After a successful bullish week and a strong surge in volatility on March 22, trading activity in the cryptocurrency market fell slightly. Bitcoin managed to gain a foothold above $28k and consolidate for further attempts to move up.

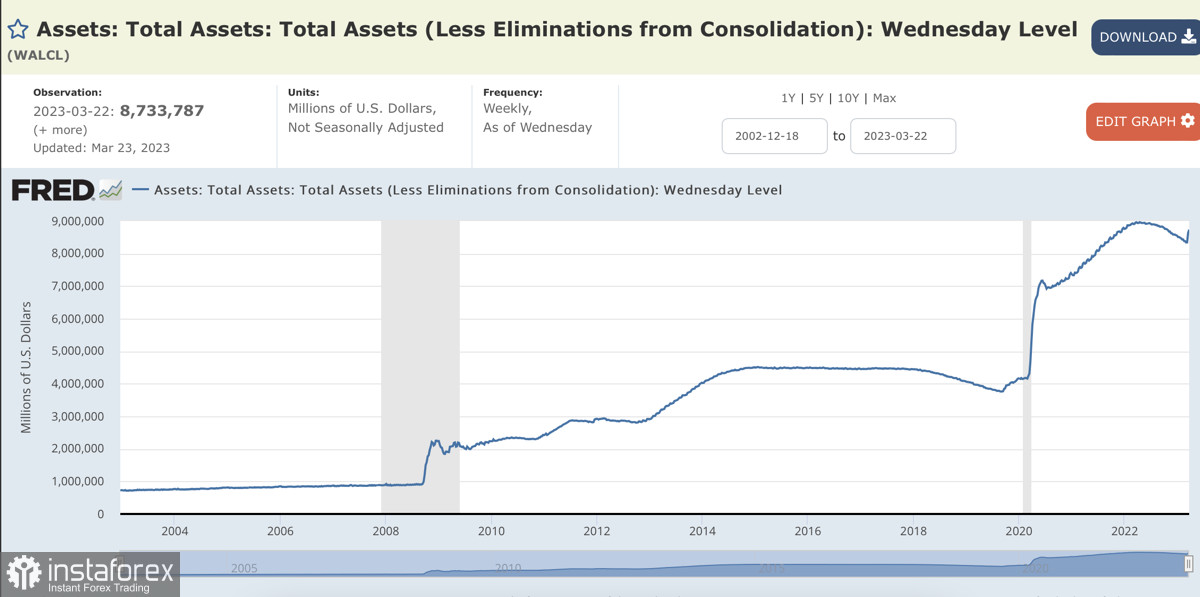

The local positive in the crypto market is accompanied by forced and extremely alarming measures to stimulate the banking system from the Fed. Over the past two days, the department's balance sheet has grown by another $100 billion, and the figure of $2 trillion is getting closer every week.

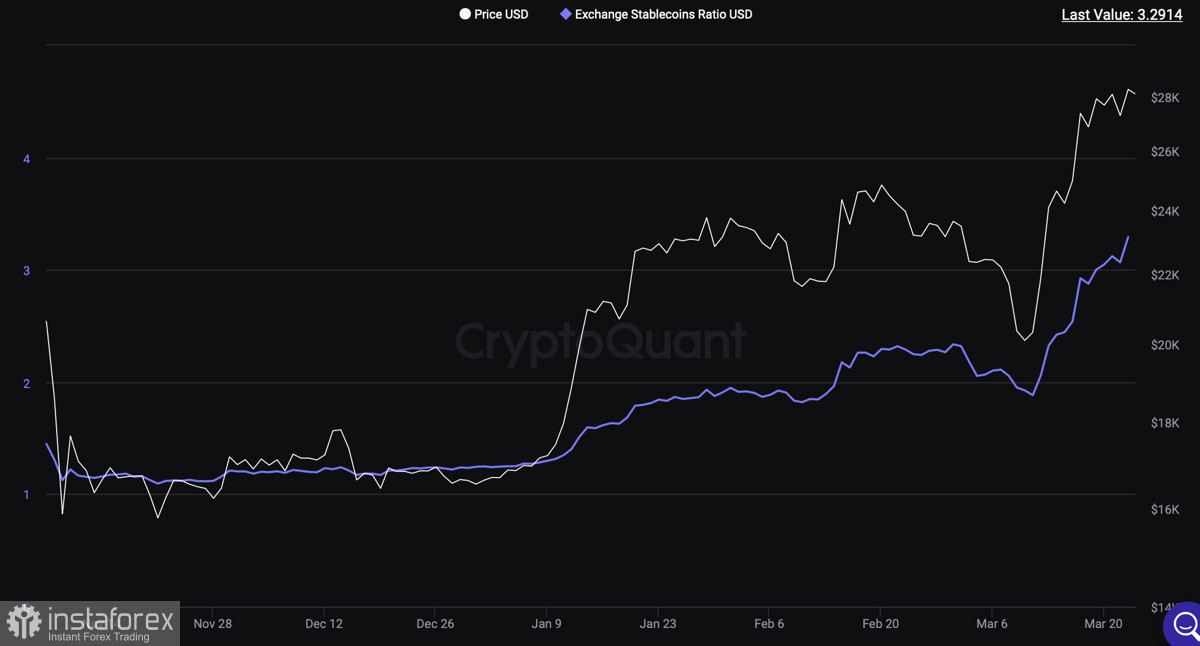

Parallel to this process, USDT issuer Tether is also "printing" stabelcoins. Over the past few months, USDT has grown by $11.5 billion. In previous cases of significant increase in USDT volumes, Bitcoin has shown strong growth, but now the situation is fundamentally different.

Fundamental factors

Bitcoin managed to update the local price high thanks to the crisis in the U.S. banking system and the quick reaction of the Fed. As we reported earlier, the U.S. central bank is extracting about $95 billion from the U.S. economy every month, the equivalent of a 50 basis point rate hike.

In March 2023, the Fed launched a quantitative stimulus program for U.S. banks, and as of March 24, they injected more than $300 billion into the market against the planned $2 trillion. In other words, the Fed has taken actions equivalent to a 1.5% rate cut in just a month.

As a result, we see the market filling up with liquidity, primarily reflected in USDT Stablecoins. Most cryptocurrency exchanges have set records in terms of trading volumes over the past few days, indicating that there is a large buyer.

However, it is important to understand that, in the medium term, the Fed will return to its quantitative easing policy. The key rate level will be raised, and according to a BBG survey, investors are confident of further rate hikes and zero prospects of moving to an actual rate cut before 2024.

Time to take profit?

Given the above, there is no doubt that in the medium term, the bubble that the Fed is now involuntarily inflating will burst. It is also obvious that now is the best time for the final profit-taking on BTC, as the market is gradually gaining bearish sentiment.

Miners have reduced their holdings by 610 BTC in just three days. Glassnode and Santiment also point to the formation of profit-taking sentiment among BTC investors. The longer the price stays below $29k–$31k in consolidation, the more players will take profits.

Bitcoin made a final bullish dash to $28k, the momentum was not enough to partially consolidate in the wide trading area of $29k–$31.6k. This is a negative factor, which will worsen as BTC consolidates below $29k, because the sales volume in the mentioned area will continue to grow.

As a consequence, the probability of a full breakdown of the $29k–$31.6k area is minimal. Given the Fed's short-term policy, we can see powerful bullish impulses to work out this area and collect liquidity, but this will be hindered by pressure on the price due to profit-taking.

Results

Bitcoin received the maximum dividend from the Fed's short-term policy, but the asset failed to consolidate inside the key $29k–$31.6k resistance zone. This will significantly complicate the further upward movement of the asset, and given the growing profit-taking sentiment, you should count on false breakouts of tops within the range.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română