In effect, Tuesday's movement of the EUR/USD currency pair was meaningless as it continued its relatively gradual upward trend. As we previously stated, the pair has successfully moved at least 5–6 times in the preceding 1.5–2 weeks. What kind of trend can we discuss at this time? Tomorrow's upward trend may be overtaken by another round of decline. We continue to see no justification for a significant strengthening of the euro. It's a good idea to have a backup plan in case something goes wrong. What's different now? Following Powell's speech on Tuesday, the dollar failed to rise far enough to resume its current march. The market sold off the dollar for multiple weeks in a row, although the American statistics from last Friday were not a failure. The collapse of two banks will not prevent the Fed from raising interest rates in the long term. Hence, in our humble opinion, not much has changed between the present picture and the picture from a week ago.

Yet there are changes in the 24-hour TF, and they are quite serious. The price has successfully crossed the pivotal Kijun-sen line during the past two days, increasing the likelihood of future development of the pair. The entire growth of the euro currency over the last six months has not been justified and reasonable, in our opinion, and it has not adjusted strongly enough. We continue to support the devaluation of the euro. If it keeps tightening its rhetoric about monetary policy, only the ECB can prevent it from falling. This week's normal meeting will be followed by a speech from Christine Lagarde. The most important part of her speech will be how she explains how the regulator will proceed and what it plans to do. She can, of course, choose to ignore this subject. In such a case, neither the market nor the euro would receive a new justification for development.

US inflation decreased by 0.4%.

Hence, the consumer price index fell to 6% y/y by the end of February. From our perspective, this is a great outcome that proves the 0.1% drop in January was a mistake. The deceleration in the consumer price index stays at a good level, which again makes it pointless to raise the rate by 0.5% in March. Additionally, it eliminates the need for further rate increases in 2023. The dollar may not grow in value in the upcoming months due to this cause. We have been arguing for a while that the 4.75% rate is insufficient to bring inflation back down to 2%. We still think so, but it should be understood that it may not be sufficient to increase the rate to 6-7% either. Overall, the dollar lost one of its fairly strong advantages yesterday.

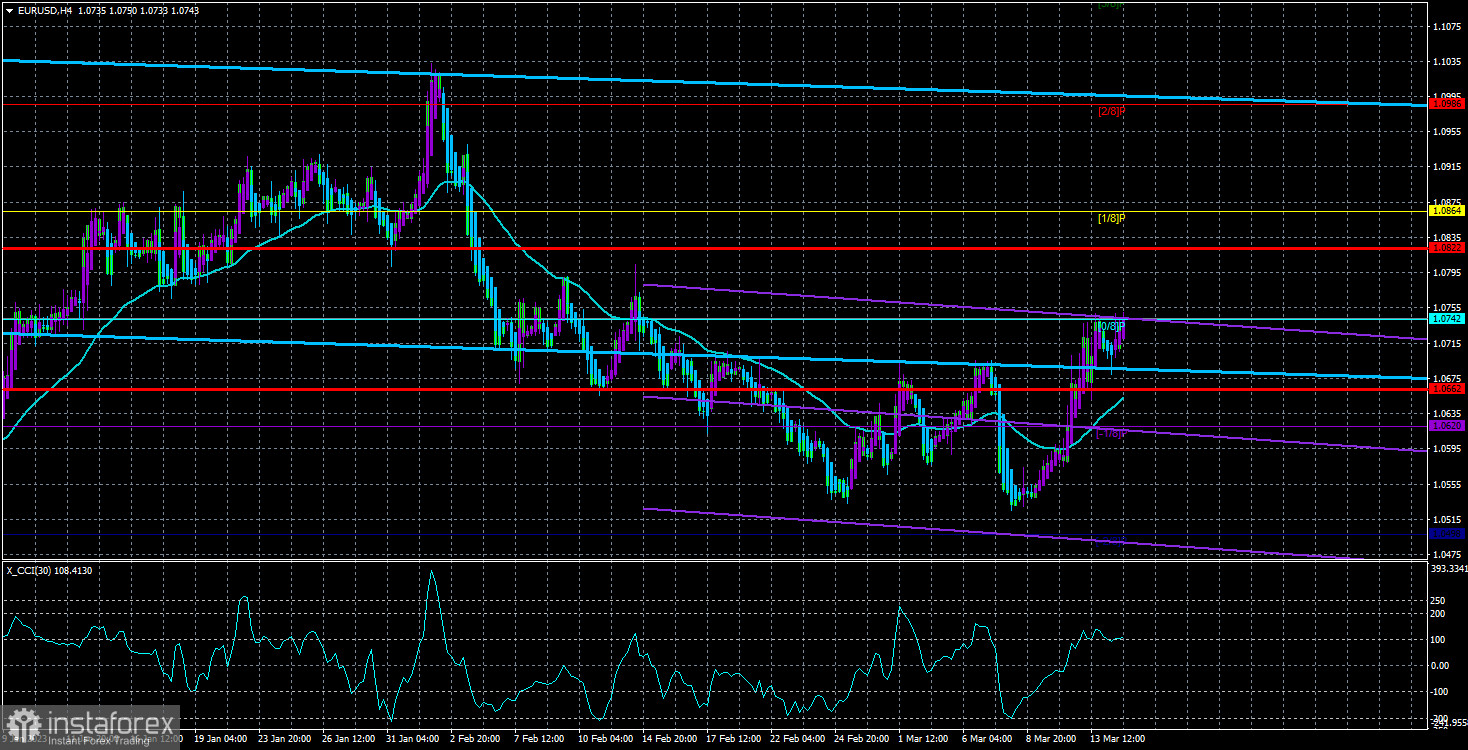

Based solely on this aspect, it is difficult to predict if the euro/dollar pair will be able to continue rising. We still don't know how much the ECB will increase its rate. After raising it by 0.25% in May, it might announce a pause. The rate of inflation in the European Union is significantly lower than in the United States. Yet, the ECB cannot tighten monetary policy as quickly as the Fed. As a result, we have doubts about the chances of the European currency growing. There are formal justifications for purchasing right now. On the 4-hour TF, the moving has been resolved, and on the 24-hour TF, the critical line has been overcome. However, there is a possibility of a "swing." Everything should become evident this week. We have a Heiken Ashi indicator, though, which unmistakably signals local reversals. We shall be prepared for another possible round of falling as a result.

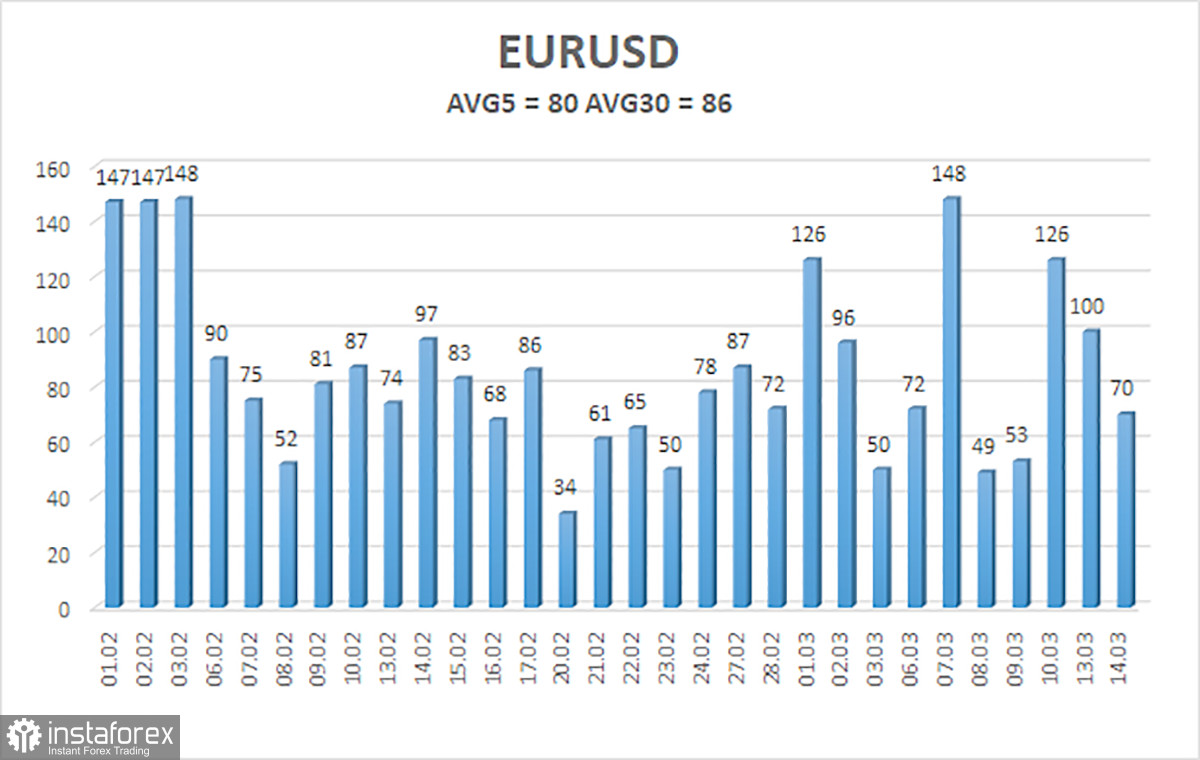

As of March 15, the euro/dollar currency pair's average volatility over the previous five trading days was 80 points, which is considered to be "normal." Hence, on Wednesday, we anticipate the pair to move between 1.0662 and 1.0822. The Heiken Ashi indicator's downward turn will signal a potential continuation of the downward movement.

Nearest levels of support

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest levels of resistance

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trade Suggestions:

The EUR/USD pair has consolidated back above the moving average line. Until the Heiken Ashi indicator turns down, you can continue holding long positions with targets of 1.0822 and 1.0864. After the price is fixed below the moving average line, short positions can be opened with a target of 1.0498.

Explanations for the illustrations:

Channels for linear regression - allow us to identify the present trend. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română