Euro continues to recover from the loss it had after yesterday's collapse, while pound, on the other hand, is not doing as well as hoped. Traders will know if this scenario will carry on today, depending on what the results of the ECB meeting will be. A further 0.5% interest rate hike will prompt an increase in euro, while the refusal of the ECB to raise rates at all will lead to a deeper price decline. In the afternoon, the US is set to release data on the labor market, which is an important part of the Federal Reserve's policy. Construction permits and new foundation starts are not going to be that important, so markets will ignore those numbers. As such, it is likely that both EUR/USD and GBP/USD will see gains, with the latter recovering from its weekly lows.

EUR/USD

For long positions:

Buy euro when the quote reaches 1.0626 (green line on the chart) and take profit at the price of 1.0675.

Euro can also be bought at 1.0599, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0626 and 1.0675.

For short positions:

Sell euro when the quote reaches 1.0599 (red line on the chart) and take profit at the price of 1.0560.

Euro can also be sold at 1.0626, but the MACD line should be in the overbought area as only by that will the market reverse to 1.0599 and 1.0560.

GBP/USD

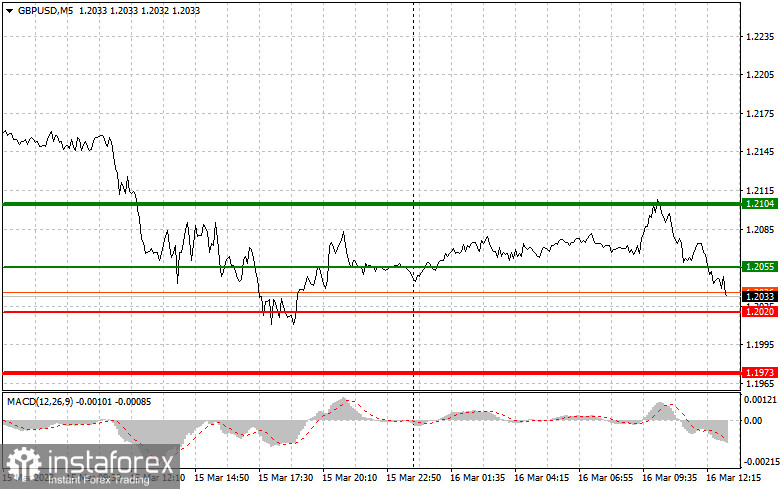

For long positions:

Buy pound when the quote reaches 1.2055 (green line on the chart) and take profit at the price of 1.2104 (thicker green line on the chart).

Pound can also be bought at 1.2020, but the MACD line should be in the oversold area as only by that will the market reverse to 1.2055 and 1.2104.

For short positions:

Sell pound when the quote reaches 1.2020 (red line on the chart) and take profit at the price of 1.1973.

Pound can also be sold at 1.2055, but the MACD line should be in the overbought area as only by that will the market reverse to 1.2020 and 1.1973.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română