Pound is gearing up for a surge in volatility. Euro, meanwhile, is expecting limited gains as risk appetite declines due to further uncertainty over the Fed and ECB monetary policies. Recent UK labor market data also allowed the Bank of England to find reasons to raise interest rates more slowly in the near future.

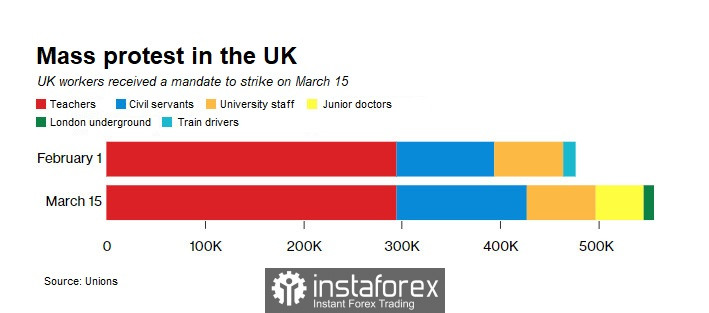

Another cause of concern is the massive strikes brewing in the UK. The London underground is expected to be virtually closed, along with some schools and hospitals to allow workers to coordinate strikes. The protests are mainly over wages, which puts pressure on Chancellor of the Exchequer Jeremy Hunt, who is trying to solve the problems within the Finance Ministry as double-digit inflation undermines the economy. Yesterday's data on average UK earnings further inflamed the situation as a decline was recorded.

More recently, Hunt and Prime Minister Rishi Sunak stated firmly that generous concessions on public sector wages will further fuel inflation, hitting the economy and households, increasing the cost of living crisis. "We want to work with the unions to negotiate a fair and reasonable wage increase," Sunak spokesman Jamie Davies told reporters yesterday. "We want to sit down at the negotiating table with the unions," he said, adding that strikes had to be suspended before any discussions could begin.

Obviously, this could have a negative impact on pound, which has halted its month-long rise around the 22nd figure. If no compromise is found, a fall cannot be avoided.

For now, bulls continue to control the market, but strong statistics on the UK economy and labor market do not really support pound much. There are chances for further growth, but it will only be amid calm market reaction over the release of the annual budget. Buyers will need to stay above 1.2130 to keep the situation under control, and there should be a breakdown of 1.2200 for GBP/USD to rise to 1.2265 and 1.2320. Should sellers take control of 1.2130, a breakdown of that range will happen and the pair will slip to 1.2090 and 1.2050.

In EUR/USD, demand has intensified after yesterday's news, giving buyers a chance to continue building the new upward trend. Staying above 1.0730 and going beyond 1.0770 will certainly push the pair to 1.0800 and 1.0835. Meanwhile, a decline below 1.0730 will lead to a further fall to 1.0690.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română