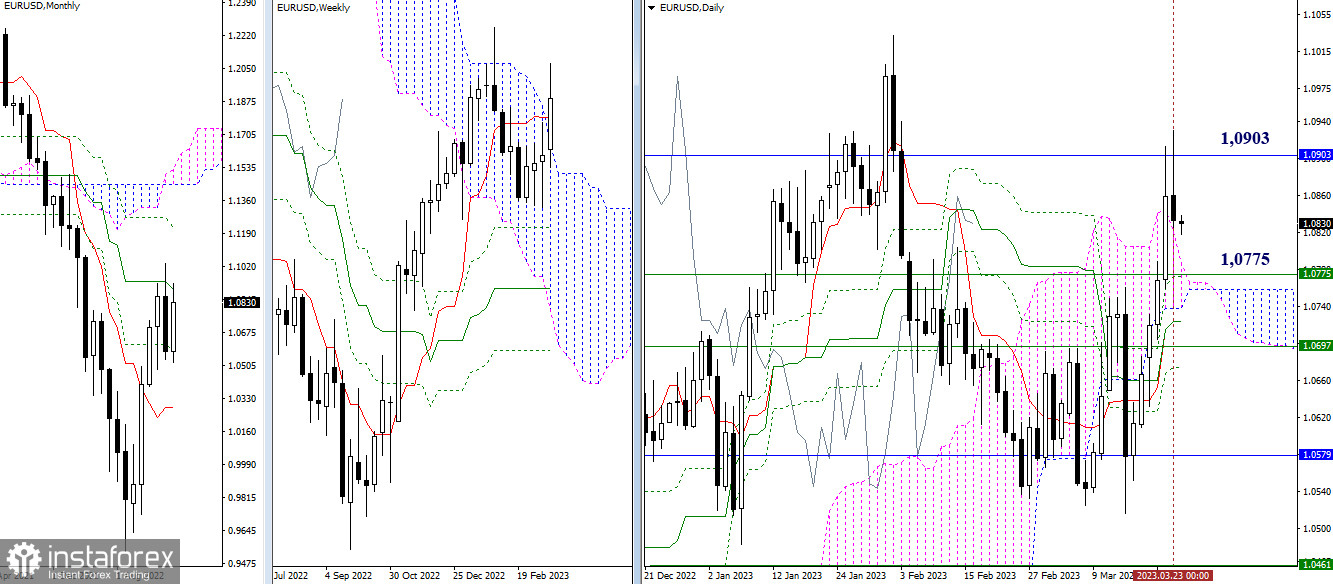

EUR/USD

Larger timeframes

The one-month resistance of 1.0903 was tested yesterday. However, the test result was not in the bulls' favor. Eventually, EUR/USD retreated back to support of the intraday cloud. Therefore, the upward targets of 1.9003 (one-month medium-term trendline) and 1.1033 (a one-year high) remain valid today provided that the bulls assert themselves. The bears' task in this section will be complicated by a vast support zone consisting mainly of daily levels 1.0787 – 1.0772 – 1.0738 – 1.0724 – 1.0675. This support zone is also reinforced by weekly support levels: 1.0775 (short-term trend) and 1.0697 (the upper border of the Ichimoku cloud).

H4 – H1

On smaller timeframes, the instrument is going through a correctional decline. A weekly long-term trendline (1.0767) acts as the key support responsible for the current balance of trading forces. If the price settles below, the bears will gain an advantage on smaller timeframes. However, to change the situation on larger timeframes, the instrument will have to surpass a wide zone of intraday and weekly levels. If the bulls can benefit from support levels, rekindle price growth, and enhance the bullish sentiment, we can determine the following intraday target levels: 1.0863 – 1.0900 – 1.0968 – 1.1005 (all of them are classical pivot levels).

***

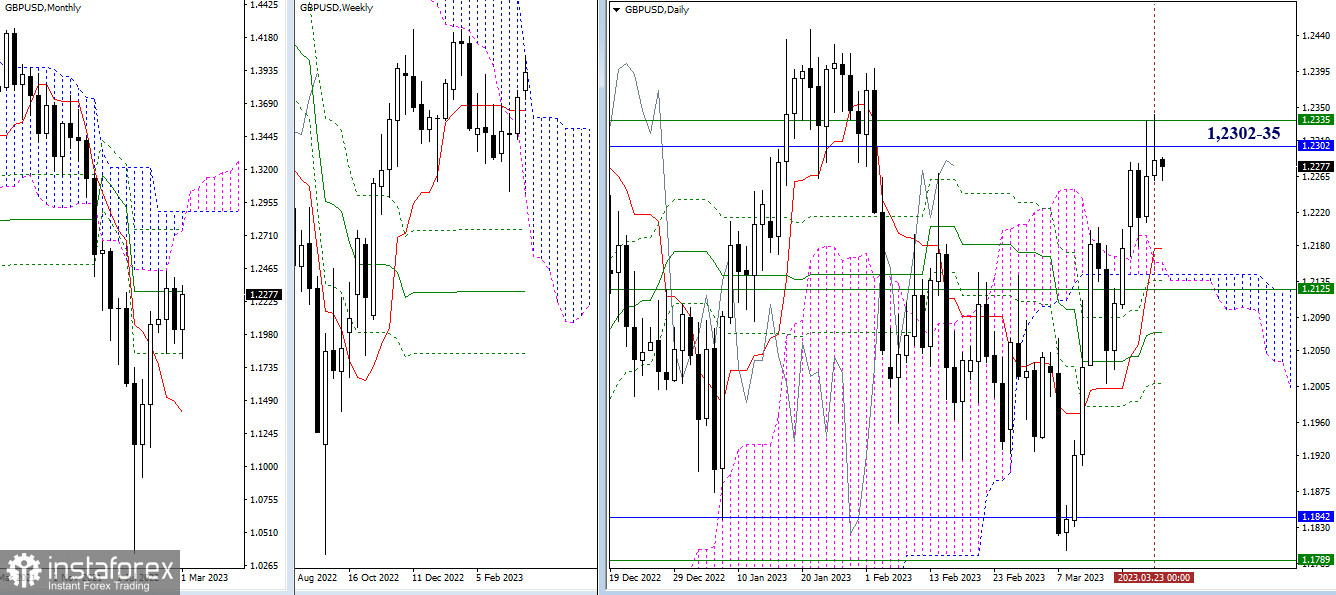

GBP/USD

Larger timeframes

The pound bulls again failed to surpass resistance at 1.2302-35 (a one-month medium-term trend + the upper border of the weekly cloud). As a result, the upward targets at 1.2302-35 and 1.2447 (a one-year high) are still valid under the current market conditions. If the area of 1.2302-35 is tested which will end up with a drop and the bears strive to affirm their leadership, the nearest support zone is defined between 1.2176 and 1.2125 which combines the levels of various timeframes.

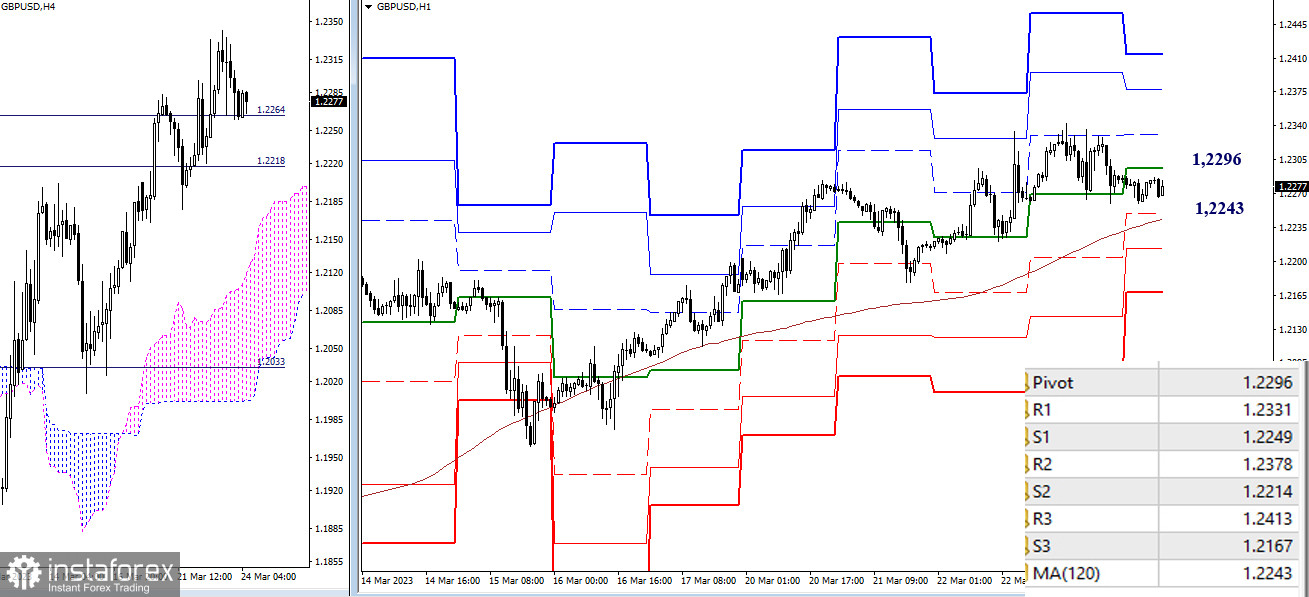

H4 – H1

On smaller timeframes, the bears are about to test the weekly long-term trendline of 1.2243. A breakout and a trend reversal could change the current balance of trading forces in favor of the bears. If so, the next downward intraday targets will be seen as classic pivot levels: 1.2214 (S2) and 1.2167 (S3). If the bulls recapture the central pivot intraday level of 1.2296 and manage to update yesterday's high of 1.2342, they will revive the upward move on smaller timeframes. To enable a further climb, it is important to overcome classic pivot levels of 1.2378 (R2) and 1.2413 (R3).

***

This technical analysis is based on the following ideas:

Larger timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Smaller timeframes - H1 – classic pivot points + 120-period Moving Average (weekly long-term trend line)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română