The slightly shaken U.S. banking system immediately revealed, or rather, exacerbated the problems of the European banking sector. The largest co-owner of the Swiss Credit Suisse - Saudi National Bank refused to provide additional liquidity amid the panic, which led to the collapse of the Swiss bank shares by 24.2% and the euro by 1.46% (154 points). The Euro Stoxx 50 lost 3.46% over the day, the S&P 500 by -0.70%.

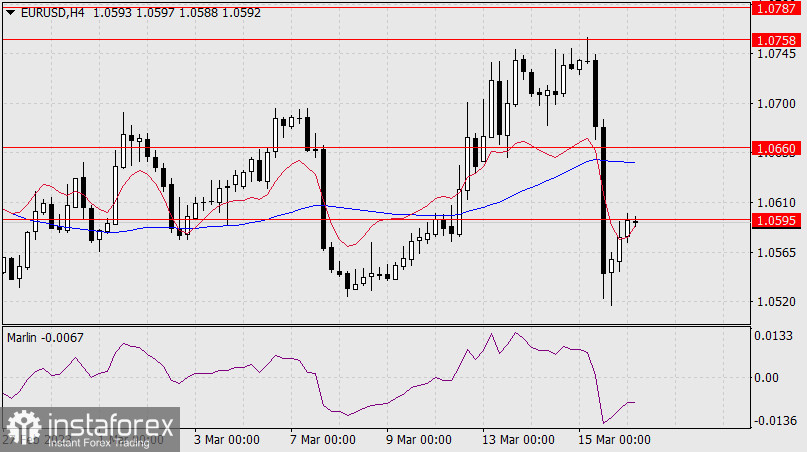

In the process of falling, the euro overcame the two target levels 1.0660 and 1.0595. On the daily chart, the Marlin oscillator has settled in the area of the downtrend. At the moment, the price is retesting 1.0595, afterwards, I expect the euro to fall to the target range of 1.0443/70.

Today, the European Central Bank is expected to announce a 0.50% hike to 3.50%. Investors have now questioned such a decisive move, raising the probability of a quarter point hike. Of course, in the current situation, a small rate hike would mean the ECB recognizes the beginning of the crisis, which could simply sow panic in the market. Therefore, out of "political considerations," the ECB could raise the rate by 0.50% and try to reassure market participants by verbal means. The Swiss central bank has already promised Credit Suisse the necessary liquidity.

On the four-hour chart, the price overcame both indicator lines, and in the process of correction, came back above the balance line. Falling below this line (below 1.0570) may resume further downward movement. The limit of the correction is 1.0660, reinforced by the MACD indicator line.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română