The EUR/USD currency pair is still increasing as if nothing has changed. The European and American currencies did not experience many incidents or breaking news on Thursday, but the Fed meeting's outcomes were made public in the evening of the previous day, which is extremely important and interesting. Unfortunately, there were no "surprises" this time. The primary event can be seen as Powell's remarks suggesting the regulator may soon stop raising the rate, in response to which the US dollar fell even further in the market. There is nothing else to note outside the fact that the key rate rose by 0.25 percent, which was to be expected. The pair's volatility was probably not overly high as a result.

From a technological perspective, nothing has changed on the 4-hour TF. We believe that the pair's continued strong and rapid growth is unjustified. We think the euro and the dollar shouldn't have risen against one another if the ECB and the Fed only increased the rate by 0.25% without making any "loud" announcements. Although the underlying background hasn't always been in its favor, the European currency has been rising for almost two weeks. Once more, we find ourselves in a circumstance where the euro is rising for some reason. We've already discussed potential drivers of the euro's growth. Instead, the scenario is as follows: there are no obvious causes for the pair's rise, but we must identify them to find a way to explain what is taking place in the market. On the other hand, there is a distinct trend in "technology," and the Heiken Ashi indicator is still holding steady. So, why not buy if there are no sell signals?

Both the ECB and the Fed pledge to keep fighting inflation.

In this section of the article, we want to call traders' attention to the rhetoric Jerome Powell and Christine Lagarde have used recently and right after their respective Central Bank meetings. Both leaders declared that maintaining price stability is still their top priority and committed to continuing to tighten monetary policy. Simultaneously, the ECB may lower the next step of tightening monetary policy to 0.25%, as discussed in January. The European Central Bank may appear to be the last to experience such a slowdown, but it also began raising interest rates far later than the Federal Reserve and the Bank of England. As a result, it is incorrect to claim that the ECB has adopted or is adopting the most aggressive monetary policy. Furthermore, we believe Christine Lagarde is lying when she says her office will do everything possible to return inflation to 2%. The ECB should increase the rate by 0.5% at each meeting, given the current level of inflation. It's possible that we are being unfair to the ECB and that it will increase the rate by 0.5 percent once again in May, but right now everything points to the contrary.

For instance, Madis Muller, a member of the ECB monetary committee, suggested on Thursday that the regulator raise interest rates a little bit further. When you need to generate money "for a long time and a lot," what does "a little more" mean? We would like to remind you that by the end of February, inflation was increasing in many EU nations. The ECB may be still relying on the long-term effects of tighter monetary policy. In other words, we aren't just talking about waiting for inflation to drop below 2% anymore. It involves keeping up the pressure on its decline. Even though energy prices were falling globally at the time, the consumer price index wasn't in a hurry to decrease. Recall that the central banks cited the rise in oil and gas prices as one of the primary causes of the increase in inflation last year. As a result, prices have decreased significantly, but inflation is taking its time to decline. Key rates were also actively raised at the same time, and QT programs were implemented. It turns out that neither the EU nor the USA, and even more so the UK, were able to reduce inflation by even two times when all three factors were combined. And in light of this realization, central banks are slowing the growth of interest rates to a formal level. Is the battle against inflation over, or are we in for a protracted period of rapid price growth?

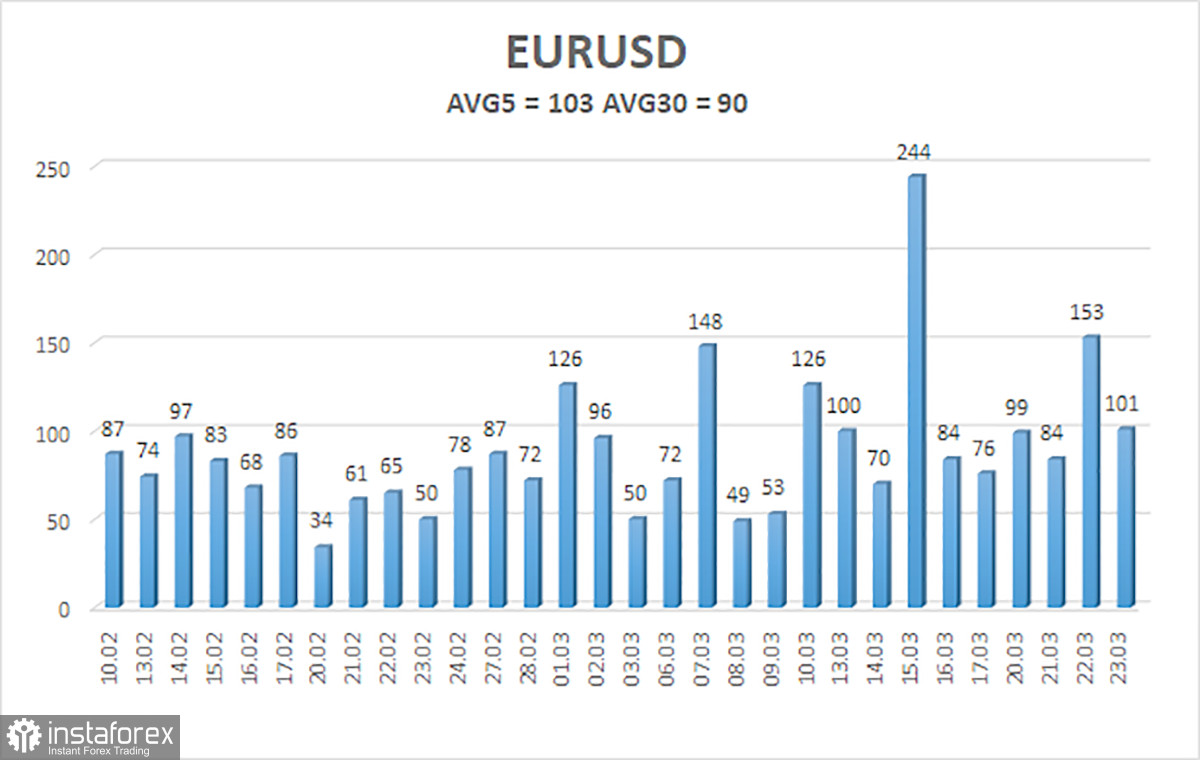

As of March 24, the euro/dollar currency pair's average volatility over the previous five trading days was 103 points, which is considered "high." As a result, we anticipate that the pair will move on Friday between 1.0746 and 1.0951. The Heiken Ashi indicator will turn back up to signal the start of the upward movement.

Nearest levels of support

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest levels of resistance

R1 – 1.0864

R2 – 1.0986

R3 – 1.1108

Trading Suggestions:

A round of downward correction has begun for the EUR/USD pair. Currently, we can take into account opening additional long positions with targets of 1.0951 and 1.0986 if the Heiken Ashi indicator reverses its trend upward. After the price is fixed below the moving average line, short positions can be opened with a target of 1.0620.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română