On Tuesday, the GBP/USD currency pair did not increase. Of course, this may be just a coincidence or a one-day break from purchasing. The pound has been growing for three days in a row, but this round of upward movement still fits into the concept of a "swing." The "swings" on the graph can now be seen and do not even need to be labeled in any manner. Hence, we do not ignore the potential that a new round of decline will begin this week. Similar to the case with the euro, it is challenging for us to explain how the value of the pound can keep rising. You may identify at least a few reasons why such an increase could have occurred over the past three days. Although they are far from clear, they are still present. But why should the British pound increase in value? The Bank of England has not issued any new "hawkish" pronouncements, and the UK economy is not showing any signs of improvement.

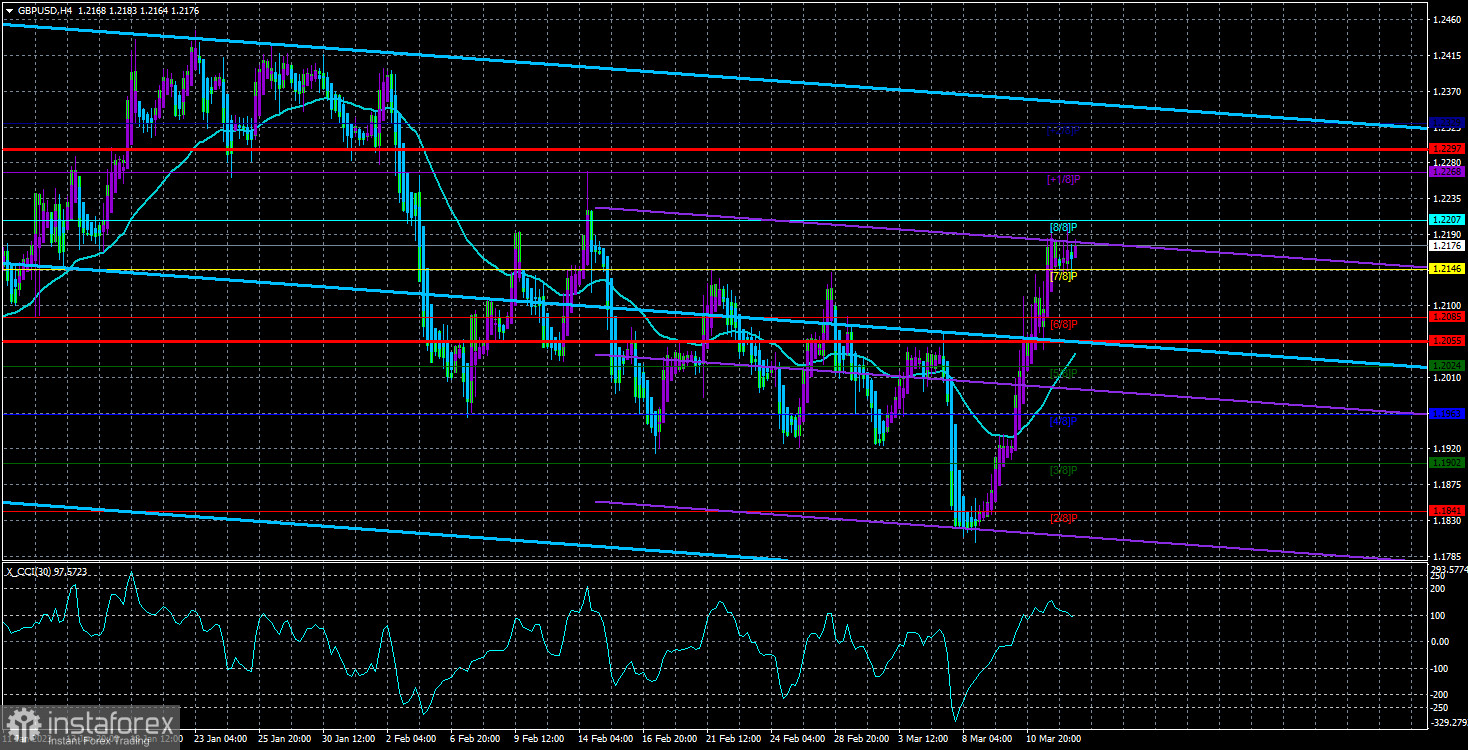

Everything isn't great on a 24-hour TF either. Fixing above the crucial line and the Senkou Span B line is not particularly important because the flat is still between 1.1840 and 1.2240. These lines are useless until the price exits the side channel. But once more, we must tell out that the pound, which had gained 2,100 points in a few months, also failed to react appropriately. Of course, any movement on the foreign exchange market is possible, but we think the pound has risen too quickly and sharply without sufficient justification. In any event, we should begin with the side channel because it is currently the most crucial. "Swings" can be maintained on a 4-hour TF.

The pound has no excuse to continue increasing this week.

Statistics were released in the UK on Tuesday, but nobody was at all interested in them. The number of applications for unemployment benefits barely exceeded traders' expectations, earnings increased in line with projections, and unemployment in the UK remained unchanged. The market did not react violently to the US inflation news either because the value was in line with expectations. As a result, the day that had the potential to be volatile ended up being dull, and the pair was flat even on the lowest TF.

In light of the pair's rapid growth during the preceding three days, I'd like to point out that some of their behavior is natural. Sooner or later, the moment had to arrive when the market would settle down and begin to assess all the data gathered on a "cold head." Yet, we did not anticipate it to occur on Tuesday. It's crucial to know what to do with the pound/dollar pair going forward. As we've already stated, the pound is currently not supported by any news of this sort coming out of the UK. There is nothing comparable to it, even if the Bank of England tightened its rhetoric and made stronger hints about tightening monetary policy.

The fundamental backdrop in the United States was able to change from "we expect a rate hike in March by 0.5%" to "we do not expect a raise at all." The market naturally lacks the knowledge necessary to respond to events appropriately, which results in unpredictable movements. Everything now comes down to a flat on the 24-hour TF and a "swing" on the 4-hour, even in the most basic terms. There won't be any other significant developments this week affecting the British and American currencies. Retail sales and the producer price index are released today, unemployment benefit applications are released tomorrow, and industrial production and the consumer confidence index are released on Friday. Not the information that may start a strong movement. Since there is no significant fundamental or macroeconomic background, we do not think the pound will be able to maintain its rise after over 400 points.

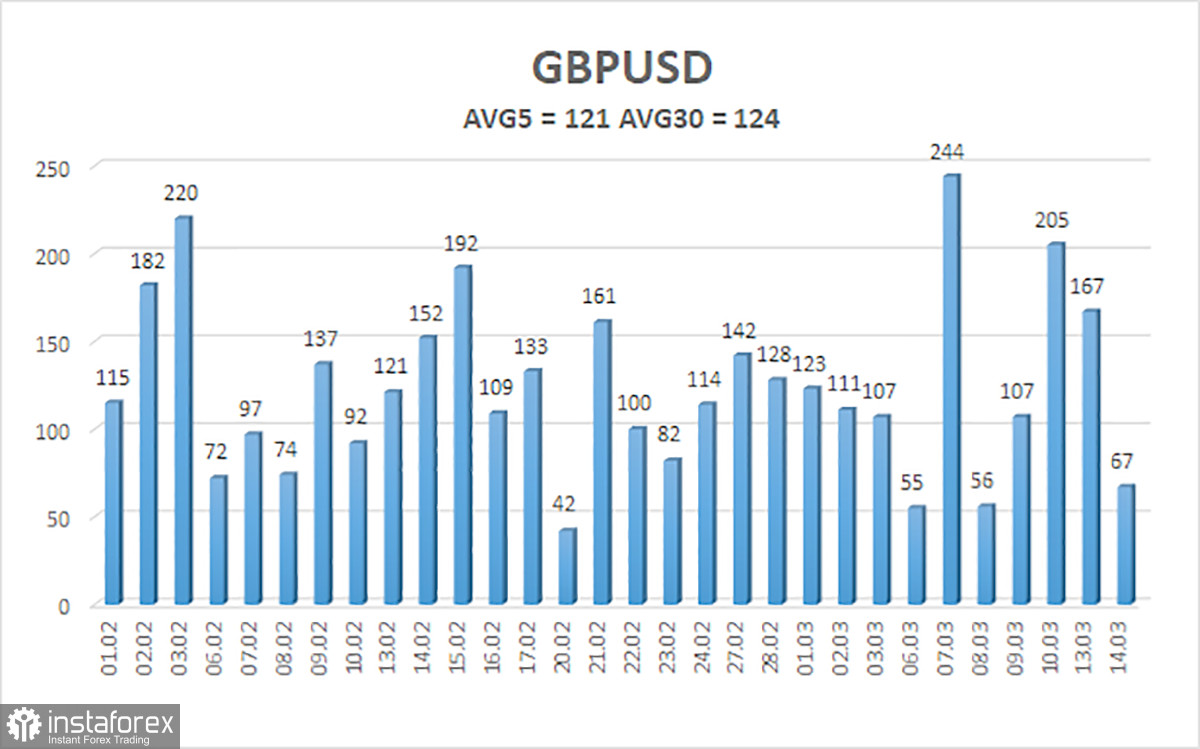

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 121 points. This value is "high" for the dollar/pound exchange rate. So, on March 15, we anticipate movement that is contained inside the channel and is limited by the levels of 1.2055 and 1.2297. A new round of movement to the south will be indicated by the Heiken Ashi indicator turning downward.

Nearest levels of support

S1 – 1.2146

S2 – 1.2085

S3 – 1.2024

Nearest levels of resistance

R1 – 1.2207

R2 – 1.2268

R3 – 1.2329

Trade Suggestions:

Over the 4-hour timeframe, the GBP/USD pair is still rising. Unless the Heiken Ashi indicator turns down, you can continue holding long positions with targets of 1.2268 and 1.2297. If the price is fixed below the moving average, short positions with targets of 1.1963 and 1.1902 may be taken into account.

Explanations for the illustrations:

Channels for linear regression - allow us to identify the present trend. If both are directed in the same direction, then the trend is strong presently.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română