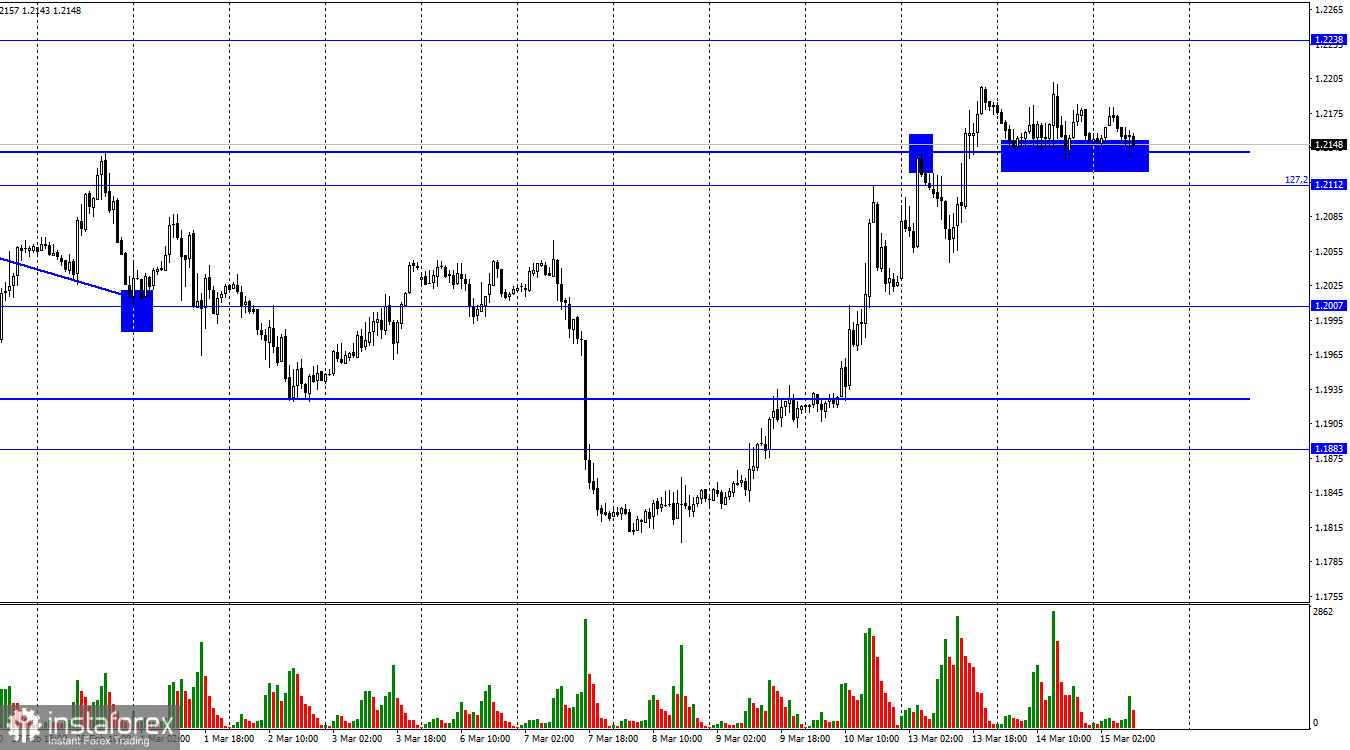

The GBP/USD pair made multiple attempts on Tuesday to retake the side corridor, which is no longer significant, according to the hourly chart. Yet, the pair is supported by its upper line. A few of its rebounds did not result in new growth, moving towards the level of 1.2238. Fixing quotes below this line will enable us to predict a decline of the pair towards the 1.2007 level. I believe that this option will likely be chosen in the near future.

In the UK yesterday, statistics of average importance were published, which had no bearing on traders. They were also uninterested in the US inflation statistics. I believe that traders are now aware of what happened and considering approaches to trading. There aren't many significant events this week that will affect the dollar or the pound, but meetings of the Fed and the Bank of England are starting to come to the fore. Traders are currently left in the dark on several FOMC-related questions. Due to the failure of American banks within a week, traders' expectations went from 0.50% at the rate to 0%. I doubt the regulator will move from one extreme to the other. Since core inflation is still high in the US and there is no urgency for it to fall to the target level, it makes no sense to take a break and not raise the rate in March. The probability of a 0.50% rate hike was initially low.

In light of this, I think that the US dollar will gradually increase after the British pound's recent rapid rise. At the very least as part of the correction. Even though three economic reports will be released at once in the US today, the background information will be rather weak. They will emerge at the same time, giving us a single time point at which the current trend may be reversed or strengthened.

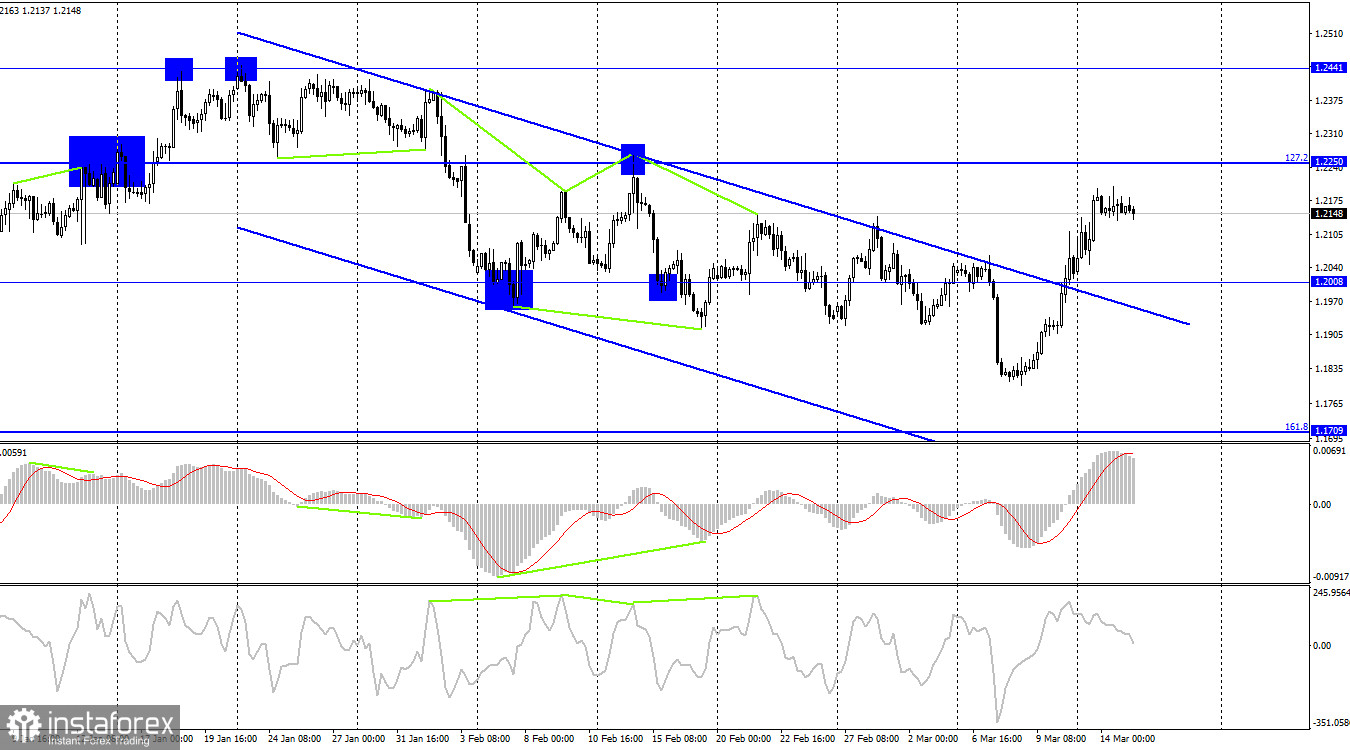

On the 4-hour chart, the pair made a fresh reversal in favor of the British pound and is now moving upwards towards the level of 1.2250 but is already outside the area of the declining trend. Although it is still difficult to believe that the US currency will continue to weaken, traders' attitudes have changed to "bullish," allowing us to anticipate continuing growth. ing divergences are currently undetectable in any indication.

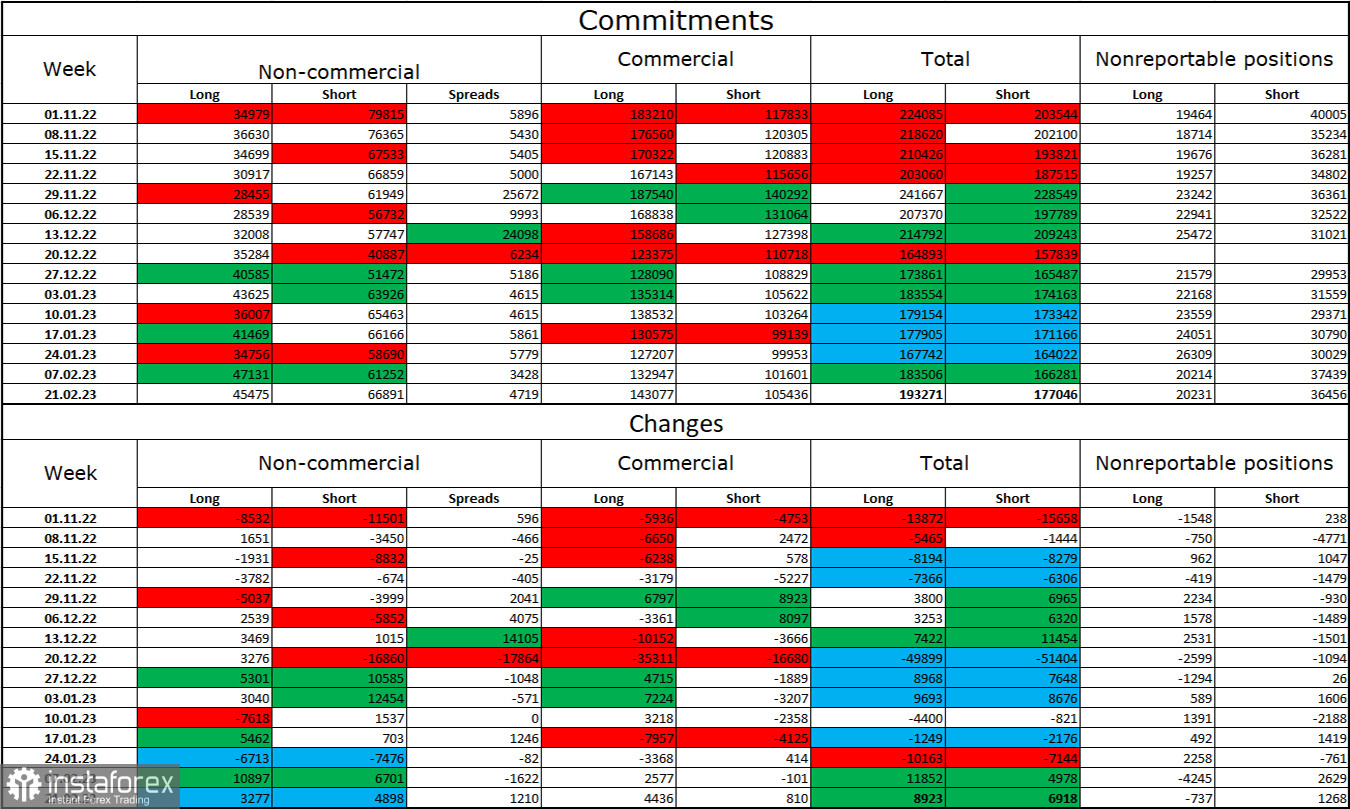

Report on Commitments of Traders (COT):

Over the past reporting week, traders in the "Non-commercial" category have become more pessimistic than they were the previous week. The CFTC still does not give new reports, thus we are currently discussing information from a month ago. Speculators now hold 3,277 more long contracts than short contracts, a difference of 4,898 units. The major players' overall outlook is still "bearish," and there are still a lot more short-term contracts than long-term contracts. The situation has shifted in favor of the British pound during the last several months, although the gap between the number of long and short positions held by speculators still exists. Moreover, "now" refers to mid-February. As a result, the pound's prospects are still poor, but the British pound is not eager to lose ground. There was a breakout outside the declining corridor on the 4-hour chart, and the pound is currently supported. I do observe that many current forces, including the traders themselves, conflict with one another.

News calendar for the USA and the UK:

US – basic retail sales index (12:30 UTC).

US – producer price index (PPI) (12:30 UTC).

US – retail sales volume (12:30 UTC).

There are no economic events scheduled for Wednesday in the UK, however, there will be numerous reports of average importance that day in the US. The information background may not have much of an impact on traders' attitudes.

Forecast for GBP/USD and trading advice:

When the hourly chart closes below the level of 1.2112, further sales of the British pound are possible with the targets of 1.2007 and 1.1928. On the hourly chart, purchases of the pair were probable if it closed above the corridor with a target of 1.2238. These transactions may be stored until the corridor closes.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română