Apple, the technology industry icon, has once again caught the attention of investors and analysts. This time, concerns have arisen regarding potential restrictions on iPhone production in China. And, as always, this did not go unnoticed in the market. The enticing scent of profit also drew attention to the deal between McDonald's and Wells Fargo, but at the same time, the chip index headed downward. Today, we will tell you about the key market events that make it a truly dynamic spectacle. Apple, the global technology giant, found itself at the center of a scandal when it was revealed that China plans to ban the use of iPhones in state organizations and agencies.

This decision immediately led to a drop in Apple's stock value and companies closely tied to China, which in turn hit the technology sector of the S&P 500, causing the most significant decline among all sectors of the index. On the other hand, data from the US Department of Labor is boosting confidence: the number of Americans filing for unemployment benefits has dropped to a level not seen since February.

However, investors are concerned that this could force the Federal Reserve to continue its tight monetary policy, which, in turn, exerts pressure on stocks. Saak Manuelyan, Managing Director and Head of Equity Trading at Wedbush Securities, notes that today's news has had a significant impact on the market, and their importance cannot be ignored.

Investors are also awaiting the release of inflation data for August, which will be available in a week. Given the recent rise in oil prices, there is some concern about the possibility of inflation making a comeback, but as Manuelyan notes, it is not entirely impossible.

According to the FedWatch tool by the CME Group, there is a high likelihood that the Federal Reserve will keep interest rates unchanged in September. However, the chances of an additional pause at the November meeting are assessed as much lower.

Craig Fer, Chief Investment Strategist at Edward Jones, points out that there are certain opportunities for the Fed to maneuver in monetary policy and believes that a cautious defensive position is important in the current situation.

In the world of finance, there is always room for unexpected twists, and as today's events show us, even giants like Apple are not immune to market turbulence. Investors remain on the lookout for new developments that could impact their portfolios.

In the closing notes of the trading session, words from John Williams, President of the Federal Reserve Bank of New York, were heard. He emphasized that the question of how restrictive monetary policy should be remains open. "We have a good foundation in policy, but we still need to rely on data," he said, pointing out that there are several key publications ahead of the September meeting of the Federal Reserve System.

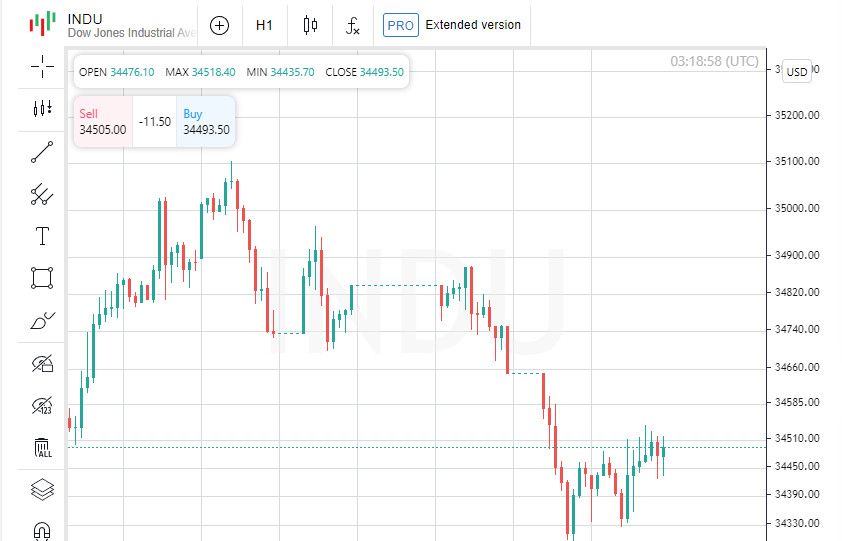

Against this backdrop, the Dow Jones index demonstrated a moderate increase, rising by 57.54 points, or 0.17%, reaching a level of 34,500.73. Meanwhile, the S&P 500 index lost 14.34 points, which amounted to a 0.32% decrease, settling at 4,451.14. The most significant decline was seen in the Nasdaq Composite index, which dropped by 123.64 points, representing a 0.89% decrease, and closing at 13,748.83.

It's worth noting that the Dow index showed higher growth compared to the S&P and Nasdaq, which can be explained by the fact that in the cyclical Dow index, Apple has a smaller weight compared to the S&P 500, which is more oriented toward market capitalization and where Apple has one of the largest weights.

However, despite the fluctuations in the indexes, defense sector stocks demonstrated the highest growth among the S&P sectors, rising by 1.3%. This drew the interest of investors inclined toward more conservative investment decisions.

Meanwhile, the Philadelphia Semiconductor Index fell by 1.98%, and Apple suppliers like Skyworks Solutions, Qualcomm, and Qorvo suffered significant losses, dropping by over 7%. This indicates that news from China is causing concern among investors who see significant risks to stock prices, especially in the technology sector, due to the relationship between the US and China.

The atmosphere in the financial markets remained tense, and sentiments regarding the Chinese economy were cooled by data showing a decline in China's exports and imports in August. This was reflected in the stocks of Chinese companies listed in the US, such as PDD Holdings, JD.com, and Alibaba, which fell by more than 4%, while Baidu's shares lost 3.4%.

While some companies faced difficulties, the Dow Jones index managed to stay afloat, partially thanks to the rise in McDonald's shares by 1% after Wells Fargo upgraded the stock rating to "above market." Additionally, good news came from UiPath, a software automation developer, whose shares rose by 11.5% due to an optimistic annual revenue forecast.

On US stock exchanges, the number of declining stocks outnumbered the advancing ones, putting pressure on the market. On the NYSE, the ratio was 1.80 to 1, and on the Nasdaq, it was 2.03 to 1, favoring the decline.

The S&P 500 and Nasdaq Composite indexes recorded new 52-week highs and lows, indicating high market volatility and fluctuations.

The volume of shares changing hands on US exchanges amounted to 9.76 billion shares, which remained below the 20-session moving average of 10.10 billion.

Despite the decline in US oil inventories for the fourth consecutive week, oil prices fell due to weak trading data in China. These data offset the impact of the recent reductions in US oil inventories, and investors are awaiting data from the US Energy Information Administration to better understand the oil market situation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română