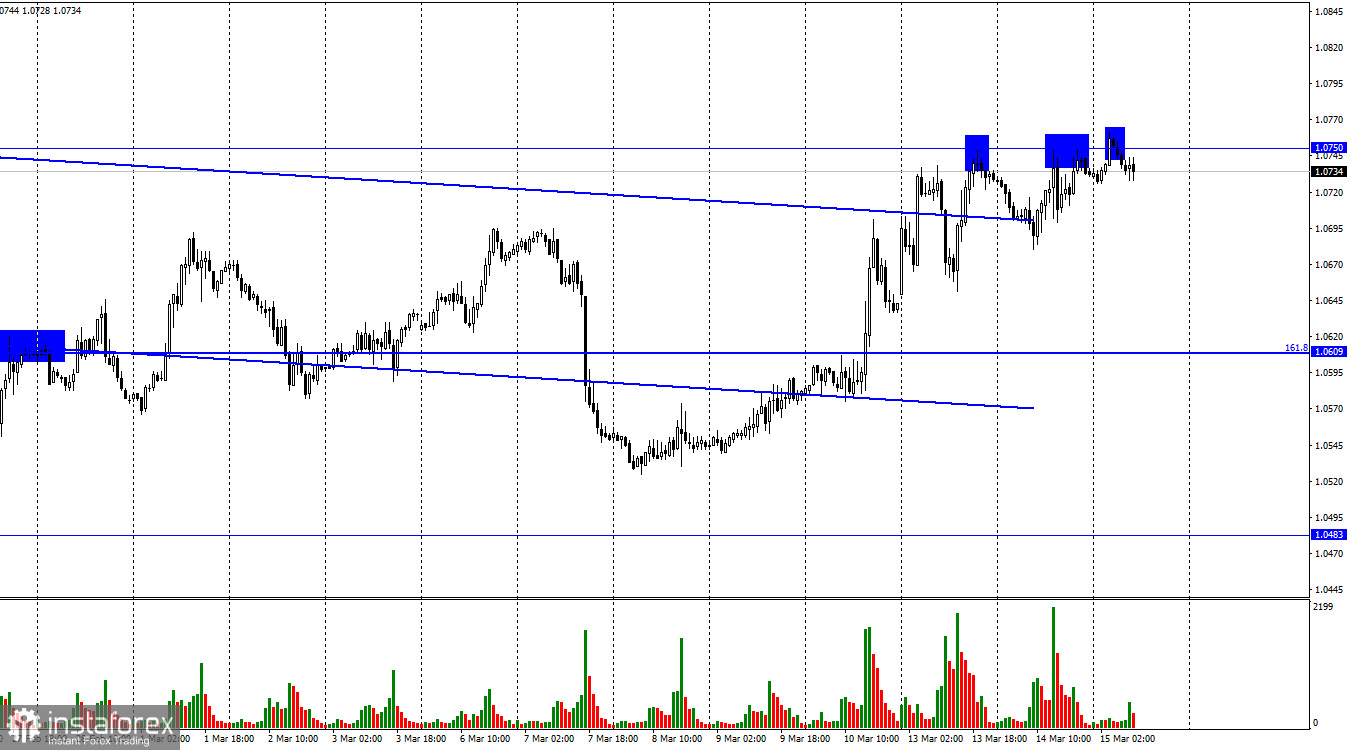

On Tuesday, the EUR/USD pair made a return to the 1.0750 level and had a few more rebounds from this level. The quotes for the pair fell, but there was no reversal in favor of the US currency. Yet, the decline could start at any time before closing above the 1.0750 mark. We can anticipate a stronger rise in the euro's value in the direction of the corrective level of 200.0% (1.0861) if the pair's rate holds above 1.0750.

The news on US inflation was the only thing that made yesterday intriguing for traders. Every inflation data often results in a significant market response, but yesterday was an exception to the trend. In February, the consumer price index was 6.0%, and core inflation was 5.5%. These figures at once allow for the formation of several conclusions. Core inflation decreased by 0.4%, a very strong pace of drop that suggests the Fed is on the right track and that a more aggressive interest rate increase is not necessary. Core inflation, though, is still falling extremely slowly. As compared to regular inflation, it reached 6.6%. It turns out that core inflation is declining more quickly than the base, but the Fed is more concerned with core inflation because it excludes the cost of oil and food. So, if we discuss the rate in terms of core inflation, the Fed did not get a signal yesterday that it needed to decrease the rate or stop it from rising. In my view, the FOMC will keep tightening the PEPP despite the banking system's crisis. The rate will rise by an additional 0.25% on March 22. The government and the same Fed will equally distribute the effects of bank failures in the US. And in May, we can expect a hike of 0.50% if inflation has not yet slowed in its fall.

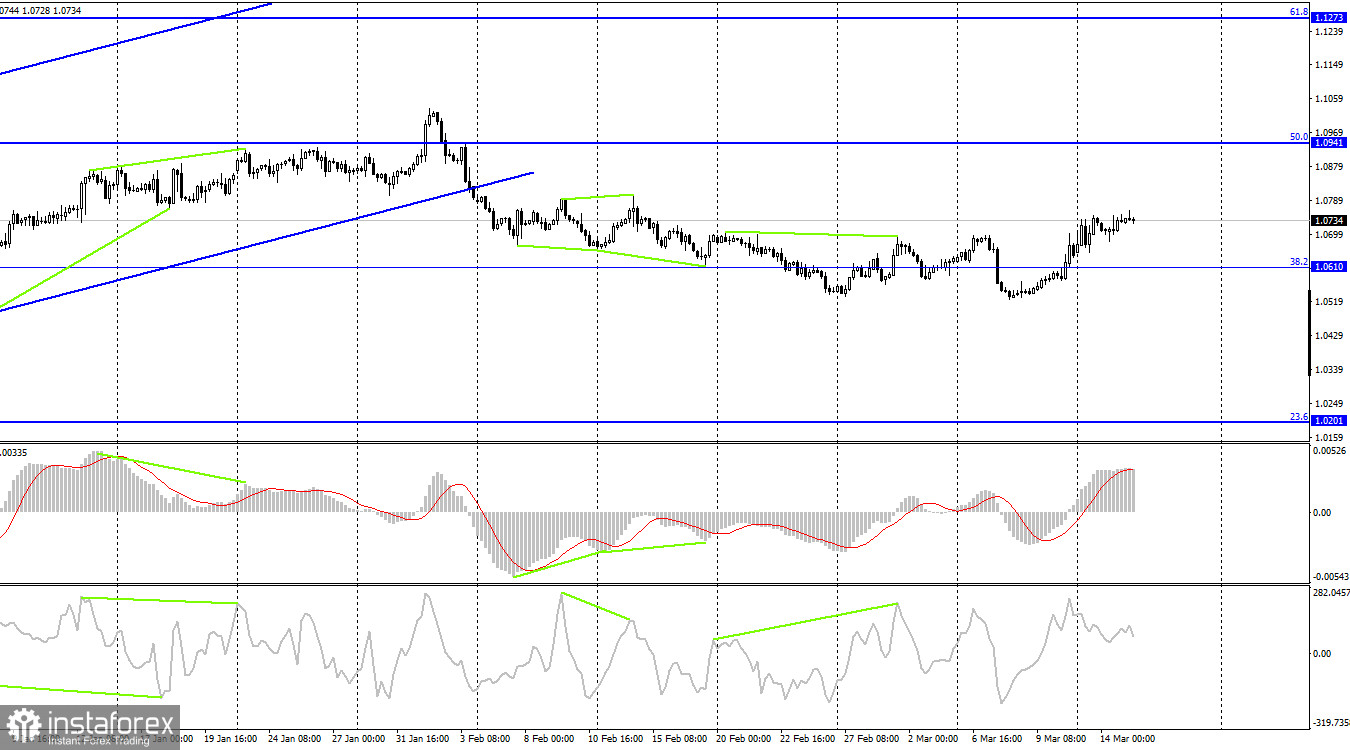

The pair has stabilized under the upward trend corridors on the 4-hour chart, which allows us to continue to anticipate a further decline even if the pair has left the corridor it has been in since October. Trader sentiment is described as "bearish," which creates strong growth opportunities for the US dollar with a target of 1.0201. But recently, there has been increasing horizontal movement.

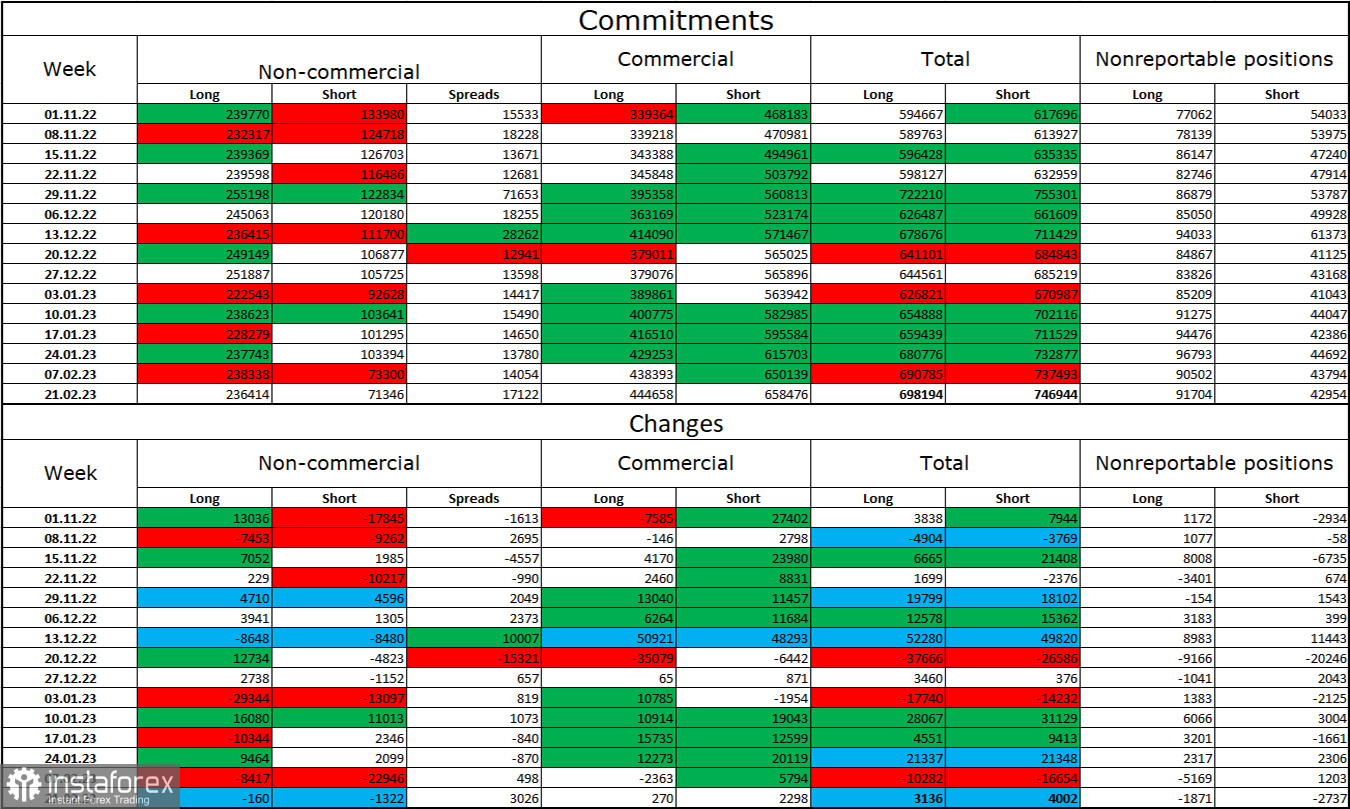

Report on Commitments of Traders (COT):

Speculators concluded 1,322 short contracts and 160 long contracts during the most recent reporting week. The positive sentiment among large traders is still present and getting stronger. I want to call your attention to the fact that the most recent report we have is from February 21. The "bullish" sentiment may have grown stronger in February, but how are things now? Speculators now have 236 thousand long contracts, while just 71 thousand short contracts are concentrated in their hands. While the value of the euro has been declining for some weeks, we are currently without new COT data. The likelihood of the euro currency's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still in the euro's favor, and its prospects are strong. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

News calendar for the USA and the European Union:

EU – volume of industrial production (10:00 UTC).

US – basic retail sales index (12:30 UTC).

US – producer price index (PPI) (12:30 UTC).

US – retail sales volume (12:30 UTC).

On March 15, there are several fascinating entries on the economic calendars of the European Union and the United States, but none of them have as much of an impact as inflation. The information background may not have much of an impact on the traders' attitudes today.

Forecast for EUR/USD and trading advice:

On the hourly chart, new sales of the pair might be initiated at the recovery from the 1.0750 level with a target price of 1.0609. On the hourly chart, purchases of the euro are probable if the price closes above the level of 1.0750 with a target of 1.0861.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română