overbought conditions. However, on the daily chart, the RSI technical indicator is hovering in the upper area of 50/70, which points to the bullish sentiment.

On the four-hour and daily charts, the Alligator's MAs are headed upwards, which reflects the quote's movement.

Outlook

Last week, EUR/USD updated its highs and stayed above 1.0930. This will likely lead to further growth towards 1.1000. However, not being able to maintain the upward cycle makes it possible for the price to rebound, which will point to the growth in the volume of short positions towards the value of 1.0850-1.0800.

The complex indicator analysis points to an upward cycle in the short-term, medium-term and intraday periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română