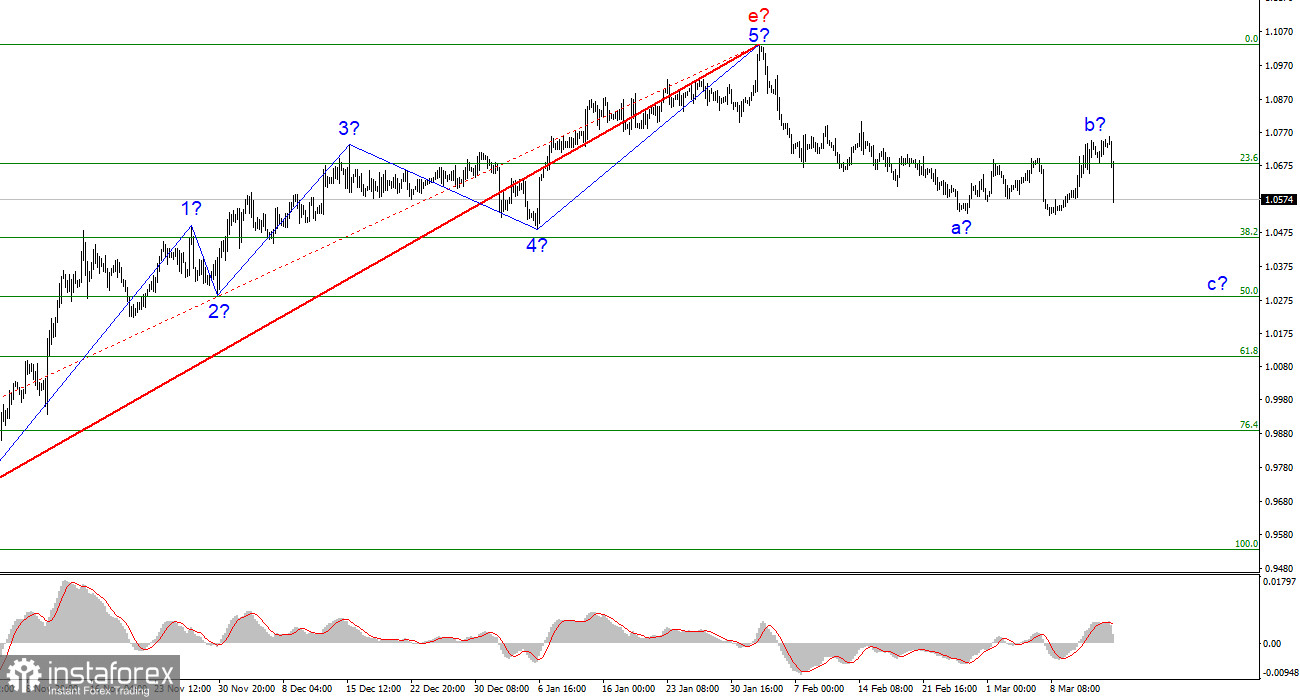

The 4-hour chart for the euro/dollar pair still shows the same wave pattern, which is excellent because it allows us to predict how the situation will develop. It's also encouraging that the movements are almost entirely in line with the wave analysis. The upward part of the trend, which has taken on the pattern a-b-c-d-e, is already finished. I continue to anticipate the pair to decline since, if the wave pattern for the current wave is accurate, we should build at least three waves down. Two of these three waves may already be finished. The proposed wave b, which is now nearing completion once more or has already been completed, has become more complicated as a result of the recent rise in quotes. But I must point out that the movement on Friday has significantly complicated the wave picture. Now that quotes are increasing, the current wave scenario can still happen, but there is a risk that the pattern of the current wave will change, which we would prefer to prevent. For the time being, I continue to anticipate that the pair will continue to decrease, with targets close to the predicted mark of 1.0283, or 50.0% Fibonacci. To determine if the market may continue developing a downward trend section after working off this level, it will be required to assess the scenario and the wave image.

On Wednesday, the euro/dollar pair decreased by 160 basis points. There was only one report available when the decline started in the morning, which may have potentially put pressure on the euro. Of course, it is not the cause of the European currency's collapse. In the European Union, industrial production rose by 0.7% m/m in January, generally in line with market expectations. Even though the day hasn't ended yet, this information isn't strong enough to move the market 160 points on its own. I previously stated that the market was quite shaken by the most recent news. Furthermore, every news was perceived as negative for the dollar, although there were some positives, such as nonfarm payrolls. I, therefore, assumed that the market is experiencing a slight panic that will soon pass and that demand for the US dollar will start to increase once more. It happened already on Wednesday.

The US dollar has fallen unfairly over the previous week, not in line with the news background, and the current wave pattern points to the formation of another downward correction wave. There was no need to panic because the issue with the two bankrupt banks in America was soon resolved. America is still the world's largest economy, and what is the world's largest economy that falls due to the bankruptcy of two banks? Hence, a new rise in demand for the US dollar was anticipated based on the news context and wave pattern. In the near future, I think the pair will continue to deteriorate. Tomorrow is already the ECB meeting.

Conclusions in general

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, it is now allowed to take into account sales with targets close to the predicted mark of 1.0284, or 50.0% Fibonacci. A corrective wave 2 or b can still be developed at this point, in which case it will have a longer form. Opening sales now on the MACD "down" signals is advised.

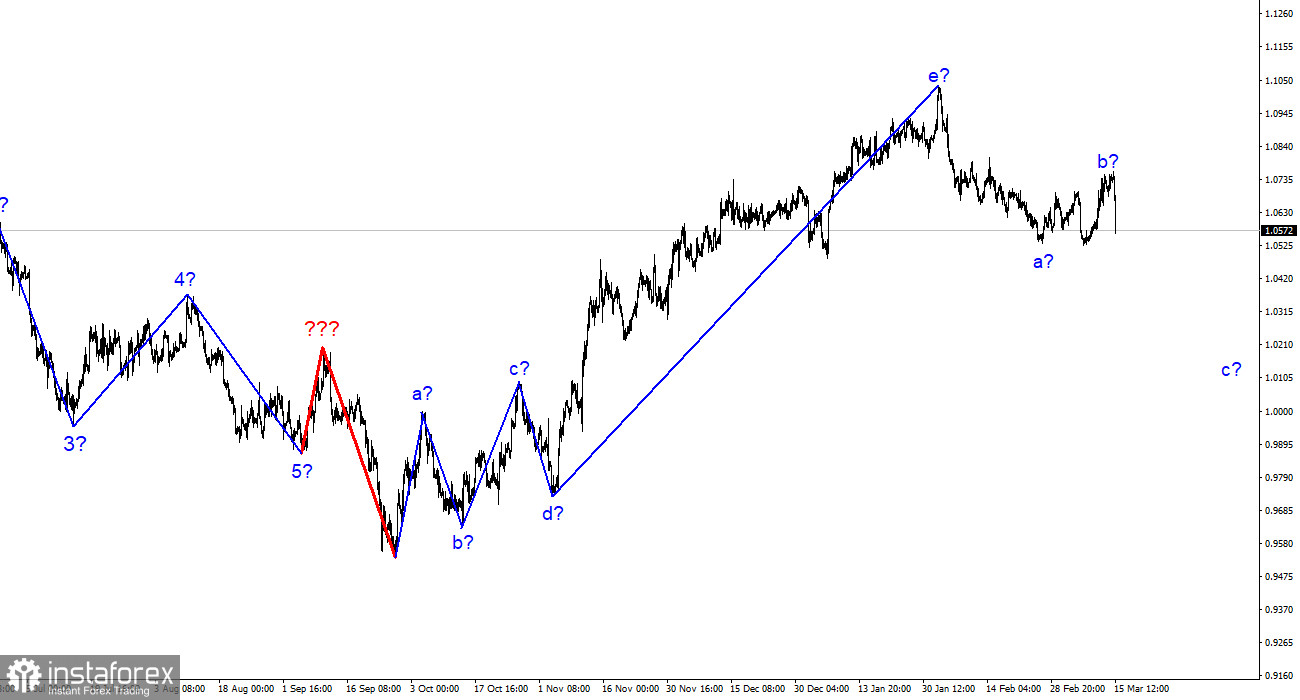

On the older wave scale, the upward trend section's wave pattern has grown longer but is likely finished. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed. The downward trend's development has already started, and it might have any size or structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română