It was a blessing in disguise. In previous articles I suggested that the euro and the pound's decline is connected to either the wave pattern or the upcoming European Central Bank meeting. However, there is one more possible reason why the euro collapsed (and as a consequence, the pound) - problems of one of the European Union's largest banks, Credit Suisse. We just found out that one of the largest shareholders of the bank - the National Bank of Saudi Arabia announced that it will not increase its stake in Credit Suisse (now it is 10%) due to regulatory problems. The main point here is that Credit Suisse needs additional funds and it requires the help of one of its major shareholders, but the National Bank of Saudi Arabia refuses to help. And so, Credit Suisse shares are down 22% on Wednesday, and trading on the stock exchanges stopped several times due to sharply increased volatility and a huge drop in prices. Credit Suisse shares fell below 2 Swiss francs for the first time in their history, and many analysts have already concluded that a banking crisis is starting in Europe as well. Take note that Credit Suisse is one of the largest banks in Europe and it is also a Swiss bank. It is obvious that its bankruptcy can affect the whole banking industry of the European Union, which will cause a domino effect.

But I don't think we should jump to conclusions just yet, as in the case of the bankruptcy of American banks. Credit Suisse can be saved, because the 2008 crisis taught governments and regulators a lot. And banks go bankrupt from time to time anyway. Hence, we have to wait for official statements from Ursula von der Leyen or other top officials of the European Council, The European Parliament and European Commission (as well as the European Central Bank). However, the euro's decline may be related to this event. Consequently, the dollar, which has been in a feverish state all last week, suddenly gets a news background, which can help it to quickly recover all losses and maintain the current wave pattern.

Credit Suisse itself said the group's internal controls over financial reporting in 2021 and 2022 were ineffective. Weaknesses and irregularities related to the inability to effectively assess risks were identified. The bank said it would require significant resources to address these deficiencies. As we can see, it is the internal problems of the bank and the need to restore liquidity that caused the collapse of the shares and the possible decline in the single currency. Now we wait for what's next to come. The ECB meeting will be held on Thursday, which will also be important for the markets. High activity on the markets can last till the end of the week and something tells me that this won't be the final disappointment from a huge bank. But this development is to our advantage, because both European currencies are declining, which is what we need.

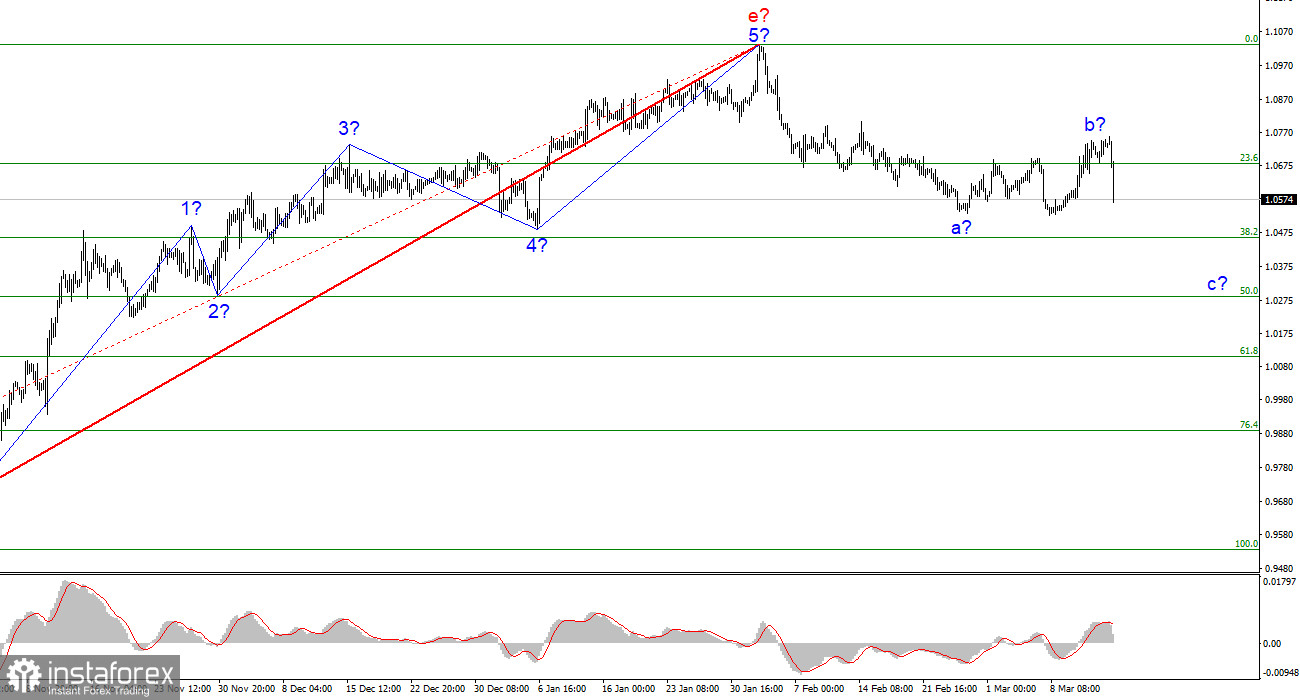

Proceeding from the analysis, I made a conclusion that the construction of the uptrend is finished. So now we can consider short positions with targets located near the calculated mark of 1.0284, which corresponds to the 50.0% Fibonacci. At this time, correctional wave 2 or b may still be under construction, in which case it will take a more extended form. It is better to open shorts now on the MACD's bearish signals.

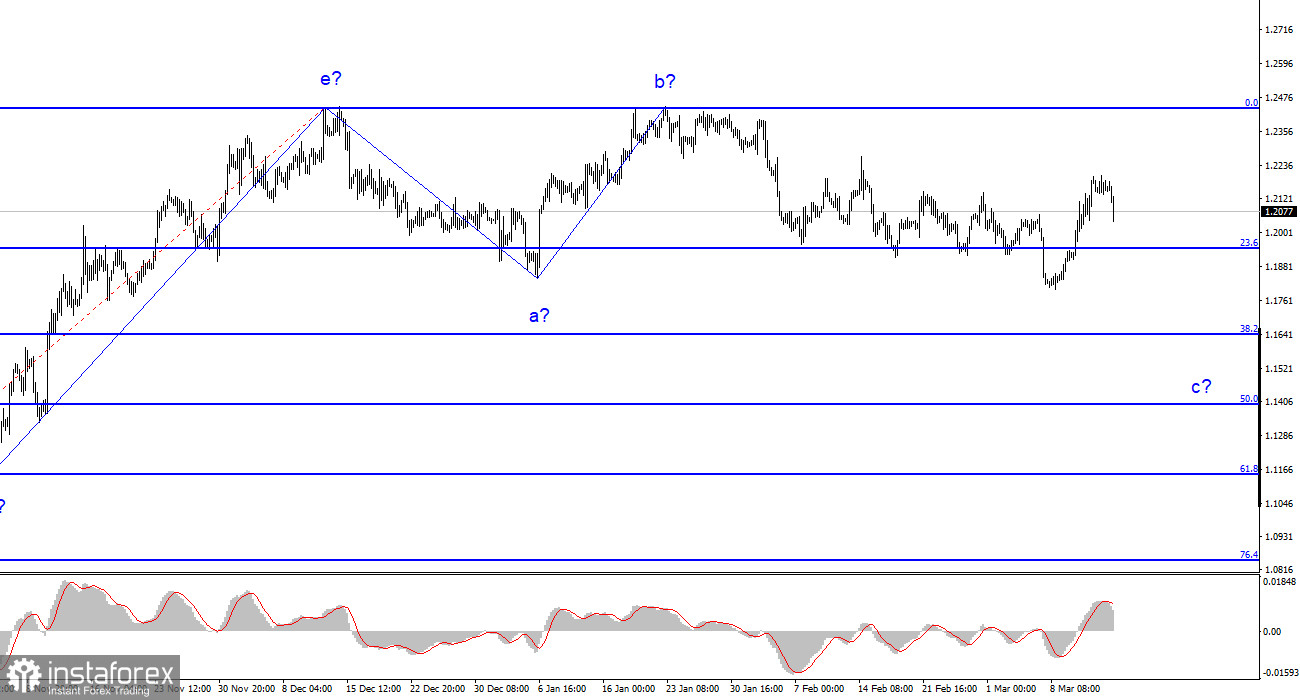

The wave pattern of GBP/USD suggests a construction of a downtrend. At this time, it is possible to consider selling with targets located near 1.1641, which is equal to 38.2% Fibonacci, according to the MACD indicator turning bearish. A Stop Loss order could be placed above the peaks of waves e and b. Wave c may take a less extended form, but for now I expect a decline of another 300-400 pips at least (from the current marks).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română