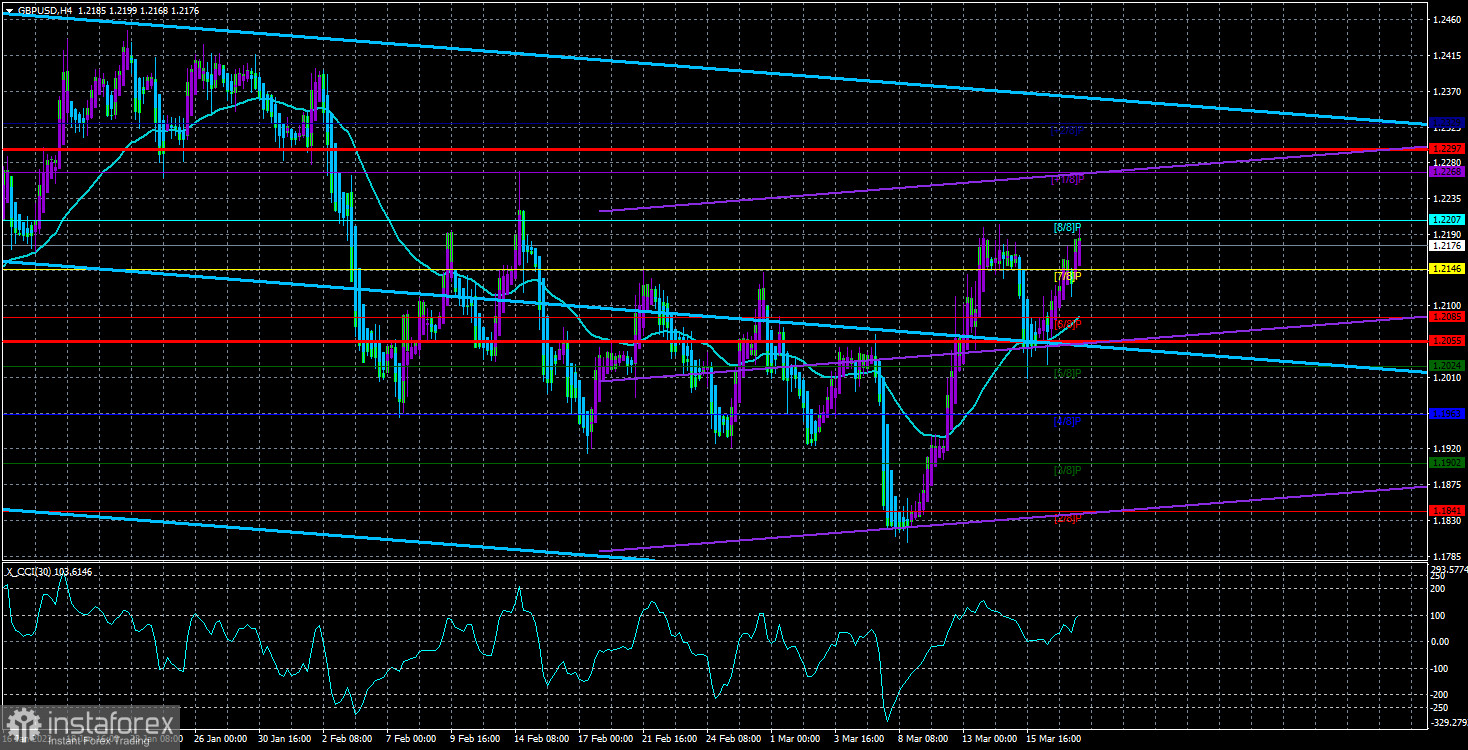

At first glance, the GBP/USD currency pair last week even ventured to continue a new upward trend. In the middle of the week, the pair adapted to the moving average but surprisingly failed to surpass it. As a result, right now, everything appears to be pointing toward the start of a new upward trend. As there have been so many of these "beginnings" recently, it is impossible to predict how long they will last, but there are "swings" that are apparent from a distance. So, it is entirely probable that such moves by the pair last week were in some way an accident. But keep in mind that the 24-hour TF continues to be stable between 1.1840 and 1.2440. As a result, even an additional rise of 260–270 points will not cause this flat to break, and the higher the pair rises, the more likely it is that a decline to 1.1840 will start. In addition, two central bank meetings will take place concurrently the following week. There will probably be a market response to these events. Although, from our perspective, any growth of the British currency at this moment is illogical and unwarranted, a weak "hawkish" stance from the Fed or a strong "hawkish" stance from the Bank of England may easily prompt additional growth of the pound.

The 24-hour time frame is where the most intriguing events are now taking place. In the sense that it is important to start right away with what is occurring on the daily chart. You must be ready for the possibility that the pair may suddenly shift their direction of movement because a flat is not strictly a movement from one boundary of the side channel to another. The change of 300–400 points on the lower TF represents a trend. So, if the pair does not enter an intraday flat, it is currently extremely probable to trade well on junior TF.

Important reports and two meetings.

All the fun will start in the UK the next week on Wednesday with the release of the inflation report for February. Official forecasts now state that the consumer price index will drop from 10.1% to 9.7-9.8%, which is not enough in our opinion. 0.3-0.4% after 10 hikes in the Bank of England's key rate is fairly little, given that the regulator has been raising the rate for 5 quarters and inflation has just recently begun to decline. Technically, the pound can grow even if inflation slightly slows down, but as we have already mentioned, BA does not always have the option to tighten monetary policy. As a result, each succeeding rate increase only pushes the date when it will stop growing closer, which is terrible for the pound.

The decision about the BA rate will be made public on Thursday morning. It is anticipated that the rate will increase by another 0.25%, marking the 11th consecutive increase. As this decision has already been made, the market has long known that the rate will increase by this amount in March. Volatility will increase undoubtedly, but the regulator's statement and Andrew Bailey's speech will be more significant. Retail sales and business activity indices for the service and industrial sectors were released on Friday in Britain.

The United States will also provide a lot of exciting possibilities. The rate should increase to 5% at the Fed meeting on Wednesday evening, Jerome Powell's speech is scheduled for the same evening, business activity indices are due on Friday, and orders for long-term goods are due on Saturday. Naturally, the Fed meeting will be the main focus of the market's attention. Powell may not say anything memorable, but it does not guarantee that there won't be a response. The Fed meeting has always been the key event for market participants. Hence, it is certain that there will be significant movements, and Powell's hints can be read in any way. One only needs to think back to Jerome's most recent speech to Congress, which caused the dollar to rise even though he said nothing particularly unexpected. It will be intriguing to see Powell's comments in light of the failure of numerous large banks. Surprises could also come as surprises. We have a very exciting week ahead of us.

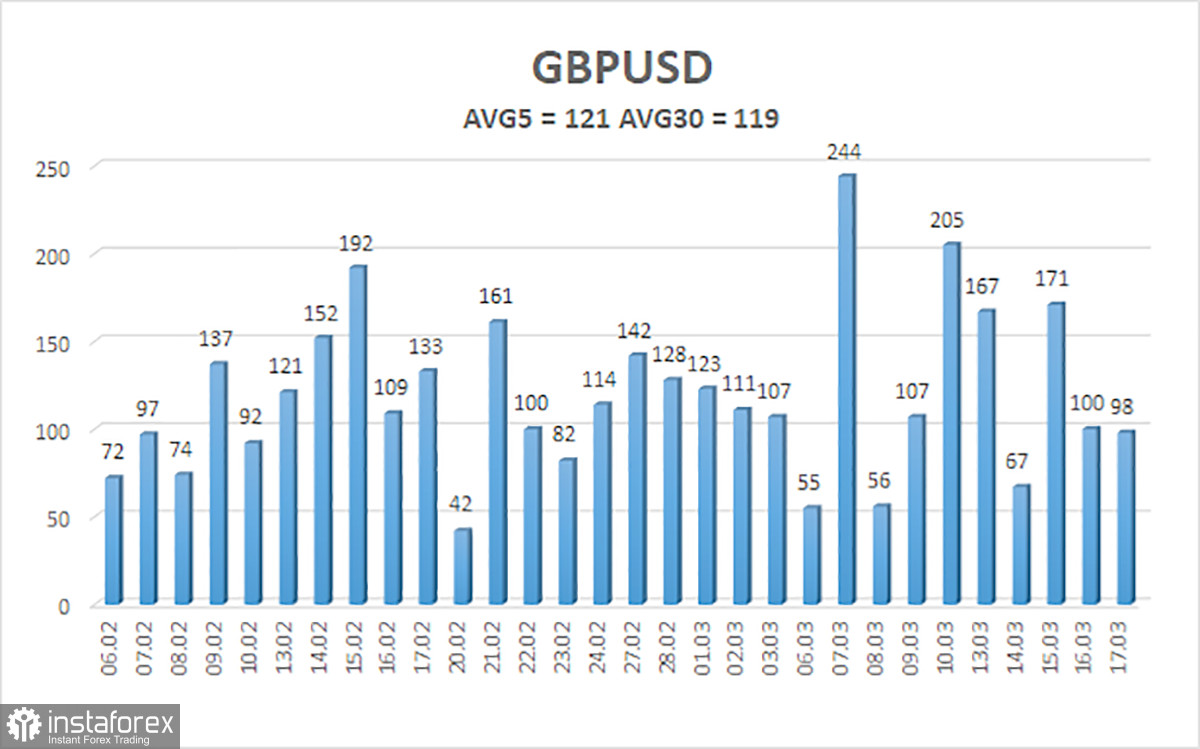

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 121 points. This value is "high" for the dollar/pound exchange rate. So, on Monday, March 20, we anticipate movement to remain inside the channel and be limited by the levels of 1.2055 and 1.2297. A new round of downward movement within the "swing" is indicated by the downward reversal of the Heiken Ashi indicator.

Nearest levels of support

S1 – 1.2146

S2 – 1.2085

S3 – 1.2024

Nearest levels of resistance

R1 – 1.2207

R2 – 1.2268

R3 – 1.2329

Trade Suggestions:

In the 4-hour period, the GBP/USD pair bounced off the moving average and started going north again. Unless the Heiken Ashi indicator turns down, you can continue holding long positions with targets of 1.2268 and 1.2297. If the price is fixed below the moving average, short positions may be taken with targets of 1.2024 and 1.1963.

Explanations for the illustrations:

Channels for linear regression - allow us to identify the present trend. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română